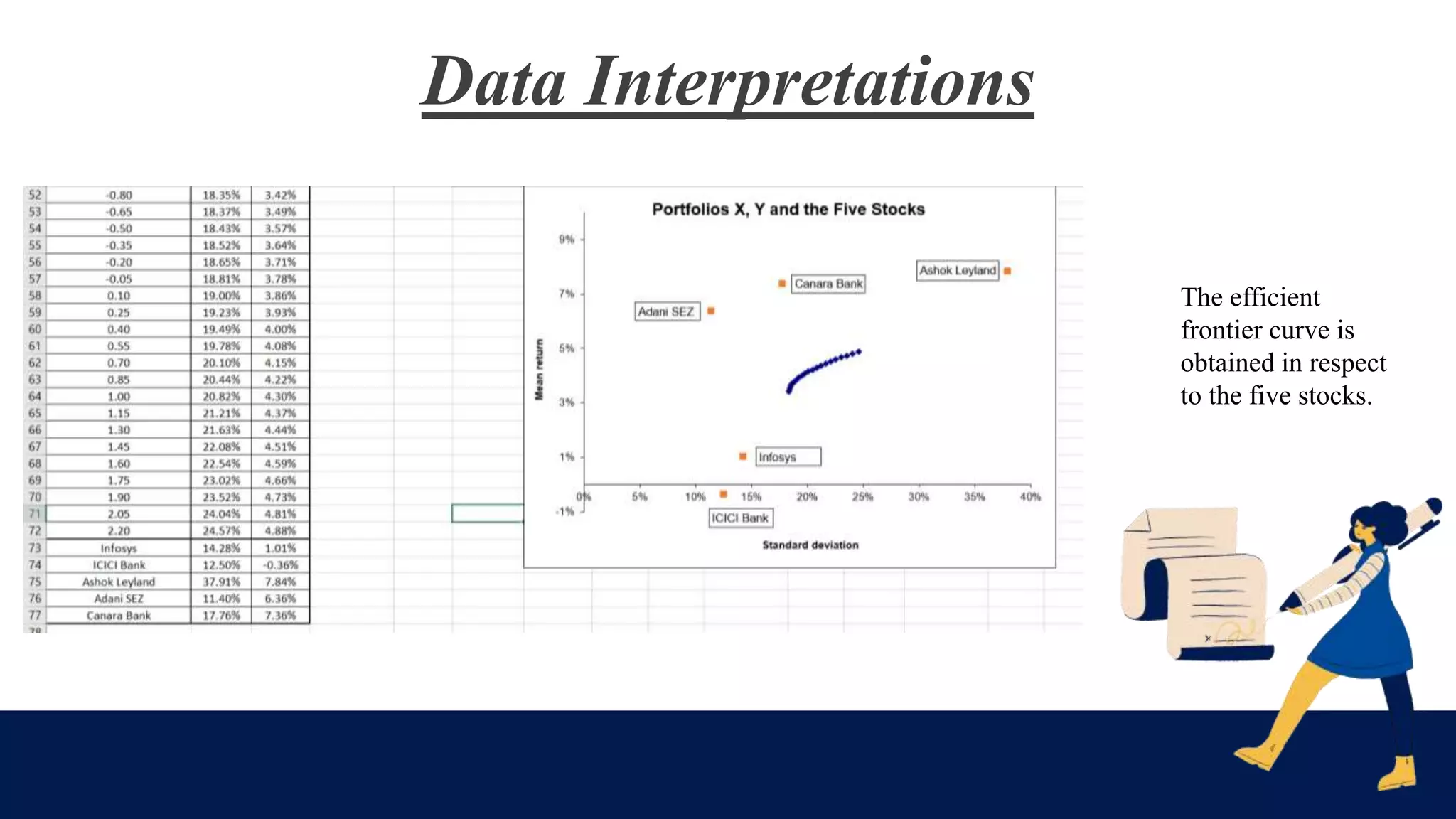

This document presents an analysis of the efficient frontier for a portfolio containing five stocks: Infosys, ICICI Bank, Ashok Leyland, Adani SEZ, and Canara Bank. Ten years of historical return data for these stocks was collected from the NSE website and used to calculate the mean, standard deviation, and variance of each stock. Portfolios X and Y were created by assigning different weights to the five stocks. The mean, variance, covariance, and correlation of the two portfolios were then calculated. By varying the weights and calculating the corresponding mean returns and standard deviations, an efficient frontier curve was obtained showing the highest possible returns for different levels of risk.