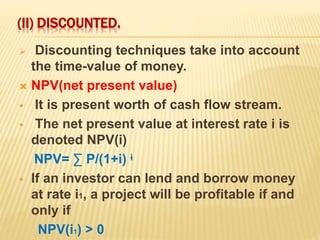

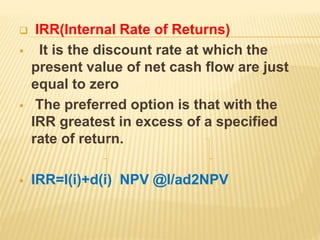

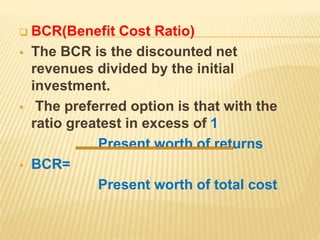

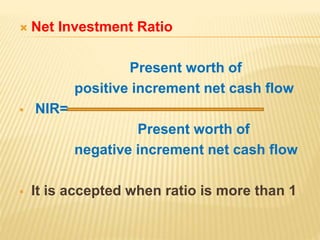

This document discusses techniques for project appraisal. It outlines key issues to consider in appraising projects such as need, objectives, options, costs, benefits, risks and sustainability. It also describes various analyses used in appraisal, including technical, economic, financial, environmental and social analyses. The main techniques of economic analysis are cost-benefit analysis, cost-effectiveness analysis and multi-criteria analysis. Financial analysis determines funding requirements and expected returns. Common appraisal methods include undiscounted techniques like payback period as well as discounted techniques like net present value, internal rate of return and benefit-cost ratio.