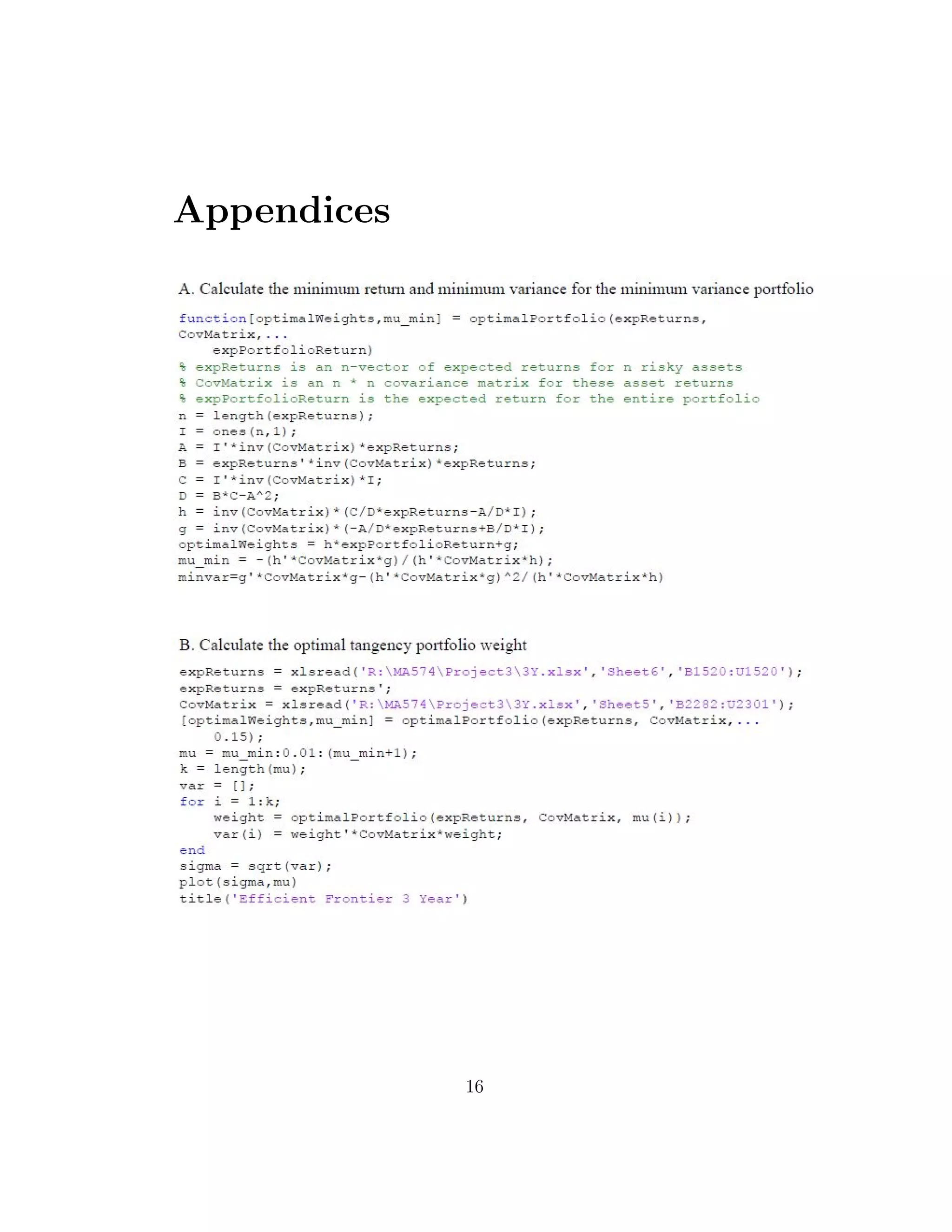

This document is a portfolio optimization project report submitted by Tingwen Zhou and Xuan Ning to Professor Marcel Y. Blais on December 15, 2016. It analyzes the performance of a portfolio reconstructed on November 7, 2016 using a 3-year period of asset data. The portfolio underperformed, losing a total of $86,025. Various metrics are calculated to evaluate the portfolio such as Sharpe ratio, Treynor ratio, and maximum drawdown. The efficient frontier is analyzed over time as weights were rebalanced weekly.

