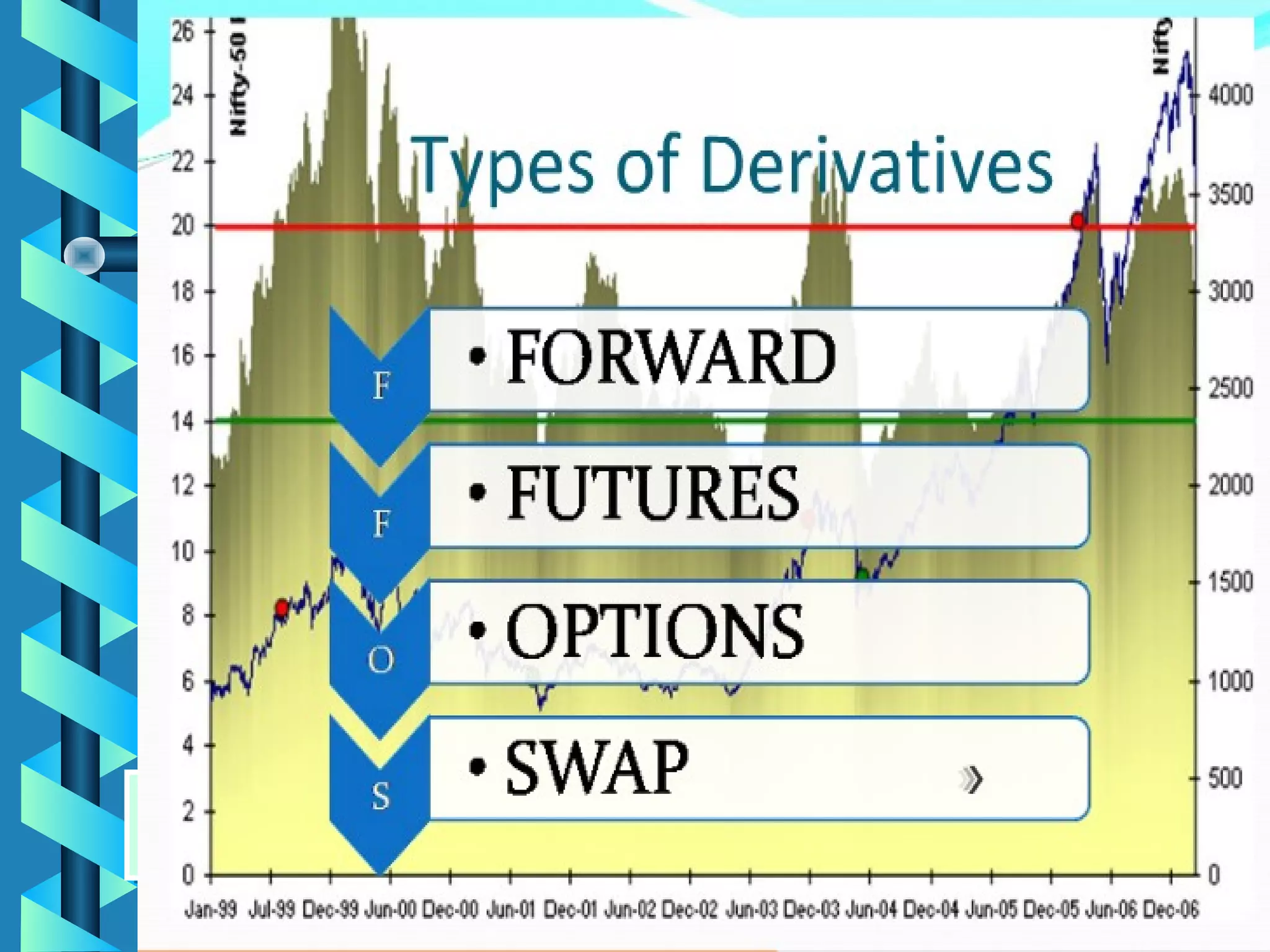

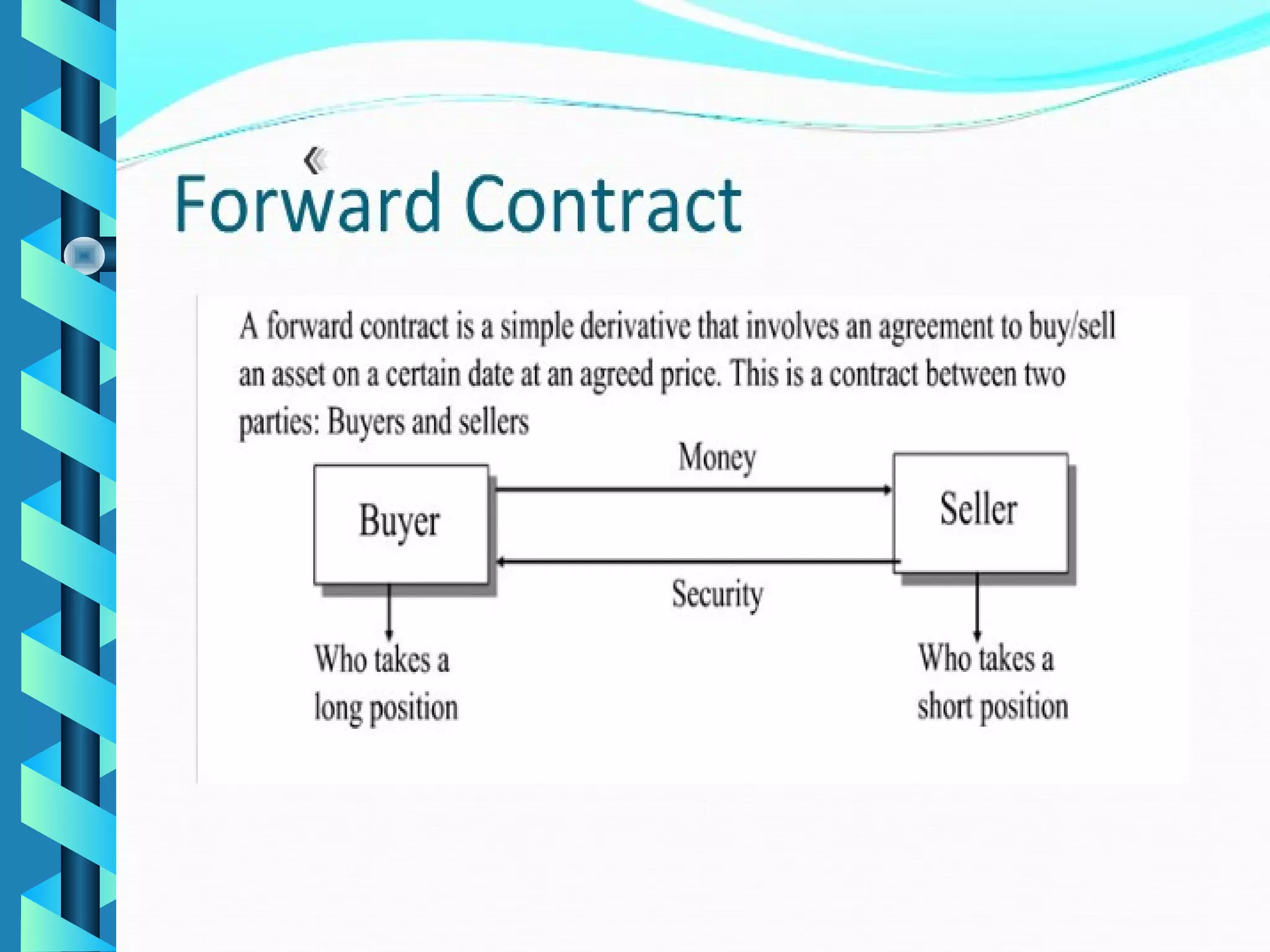

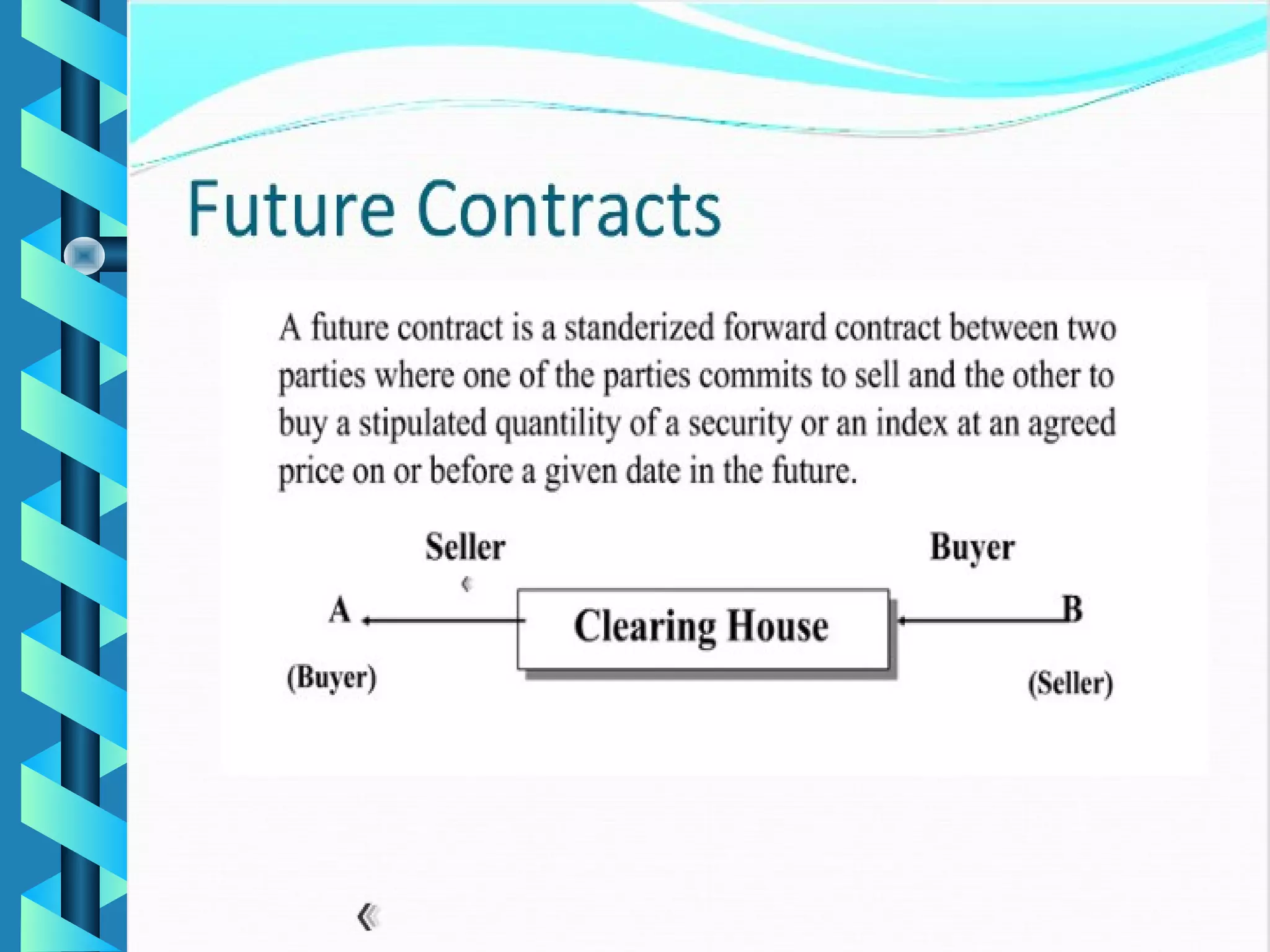

