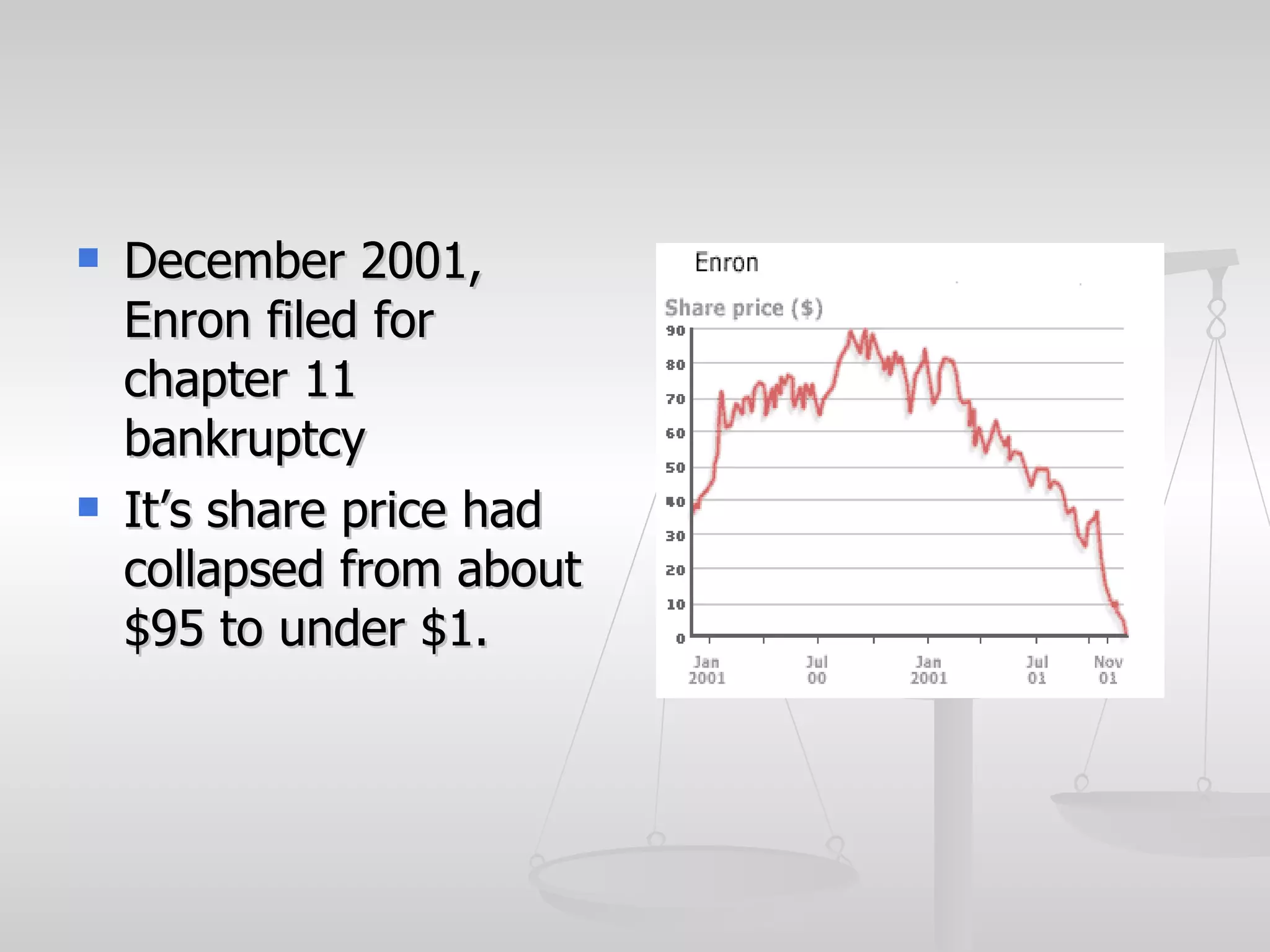

Enron was an energy company that collapsed in 2001 due to widespread corporate fraud. It had engaged in dubious accounting practices to hide losses and inflate profits. When these were revealed by a whistleblower, Enron's stock price plummeted and it declared bankruptcy. The scandal highlighted the need for reforms in accounting oversight and transparency to protect investors.