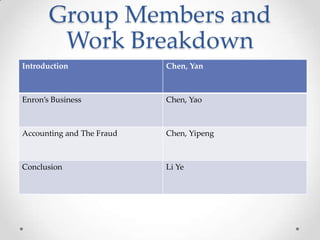

Group members were assigned topics to research about Enron. Yan Chen covered the introduction, providing background on Enron's achievements and rapid growth into a global energy giant. Yao Chen discussed Enron's business model and trading operations. Yipeng Chen analyzed Enron's accounting fraud and deception. Li Ye concluded by discussing the impact of the scandal, including Arthur Andersen's involvement and the subsequent Sarbanes-Oxley financial reforms. The document provided an overview of Enron's history from its rise to prominence to its collapse in an accounting scandal due to unethical business practices and misleading financial reporting.