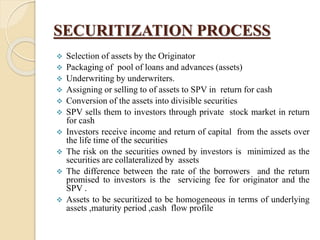

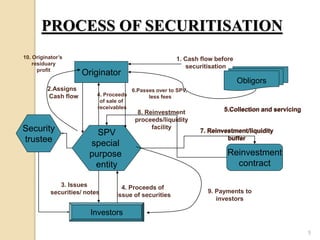

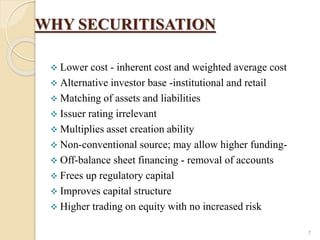

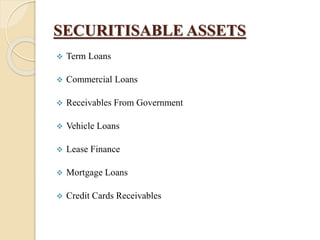

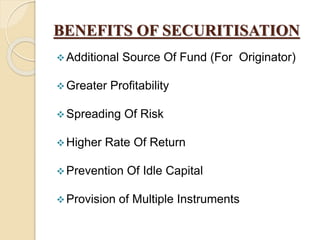

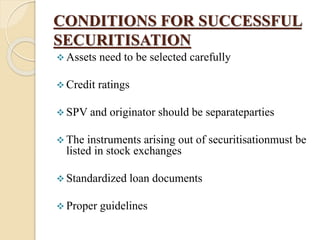

Securitization is the process of packaging loans and other receivables into marketable securities that can be sold to investors. It allows originators like banks to transfer assets off their balance sheets in exchange for upfront cash, while still earning fees from servicing the assets. The presentation discusses the securitization process in India, benefits for originators, requirements for success, and challenges facing the Indian securitization market like stamp duties and legal issues. While securitization is growing in India, challenges around legislation and standardization remain.