![$987,953. The basic information is stored in the table.

We closed all Interactive Brokers portfolio positions on Thursday Decem-

ber 8th, then analyze the overall portfolio performance with all the data we

gathered. We had 30 trading days in total, and we adjusted the portfolio 5

times.

2 Portfolio Performance

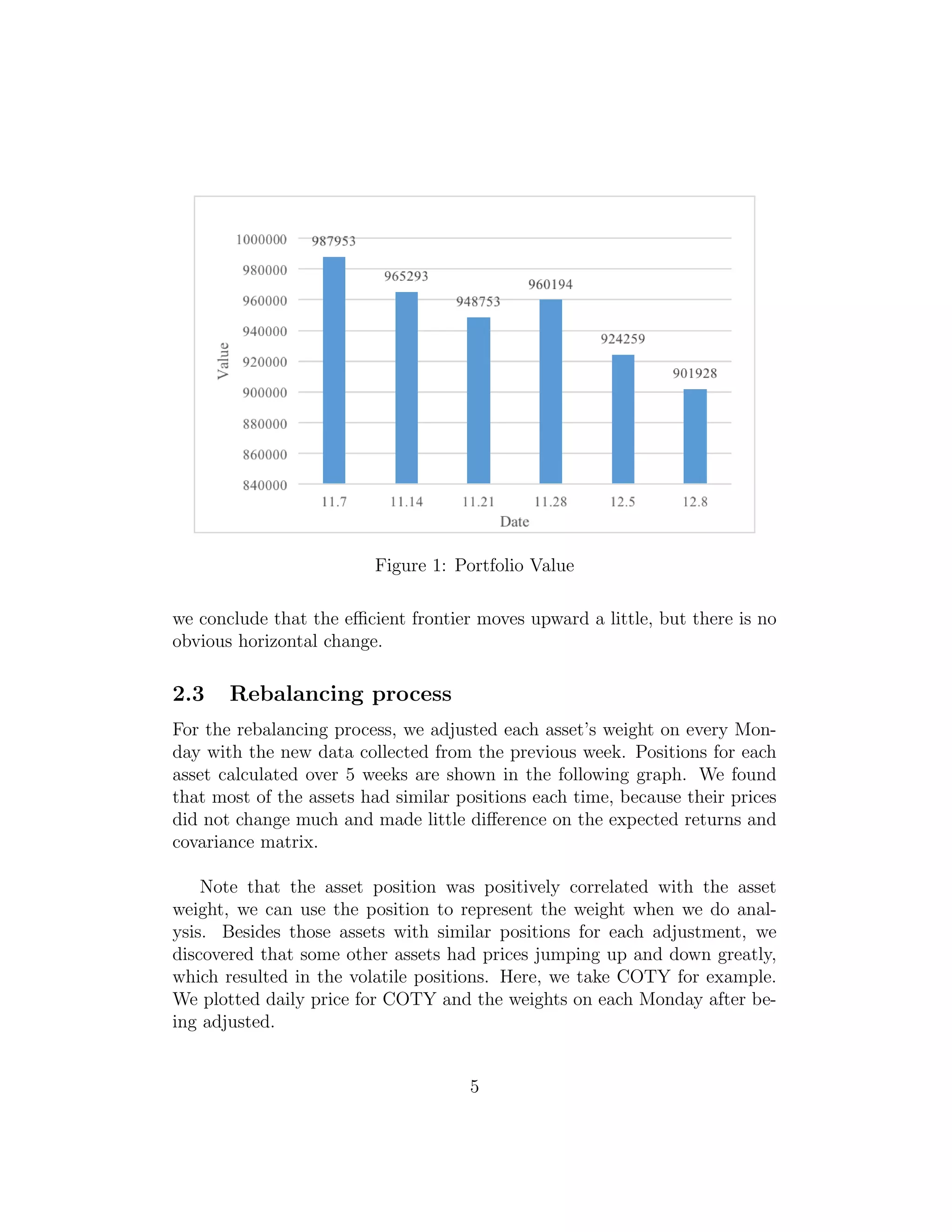

2.1 Portfolio value

We plotted a histogram of weekly portfolio returns to track its performance,

and unfortunately, we had a loss of $86,025 ($987,953-$901,928) at last. We

presented all the portfolio values in the table and plot the distributions in

the histogram, from which we concluded that our investment failed to earn

profits.

