Embed presentation

Downloaded 244 times

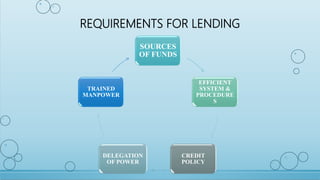

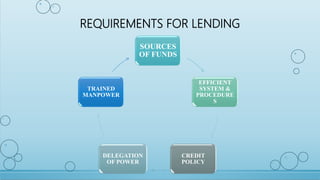

The document discusses credit management, detailing its definition, principles, functions of banks, types of lending, and requirements for lending. It emphasizes the importance of managing credit effectively, highlighting the '6 C's of borrowers' as key factors in evaluation. Additionally, it provides references for further reading on credit risk management and related topics.