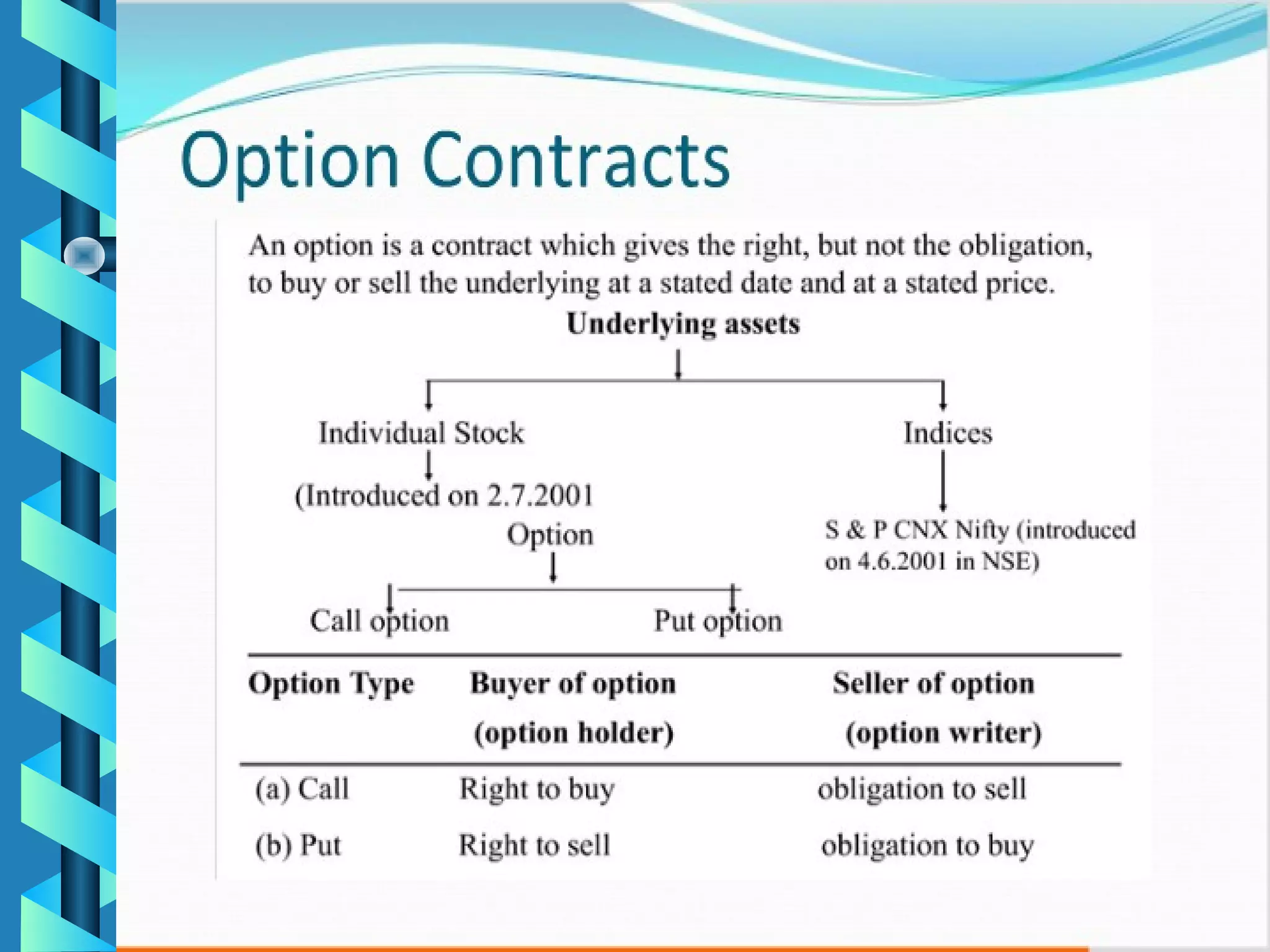

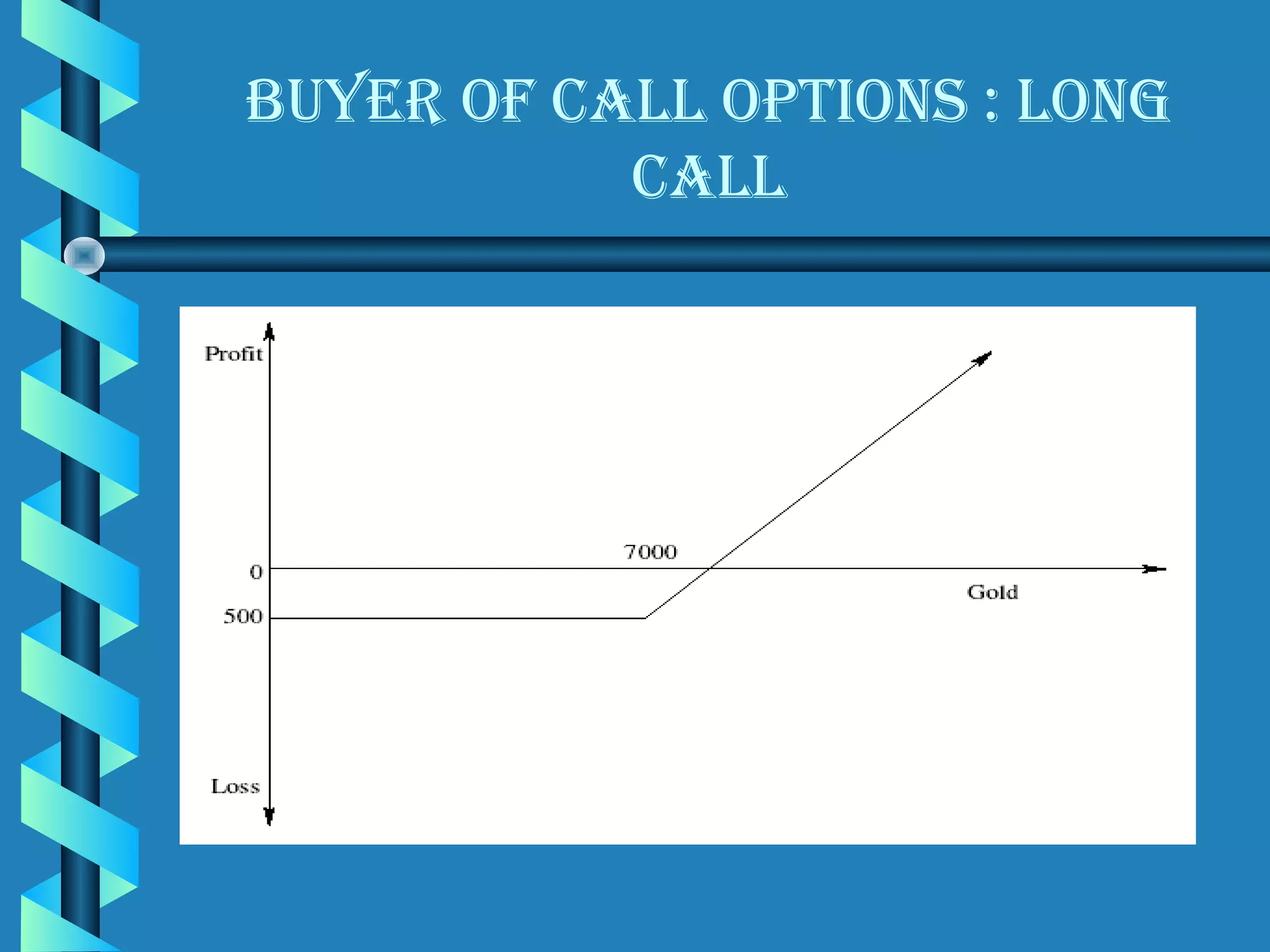

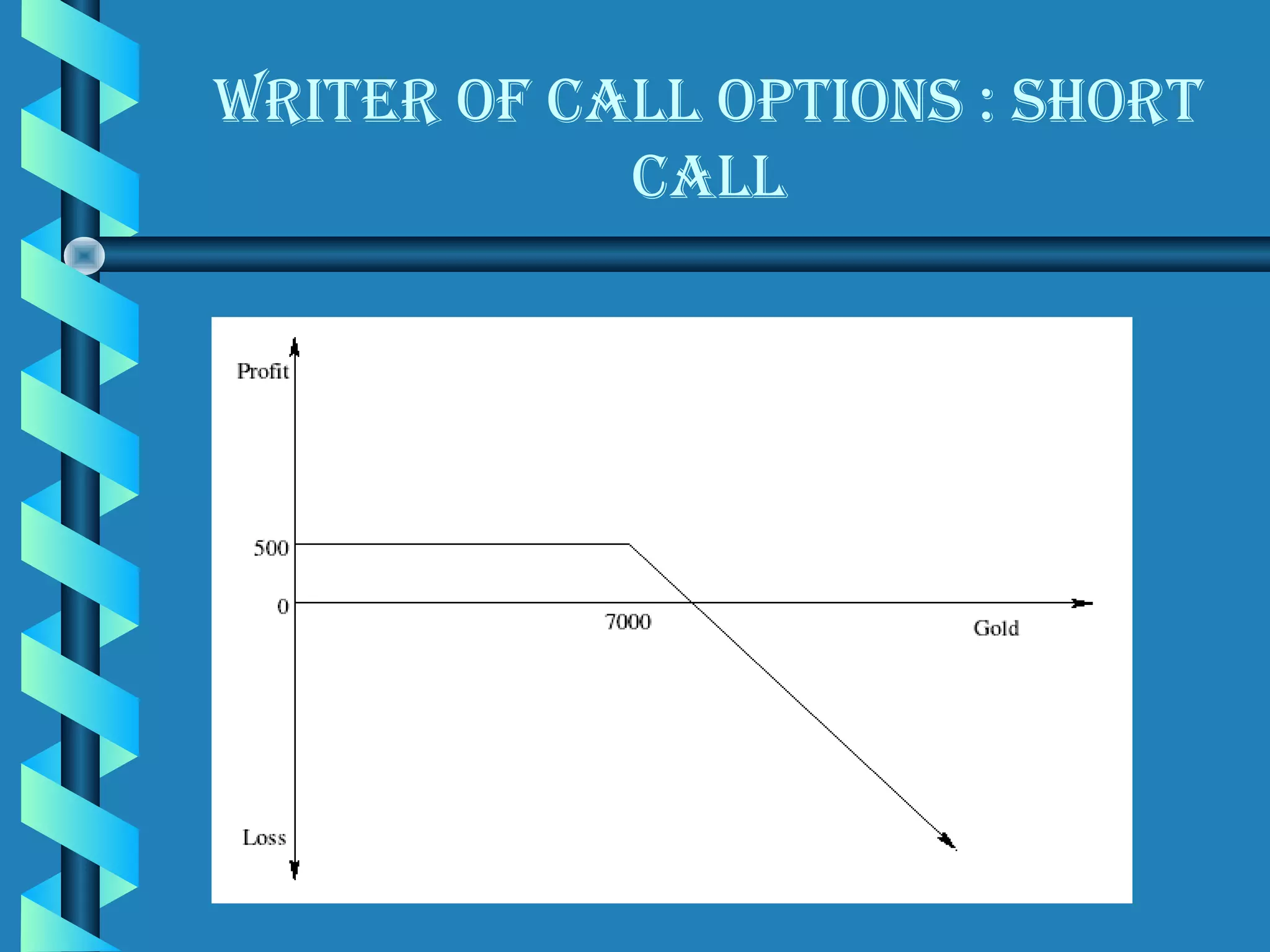

