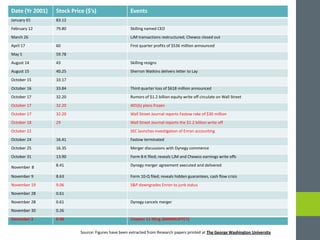

The document provides an overview of the Enron scandal from a corporate perspective. It discusses Enron's origins and growth into one of the largest energy companies in the world. It then examines the accounting fraud and deception that took place, hiding billions in losses and debts through off-balance sheet entities. Key people like CEO Ken Lay and CFO Andrew Fastow benefited greatly from these actions. The scandal broke in late 2001, wiping out billions in market value and causing thousands of layoffs. It shook confidence in corporate accounting practices and led to new regulations like the Sarbanes-Oxley Act of 2002.