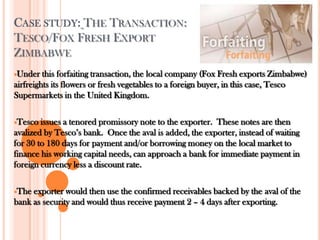

Factoring & Forfeiting

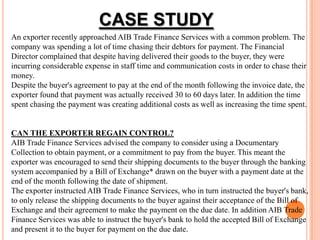

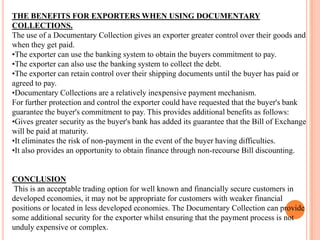

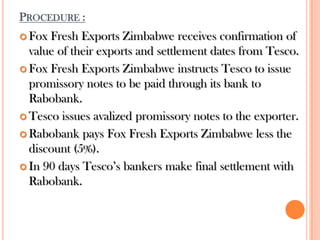

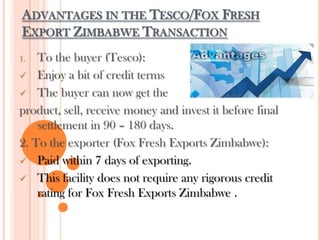

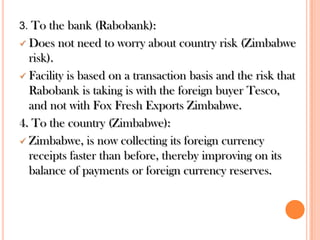

James Manufacturing, a small boat trailer manufacturer, was awarded a large contract but faced cash flow issues due to the long payment terms from the state. Through factoring, James received an advance of 80% on delivered trailers, providing working capital to complete the order on time. Forfeiting allowed Fox Fresh Exports in Zimbabwe to receive immediate payment in foreign currency less a discount by selling promissory notes from UK importer Tesco to a bank, improving cash flow. Both helped companies access working capital and meet delivery deadlines.