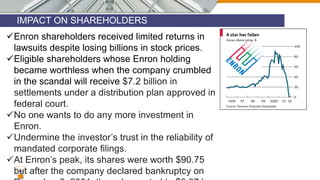

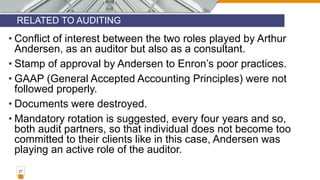

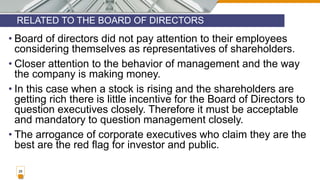

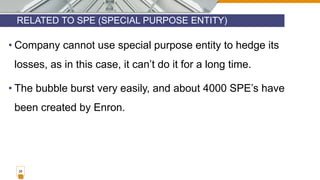

Enron was an American energy company that collapsed in 2001 due to widespread corporate fraud. The company used accounting loopholes to hide billions in debt and inflate profits. When the fraud was revealed, Enron filed for bankruptcy. Thousands of employees lost their jobs and retirement savings. The scandal exposed flaws in auditing practices and led to new laws like Sarbanes-Oxley to increase corporate accountability and transparency.