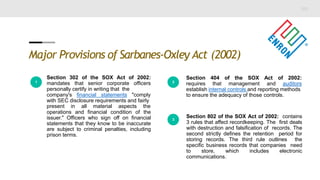

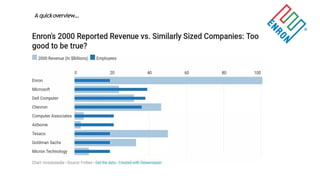

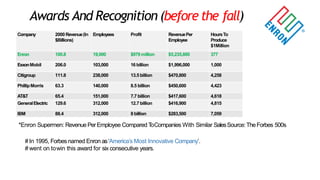

The document outlines the rise and fall of Enron Corp., highlighting its impressive growth due to deregulation and innovative practices, followed by a catastrophic collapse caused by fraudulent accounting and misleading financial reports. Key figures in the scandal include CEO Kenneth Lay, CFO Andrew Fastow, and whistleblower Sherron Watkins, whose actions ultimately led to regulatory reforms like the Sarbanes-Oxley Act of 2002. The aftermath resulted in significant job losses, financial penalties, and a reassessment of corporate governance practices.

![Smartest Guys in theroom

KennethLeeLay:

• Thefounder, CEOand Chairman of Enron and was

heavily involved in the Enronscandal.

• Laywas found guilty of 10 counts of securities fraudin

the trial of Kenneth Layand JeffreySkilling.

JeffreyKeithSkilling :

• TheCEOof Enron Corporation during the Enron scandal.

• Enron adopted Skilling‟s "mark-to-market" accounting.

• April,2001:In response to Richard Grubman saying "You know, you are the

only financial institution that can't produce a balance sheet or cash flow

statement with theirearnings", Skilling replied: "Thank you very much,we

appreciate that...Ass****." [23]

• Skilling unexpectedly resigned on August 14,2001.](https://image.slidesharecdn.com/enronfinalultimate-190622114037/85/Enron-A-Financial-Mess-6-320.jpg)