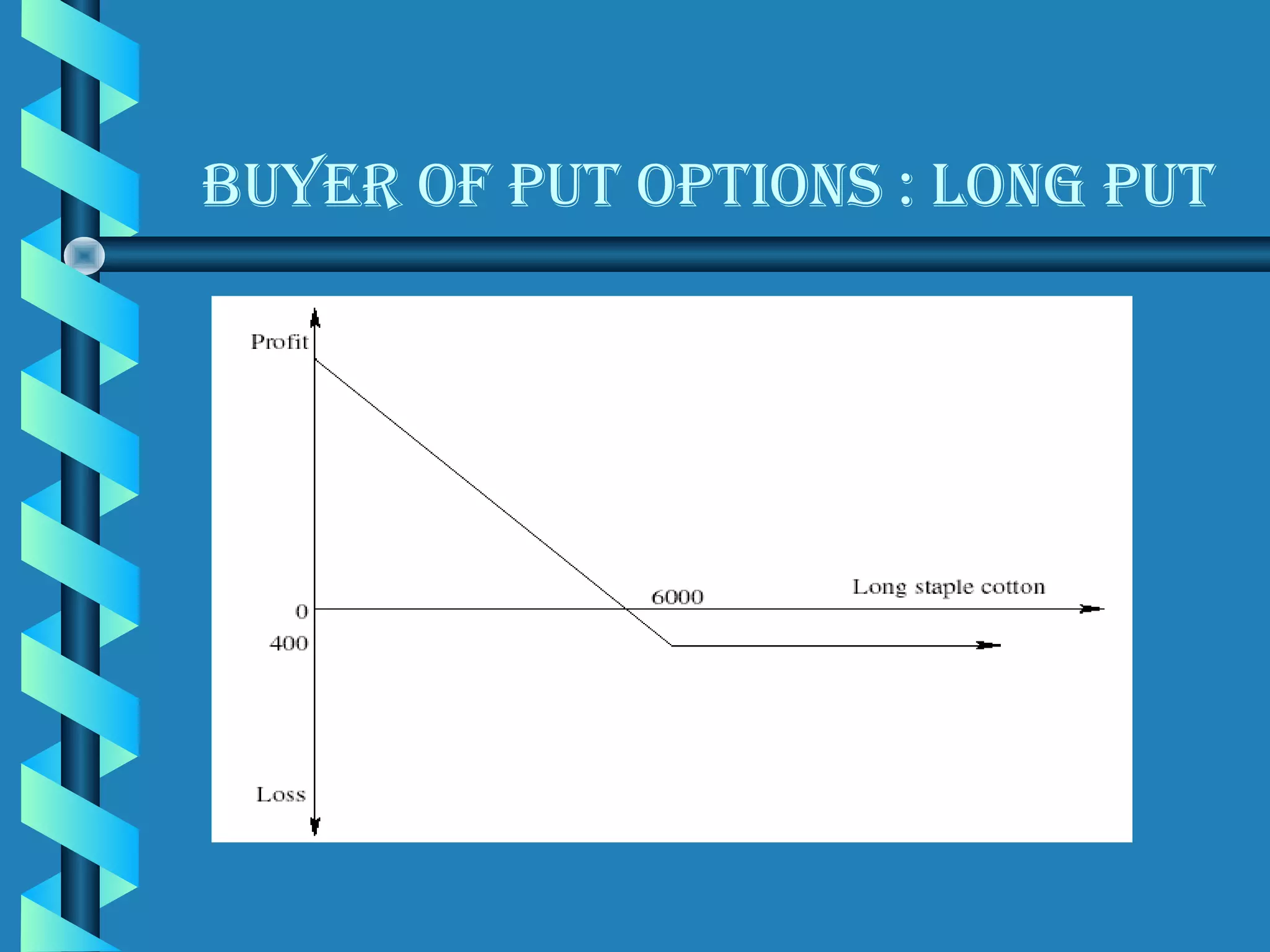

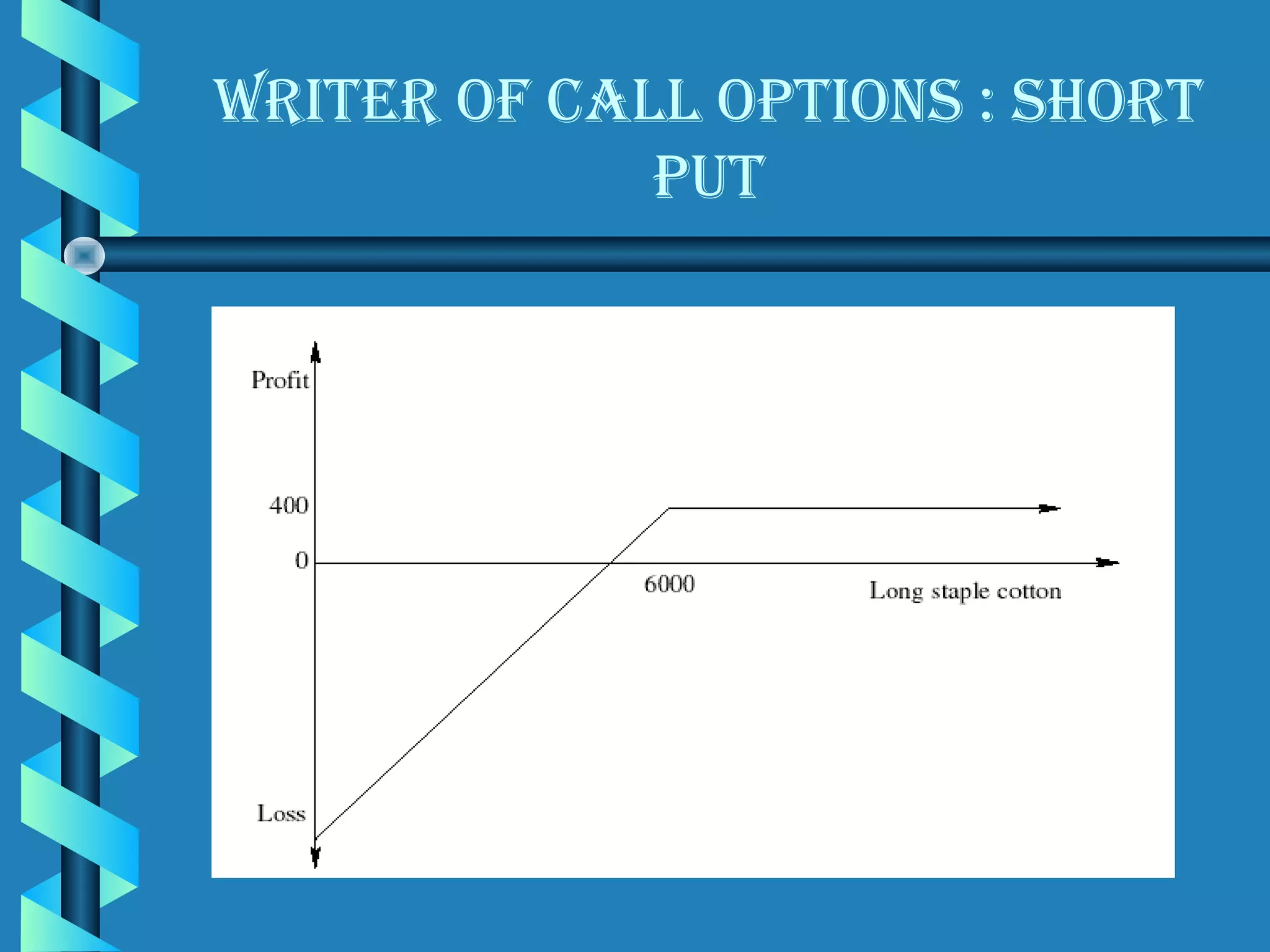

