The document provides an introduction to project finance modeling. It defines a project as a temporary, one-time activity intended to create a unique product or service. Project finance involves using both debt and equity to finance long-term infrastructure projects, with debt repaid through cash flows generated by the project's operations. Project finance modeling develops analytical models to assess the risk and return of lending to or investing in a project by forecasting its expected future cash flows.

![17

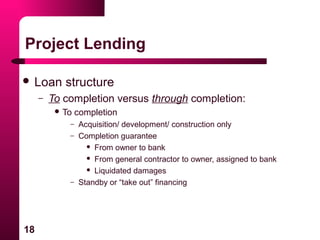

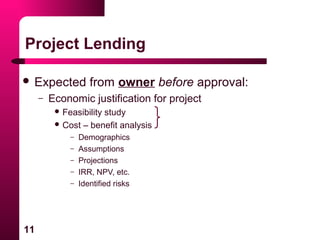

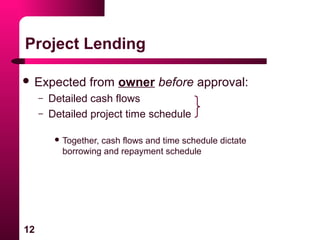

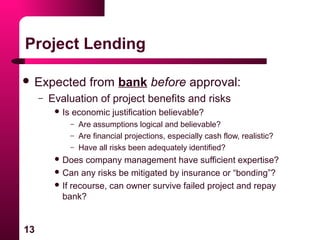

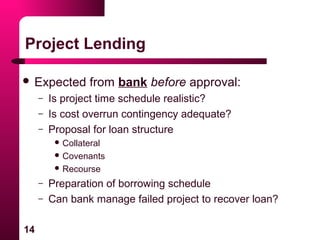

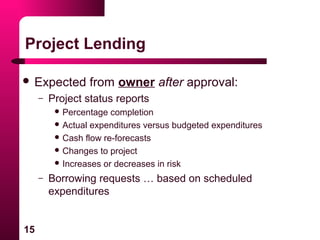

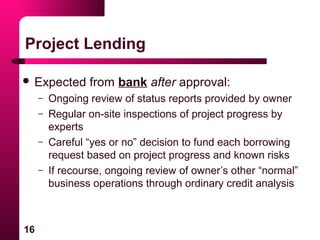

Project Lending

Loan structure

– Recourse (guarantees, etc.)

Bank wants recourse to owner and owner’s assets

– Moral value even if limited economic value

[partner/ sophisticated investor theory]

– Exercising rights of recourse expensive, time consuming

Owner wants “non-recourse” financing](https://image.slidesharecdn.com/as-fm-002-en-150912094054-lva1-app6892/85/Project-Finance-Modeling-17-320.jpg)