Date 11.7 11.14 11.21 11.28 12.5 12.8

Portfolio Value 987,953 965,293 948,753 960,194 924,259 901,928

Table 2: Portfolio Value

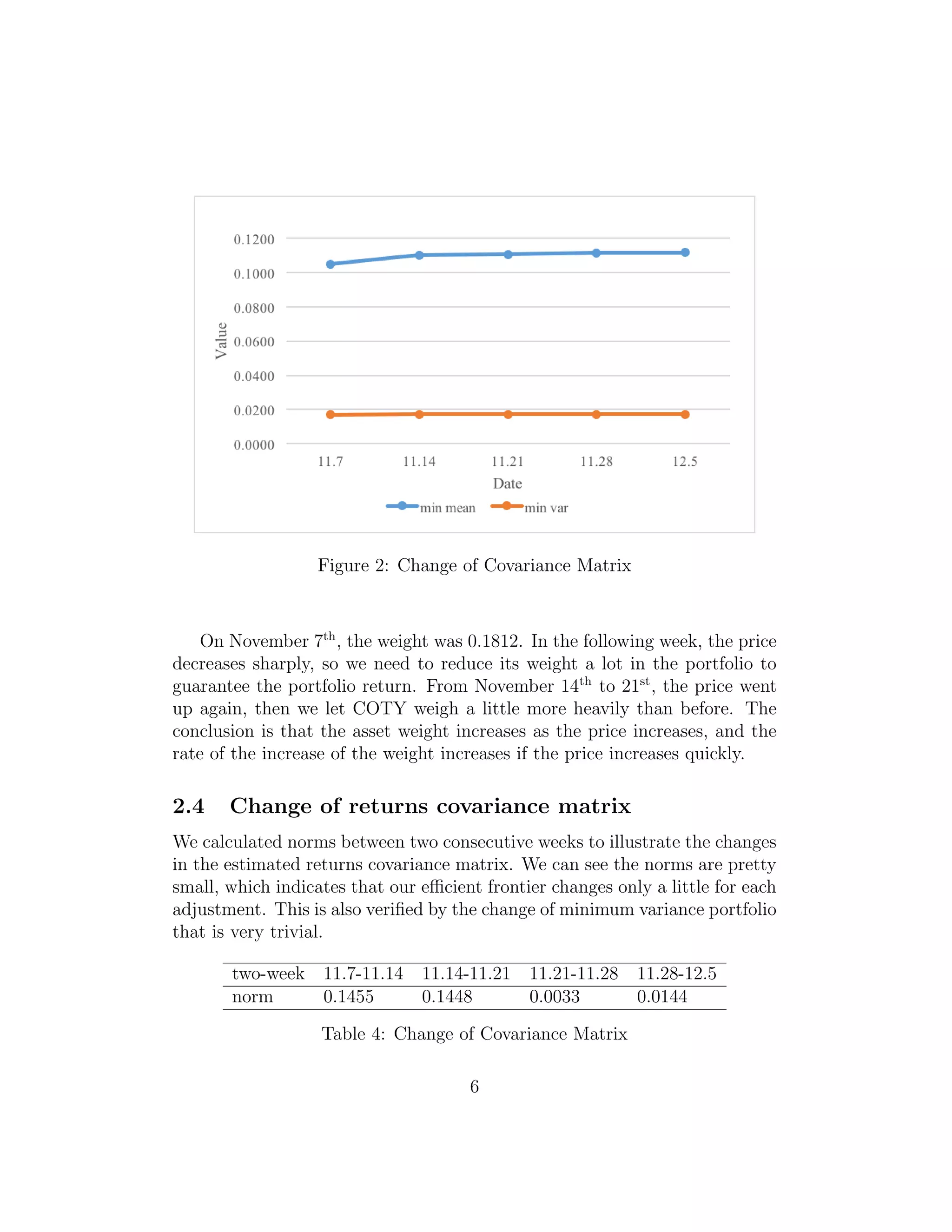

2.2 Efficient frontier (Minimum variance portfolio)

We can compare week-to-week minimum variance portfolios to illustrate how

the efficient frontier[1]

changes. The table and plot about minimum mean and

minimum variance are as follows:

