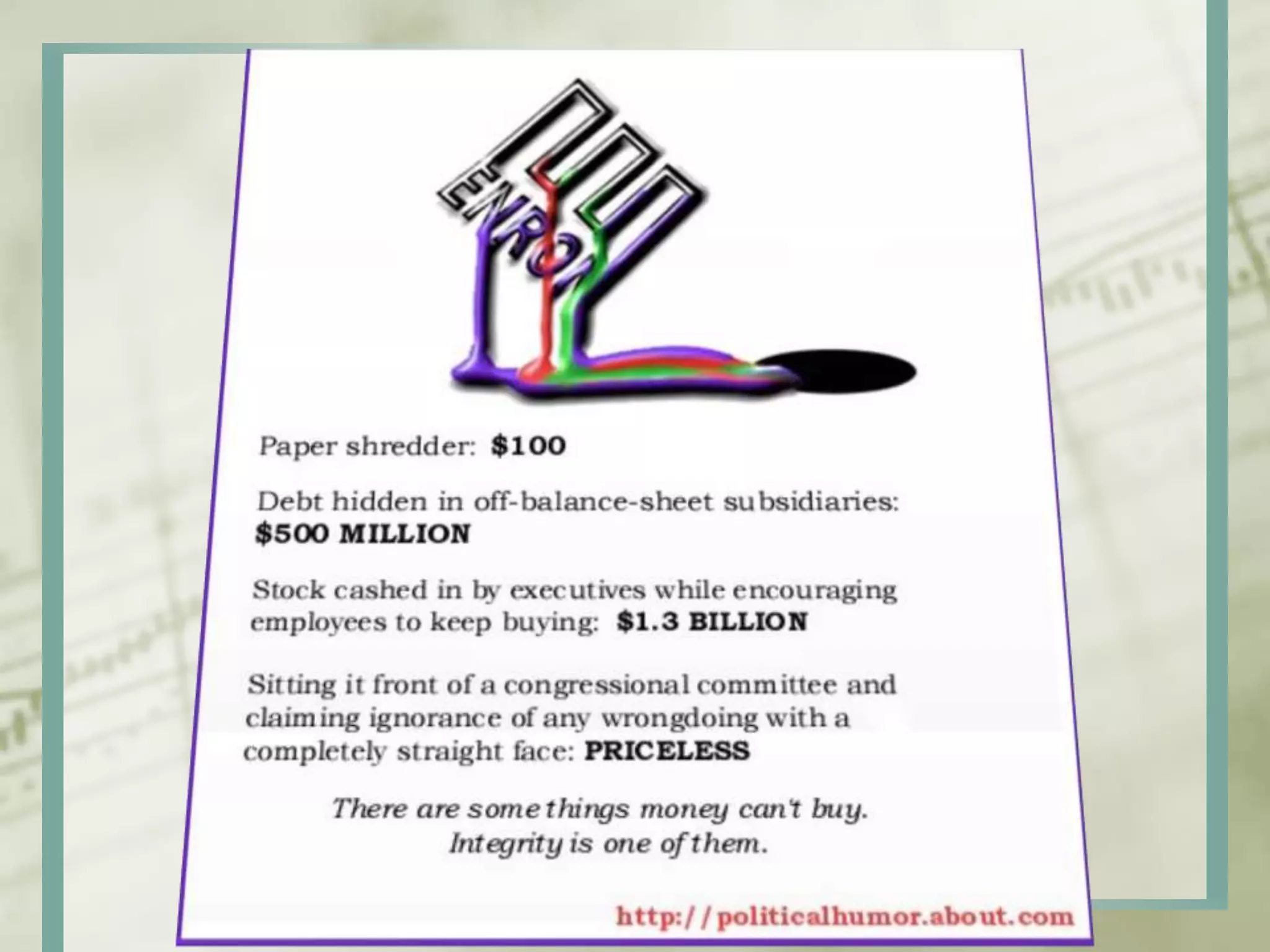

Enron was an energy company that collapsed in 2001 due to an accounting fraud scandal. The document discusses how Enron achieved great success initially by innovating in the energy market. However, it then describes how Enron used complex accounting practices and off-balance sheet entities to hide debts and inflate profits. This allowed top executives to profit through stock sales even as the company's financial situation deteriorated. When the fraud was revealed, Enron declared bankruptcy, destroying the savings of employees and shareholders. The document analyzes the roles of Enron's management, accounting practices, and lax regulatory oversight in enabling the massive fraud.