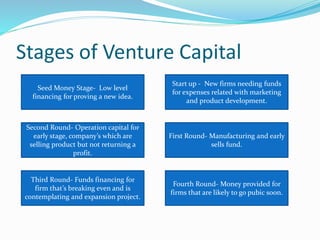

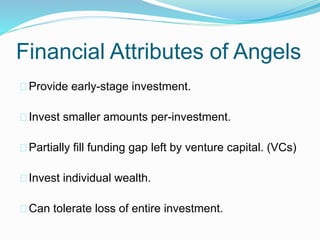

This document discusses venture capital and angel financing. It defines venture capital as money provided by investors to start-ups and small businesses with long-term growth potential. Venture capital financing is high-risk but can have high rewards. Angel financing refers to early investments from individuals, usually friends or family of the entrepreneur. The document outlines the stages of venture capital funding, advantages and disadvantages, as well as how venture capital firms and angel investors operate.