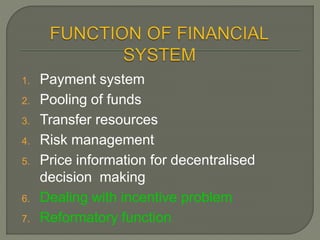

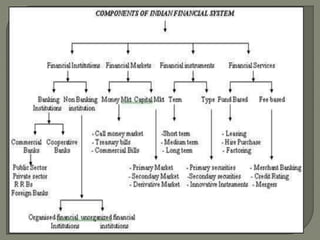

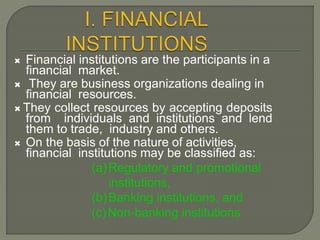

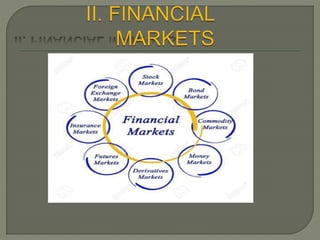

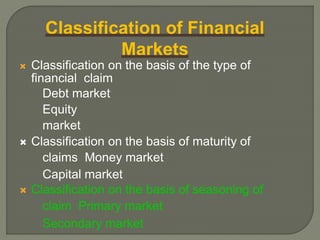

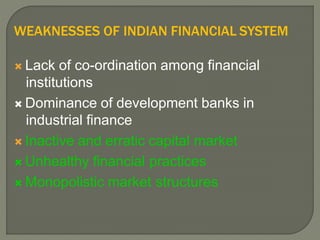

The financial system comprises intermediaries, markets, and instruments that transform savings into investments. It provides financial inputs that are crucial for economic development and improving standards of living. The system involves the activities of saving, financing, and investment. It includes various institutions like banks, non-banking financial companies, and financial markets that facilitate transactions and allocate resources. Financial instruments are traded in these markets to raise capital. The system also provides important financial services. However, the Indian financial system faces some weaknesses like a lack of coordination and inactive capital markets.