Date 11.7 11.14 11.21 11.28 12.5

min mean 0.1050 0.1101 0.1106 0.1114 0.1117

min variance 0.0170 0.0172 0.0172 0.0171 0.0171

Table 3: Change of Efficient Frontier

Through our adjustments, the minimum variance oscillates between the

interval [0.0170, 0.0172] and the minimum mean slightly increases. Therefore,

4](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-5-2048.jpg)

![Figure 3: Rebalance Process

2.5 Overall performance

For the overall portfolio performance, our initial portfolio value was $987,953,

and the ending value was $901,928. Therefore, we lost $86,025 in total.

Unfortunately, our portfolio was a failure.

3 Portfolio Performance Analysis

We collected all the daily prices[2]

for the 20 assets in our portfolio from

November 7th

to December 7th

, and would use this sample to do the follow-

ing portfolio performance analysis.

3.1 Sharpe ratio

The Sharpe ratio of a portfolio is its excess returns per unit of total portfolio

risk, and higher Sharpe ratios indicate better risk-adjusted portfolio perfor-

mance. The formula for Sharpe ratio is RS =

µp−µf

σp

. Here, we used sample

7](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-8-2048.jpg)

![mean return for µp and sample standard deviation of returns for σp. Also

for µf , we selected 12-month LIBOR[3]

as the risk-free rate which is 1.57%.

Finally we got Sharpe ratio is -0.370. Therefore, the return decreases 0.37

units for every unit of total risk.

3.2 Treynor ratio

The Treynor ratio is interpreted as excess returns per unit of systematic risk,

and is calculated as

µp−µf

βp

. We used S&P 500 as benchmark. The final result

was 0.072. In theory, the higher the Treynor ratio, the better the portfolio

performance. But we think the prerequisite should be: βp is positive. Indeed,

βp for our portfolio is negative, and µp is smaller than µf which is also not

ideal. Under this circumstance, we got a positive Treynor ratio. Therefore,

we cannot conclude that the portfolio is managed well.

3.3 Information ratio

Information ratio measures the average of an active portfolio return in excess

of a positive portfolio return. It is relative to the increased volatility of active

portfolio compared to the passive one. The formula to calculate Information

ratio is RI =

µp−µf

σRp−RM

, and S&P 500[4]

is used as benchmark here. The

information ratio for our portfolio is -0.016.

3.4 Sortino ratio

The Sortino ratio is calculated as µp−r0

σr−

0

. It is similar to Sharpe ratio, but

penalize only those returns falling below a required rate of return. r0 is

either a target return or some minimal acceptable return, often r0 = µf , σr−

0

is the left simivariance, defined as

ro

− inf

r0(x − r0)2

f(x)dx. But we can use

S2

a− which is calculated as 1

n

n

i=1[min{0, Ri − a}]2

to estimate σr−

0

. We set

a = 0, this means we only involve those negative portfolio returns in the

denominator. The Sortino ratio calculated is -0.017.

