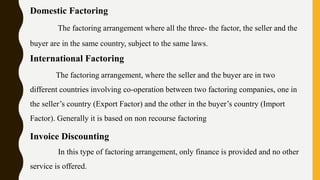

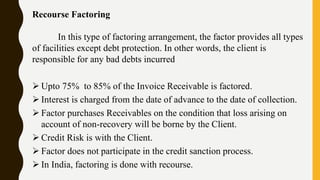

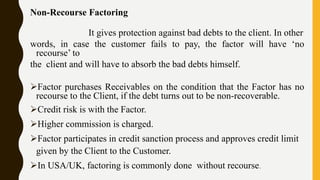

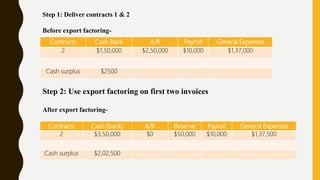

This document discusses factoring, which is a financial transaction where a business sells its accounts receivable to a third party called a factor in exchange for immediate cash. There are several types of factoring described, including domestic, international, recourse, non-recourse, maturity, and invoice factoring. The key differences between factoring and a bank loan are also outlined. A case study is then provided showing how a company used export factoring and purchase order financing to fulfill several contracts requiring upfront capital.