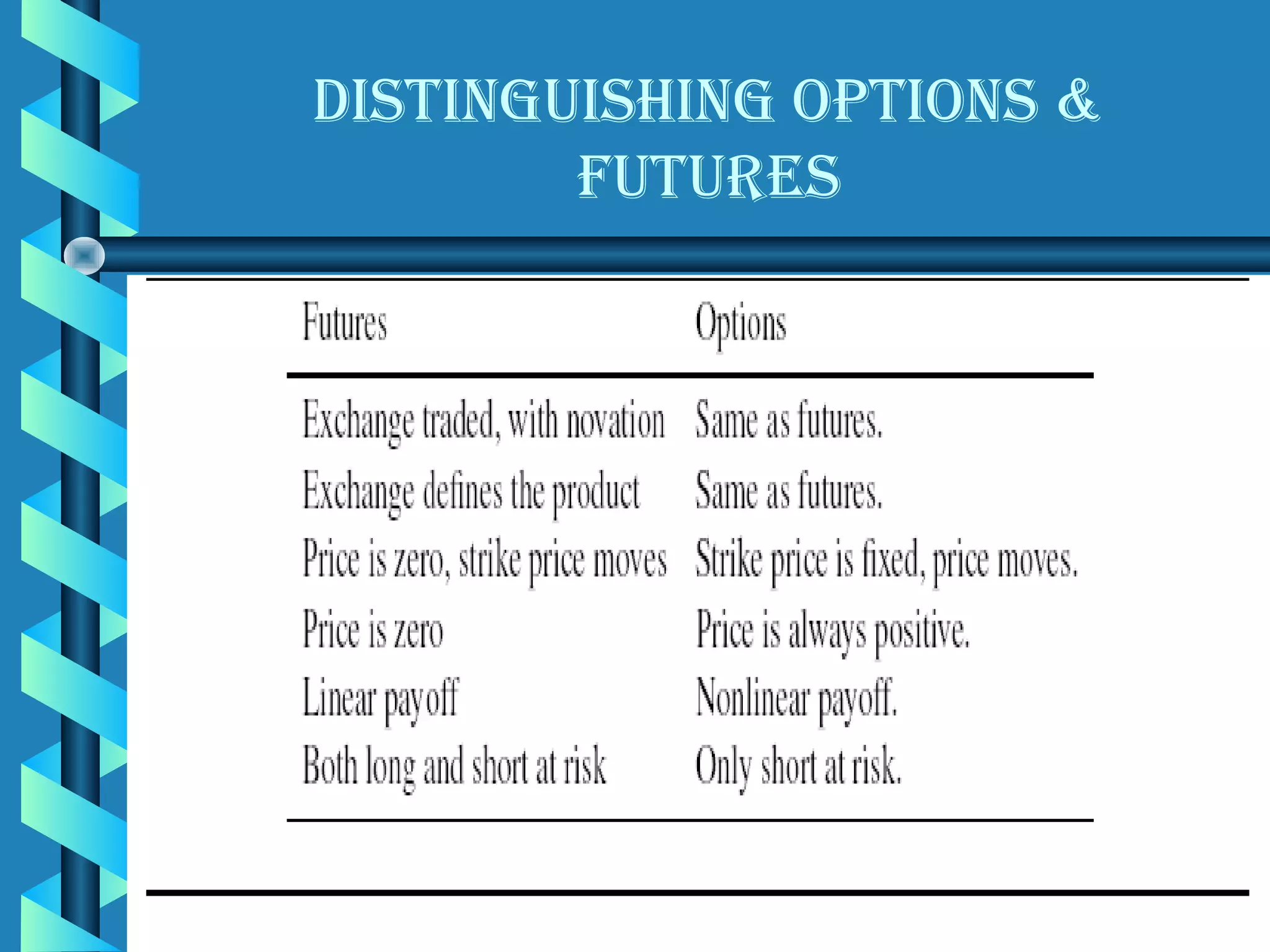

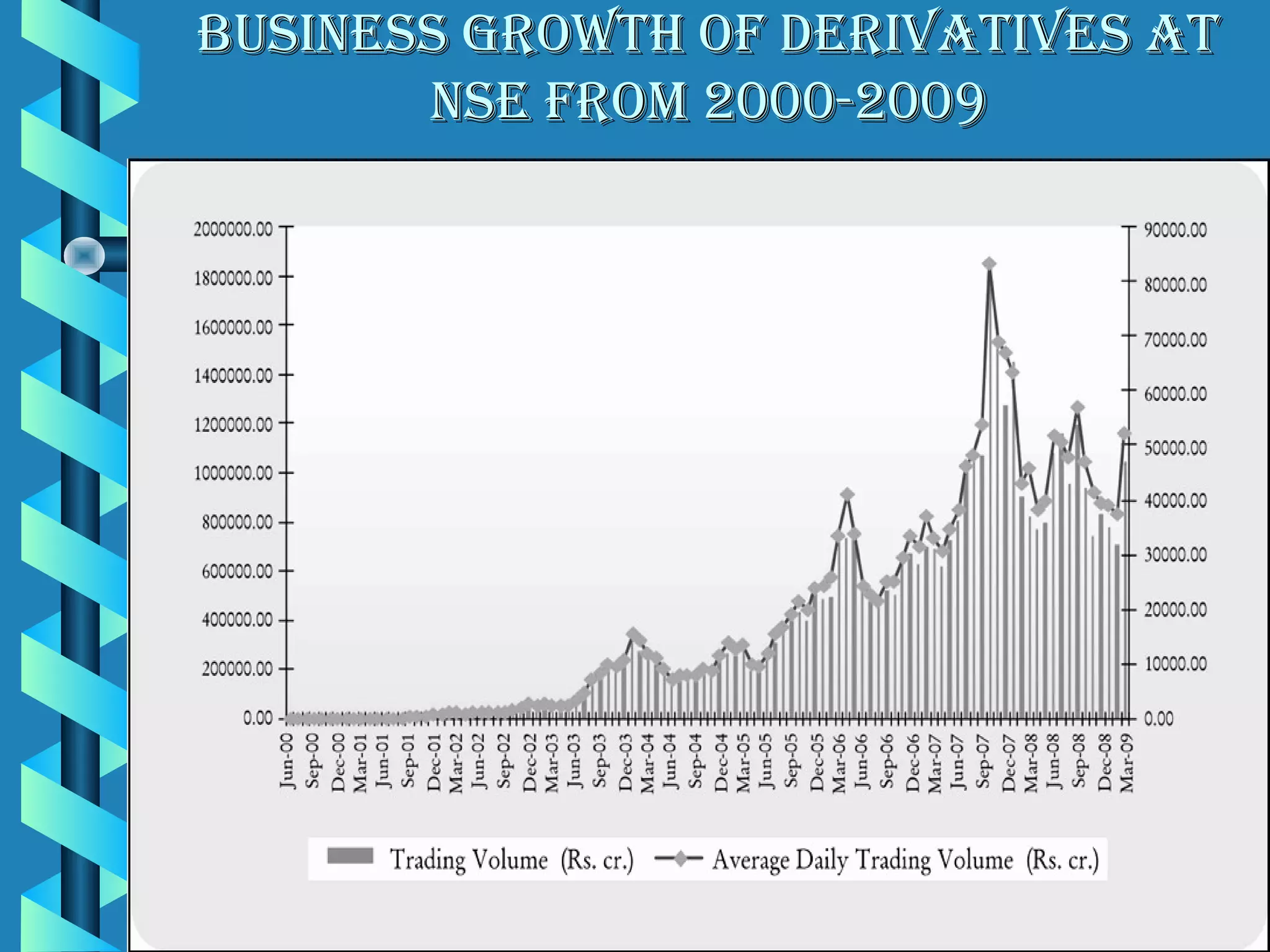

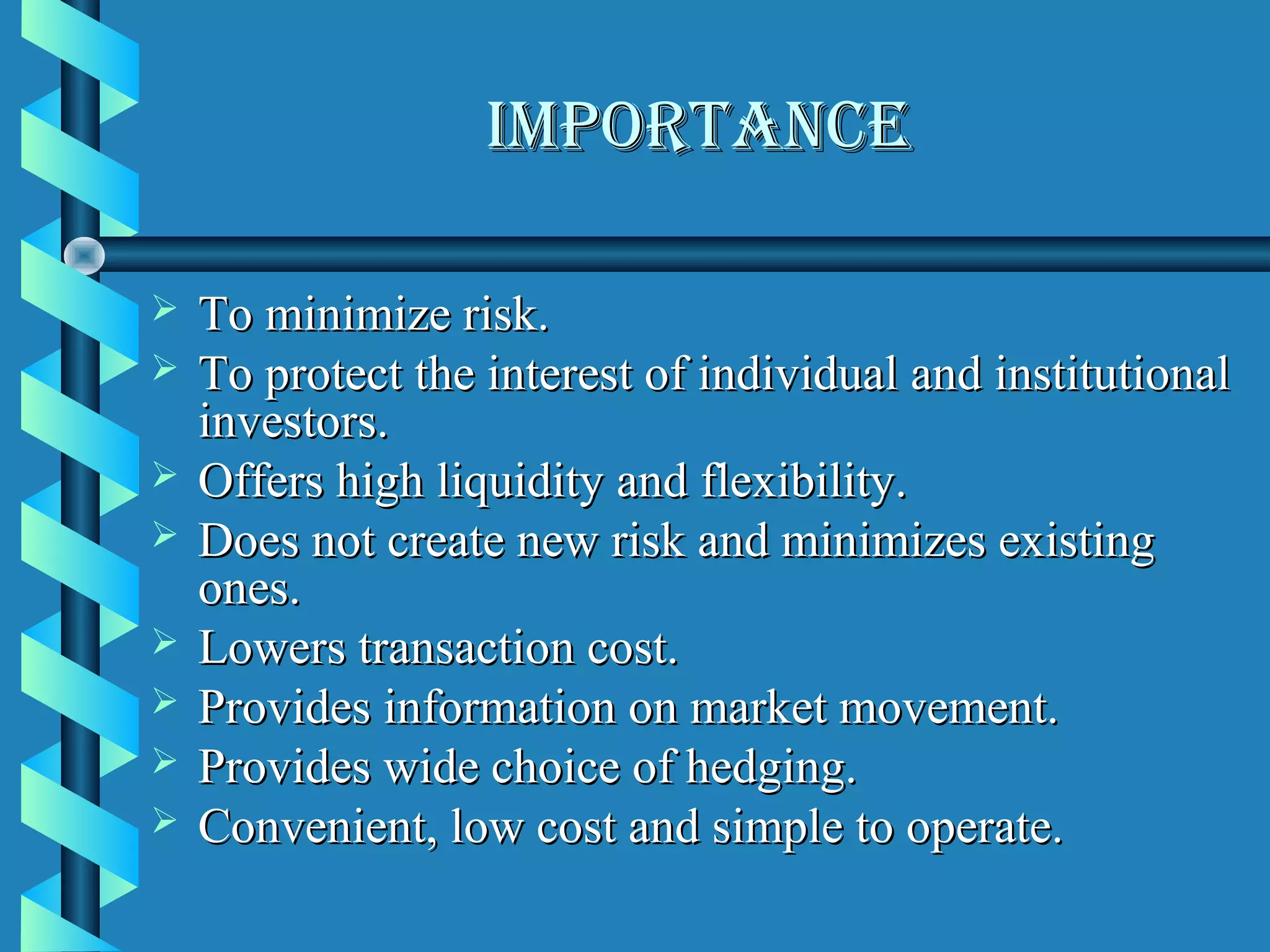

The document discusses the derivative market in India and risk management in banks. It defines derivatives and their various types like futures, options, and swaps. It explains how derivatives help banks manage risks like credit risk, interest rate risk, and liquidity risk. The history of derivatives trading in India is also summarized dating back to 1875. Key players in the market like hedgers, speculators, and arbitrageurs are identified along with their roles.