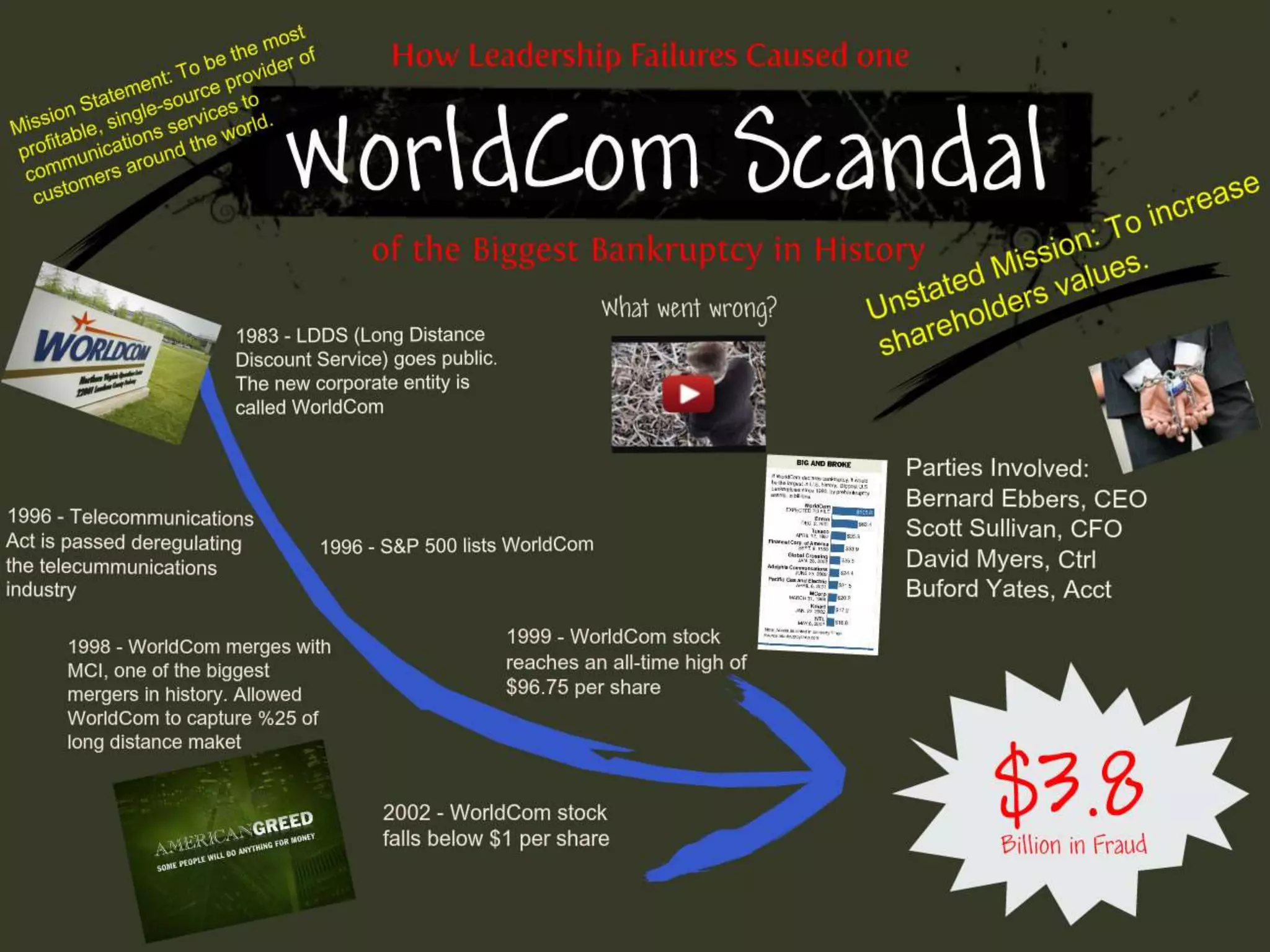

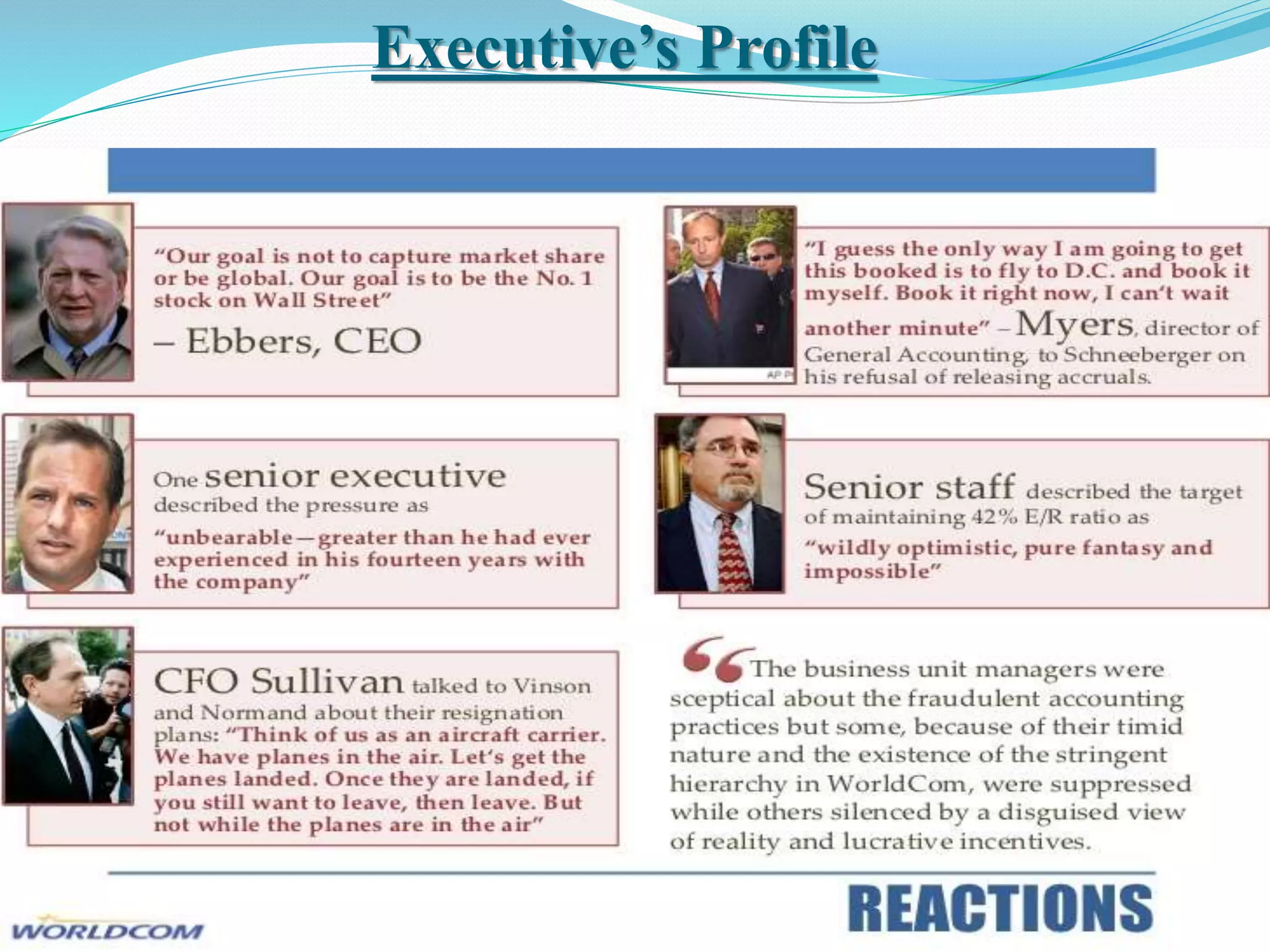

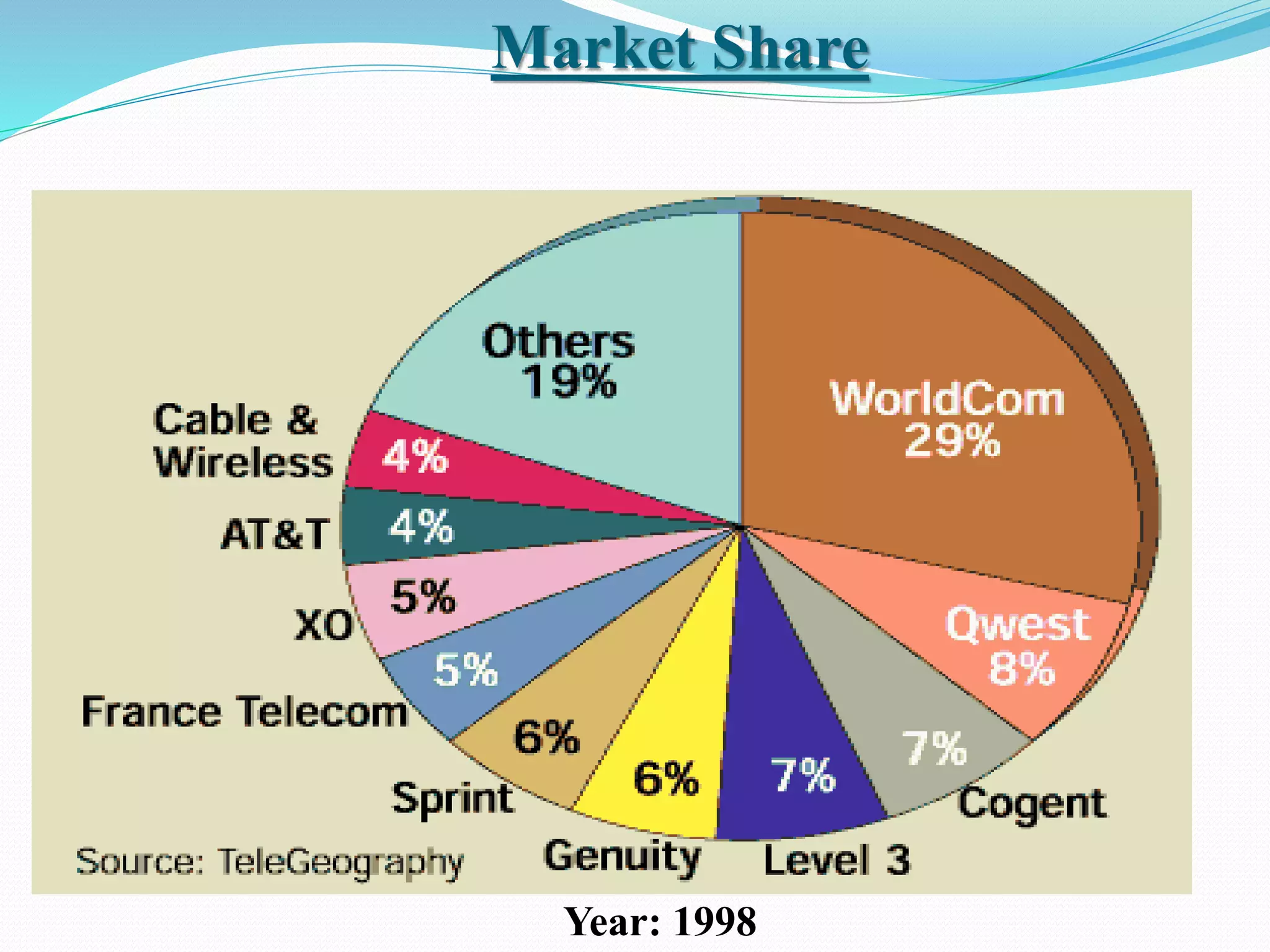

