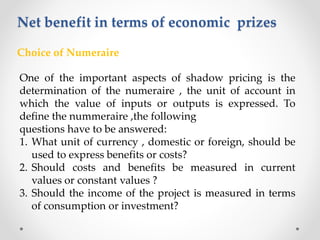

The document discusses Social Cost Benefit Analysis (SCBA), a methodology for evaluating investment projects from a societal perspective, highlighting its advantages such as maximizing welfare and its ability to prioritize resources, while also noting challenges like measuring social costs. It explores the UNIDO and Little-Mirrlees approaches to SCBA, outlining their frameworks and methodologies for assessing project impacts on economic aspects like efficiency, income distribution, and the value of merit and demerit goods. Overall, SCBA serves as a crucial tool for informed decision-making in project evaluations and resource allocation.