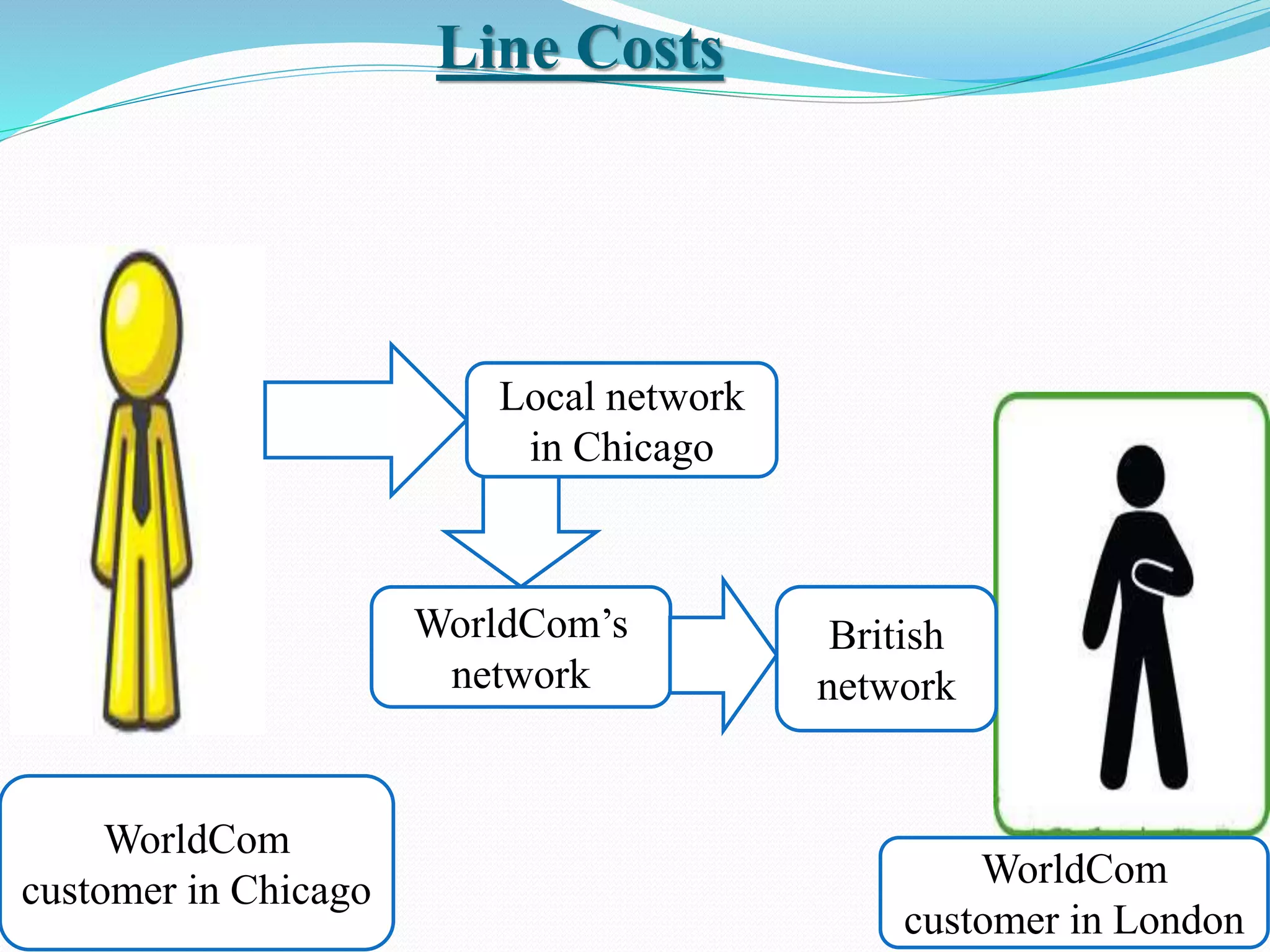

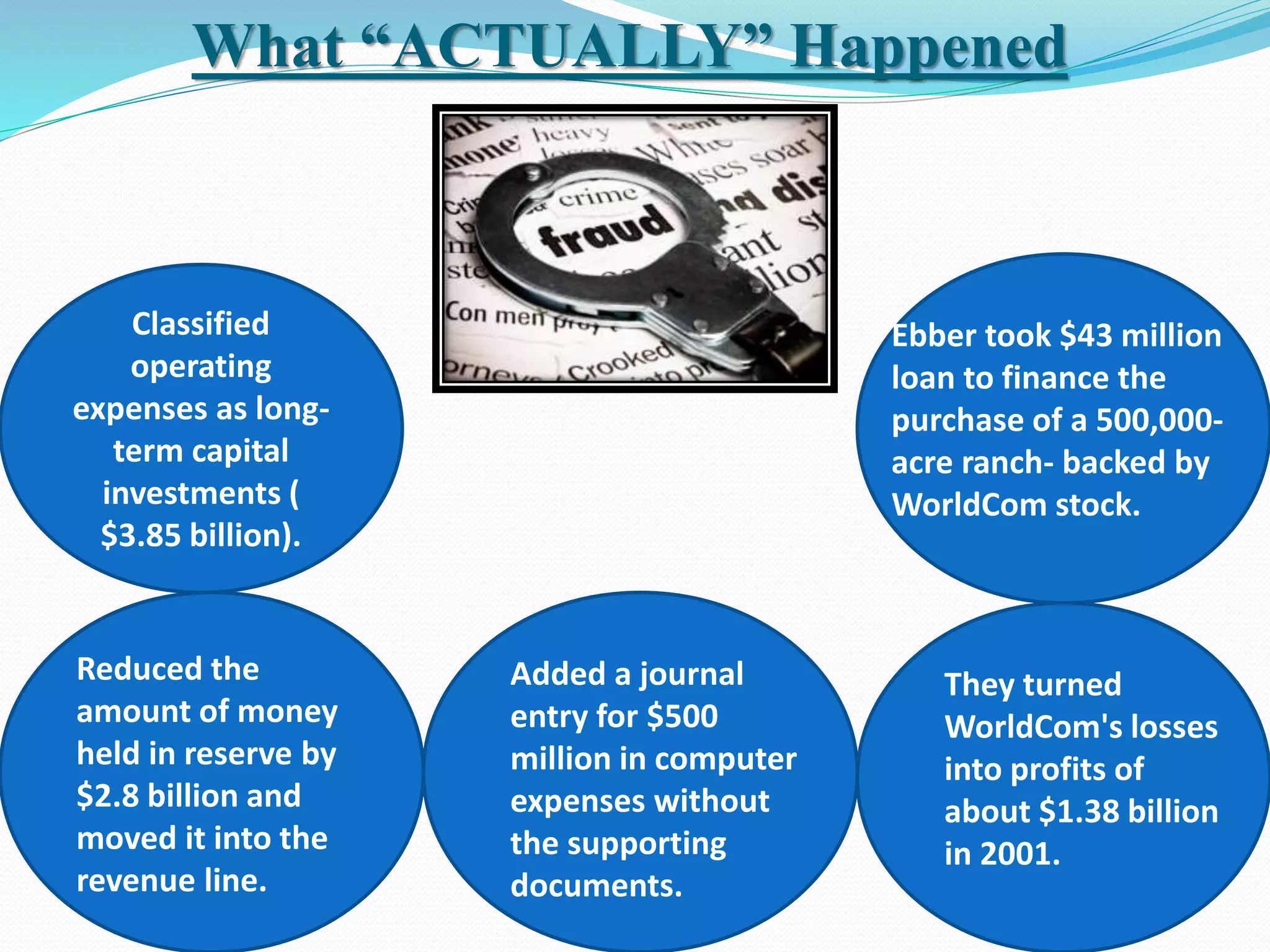

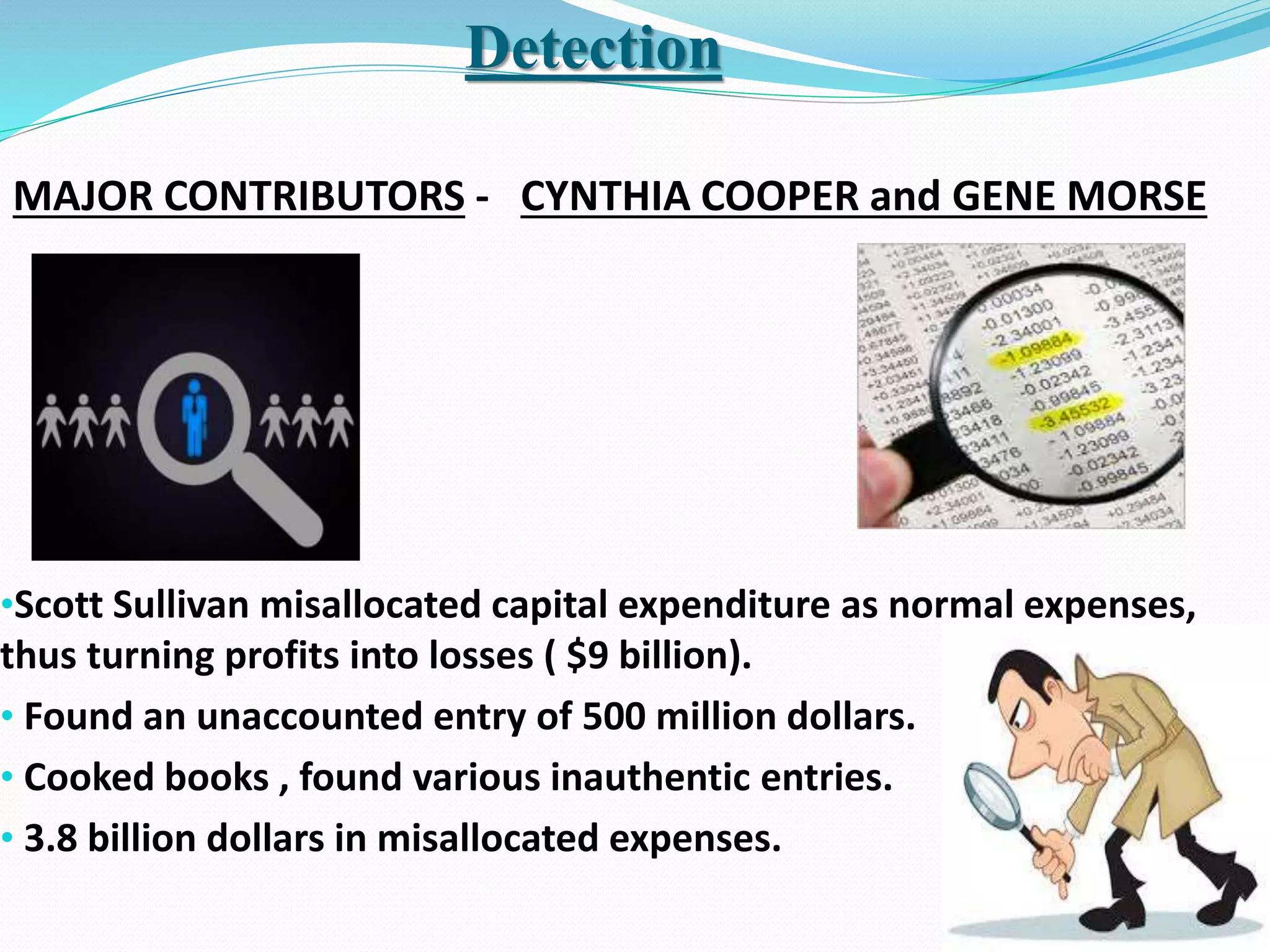

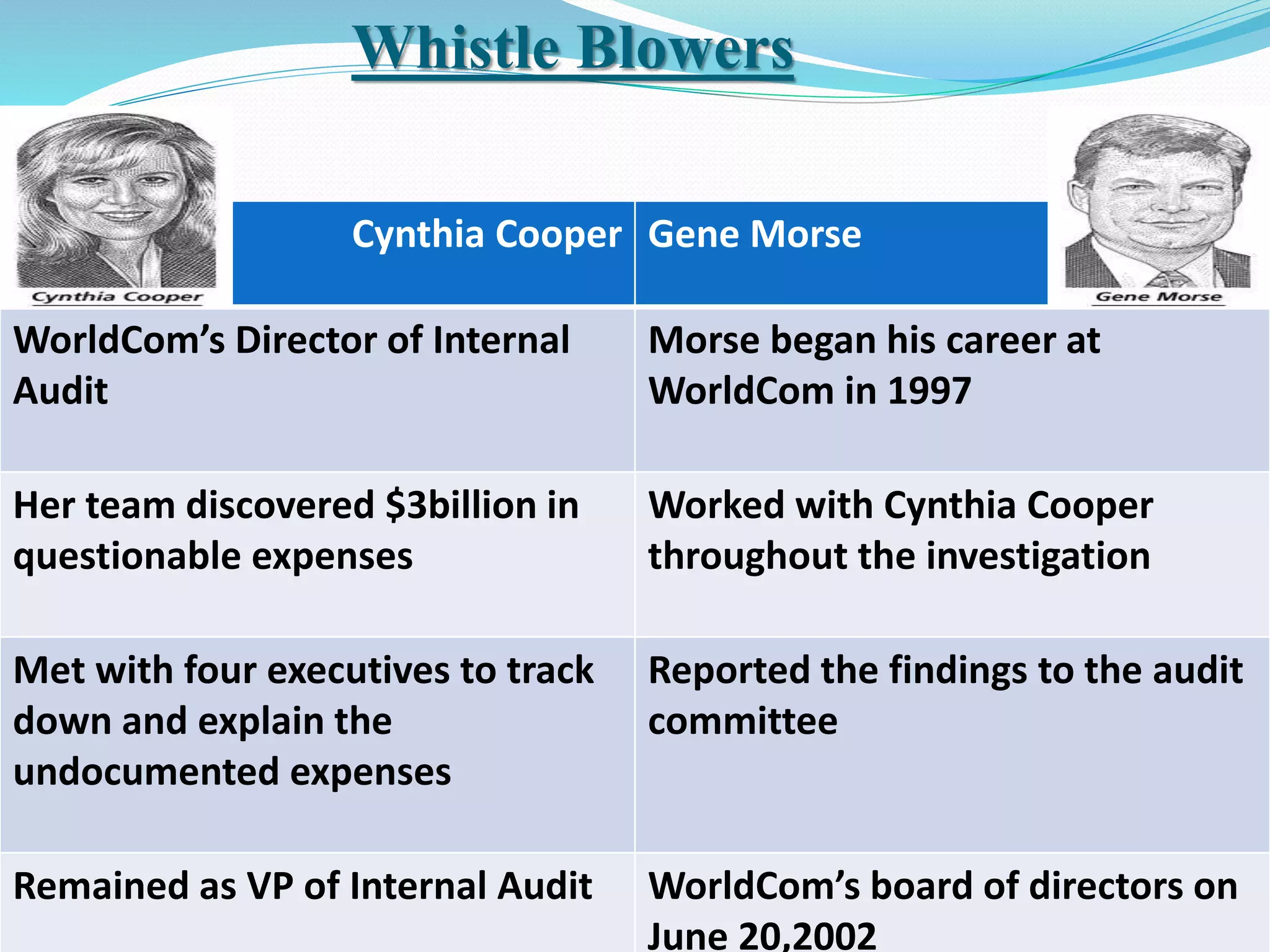

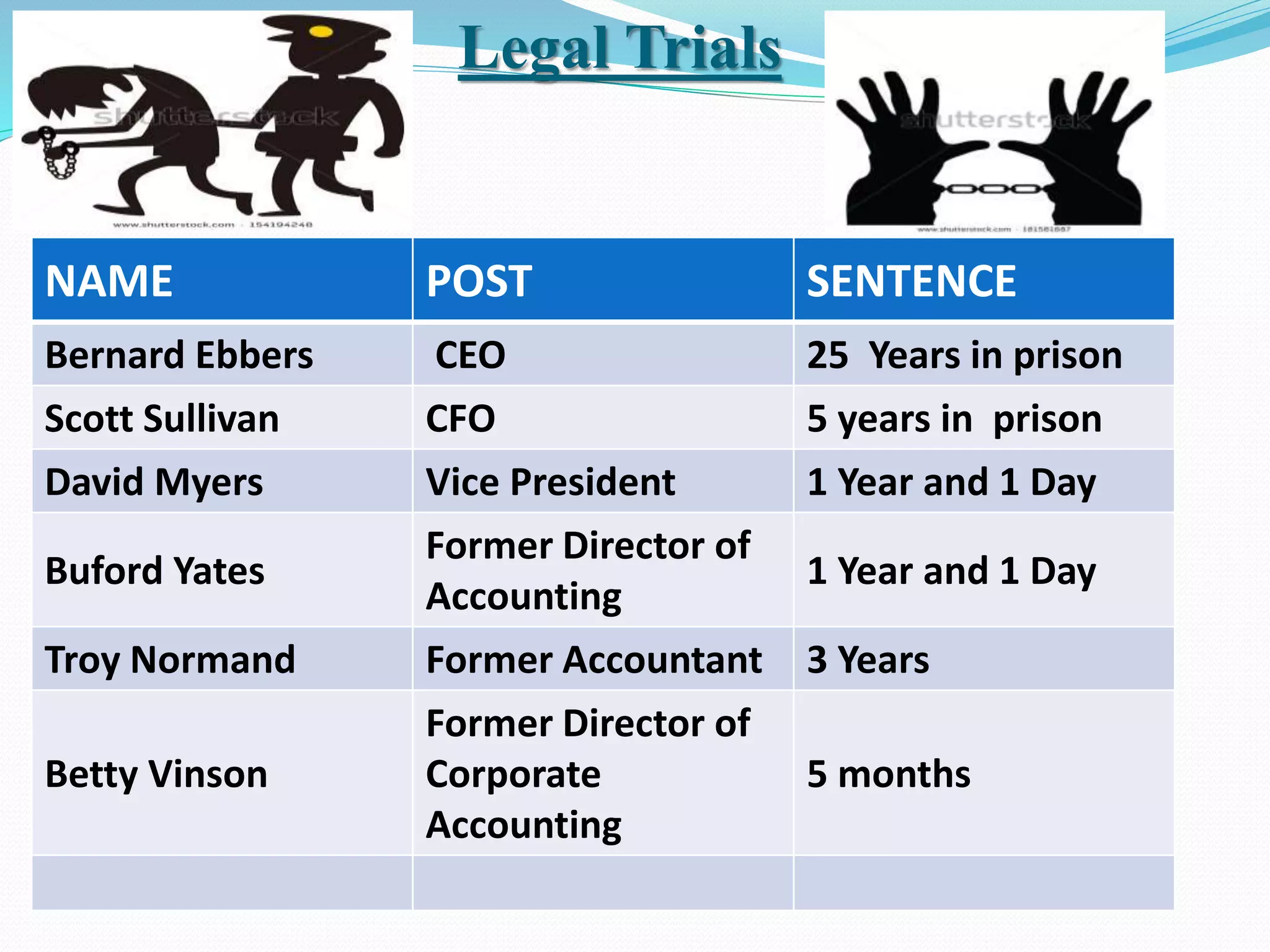

Worldcom was a telecommunications company founded in 1983 that grew rapidly through acquisitions. By 2000, it was one of the largest such companies in the world. However, its aggressive expansion left it struggling with high debt. To hide losses and inflate profits, Worldcom executives under CEO Bernie Ebbers fraudulently reported $3.8 billion in expenses as capital costs. This was uncovered in 2002 by internal auditors Cynthia Cooper and Gene Morse. Worldcom filed for bankruptcy that year in what was then the largest such filing in U.S. history. Ebbers and other executives were convicted of fraud. The scandal led to stricter financial regulations with the Sarbanes-Oxley Act