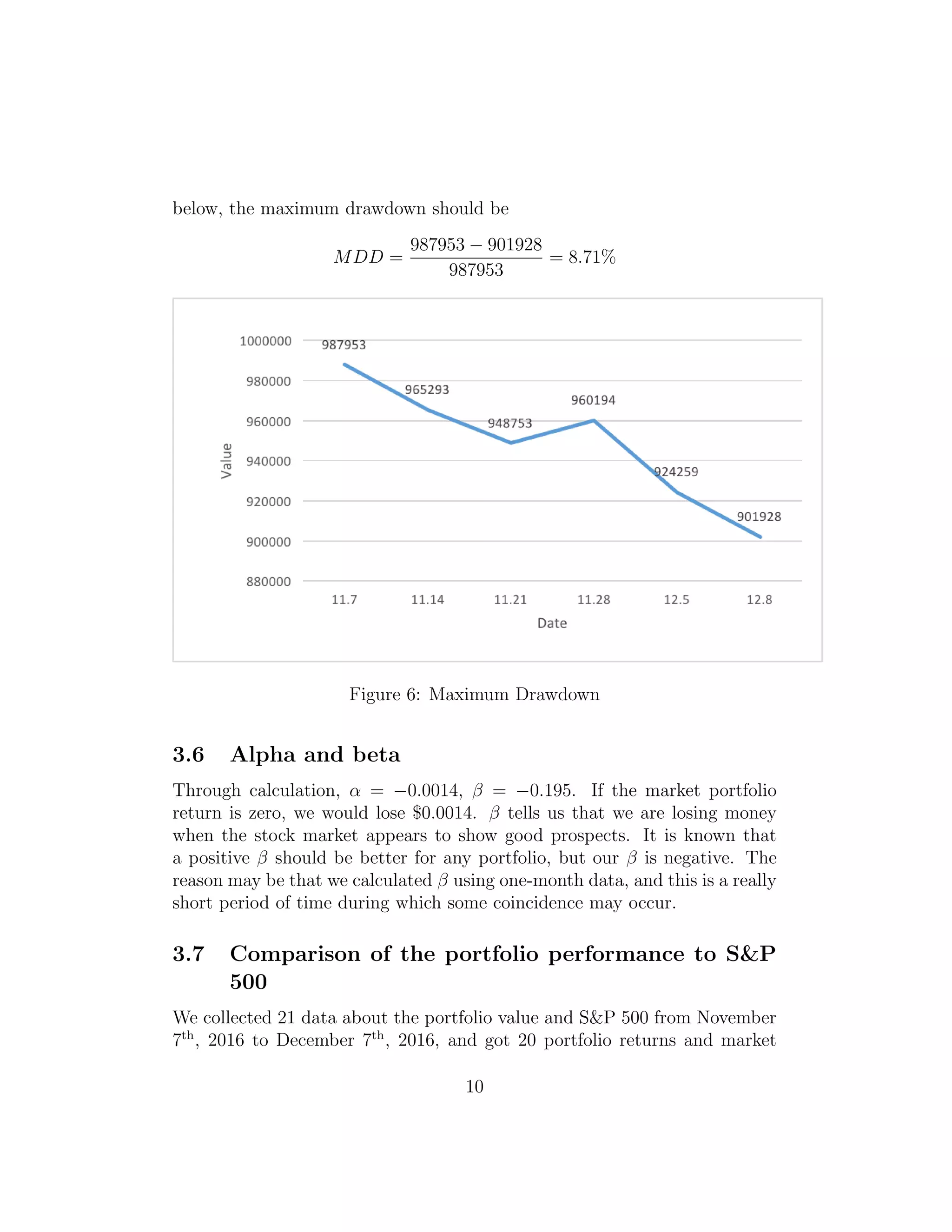

3.5 Maximum drawdown

Maximum drawdown is the maximal equity retracement of a portfolio over

some fixed period of time. Based on our week-to-week portfolio values shown

9](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-10-2048.jpg)

![returns respectively. We plotted these two returns below, and found that the

S&P 500 return was very stationary while our portfolio return jumped up

and down. S&P 500 is an American stock market index based on the market

capitalizations of 500 large companies[5]

. Indeed we selected a few small-cap

stocks in our portfolio, so the fluctuations seemed rational.

Figure 7: Portfolio vs Market

3.8 Margin calls

We failed to construct our initial portfolio at the first attempt. Because

when we tried to adjust the tangency portfolio in the following week, we

found many weights were either too high or too low, and we could not trade

based on these weights since our capital and premium were limited. If not,

the excess liquidity would fall below zero and we would be in margin viola-

tion. Then we realized the source of mistake should be the one-month data.

Since one month is really short, we cannot consider the asset prices are sta-

tionary and consistent. We need to choose another long period of time like

three years as we did at last.

11](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-12-2048.jpg)

![After this adjustment of time series, the tangency portfolio weights ap-

peared reasonable over the following five weeks. The excess liquidity was

always positive in the remaining time, and we were never in margin violation

again.

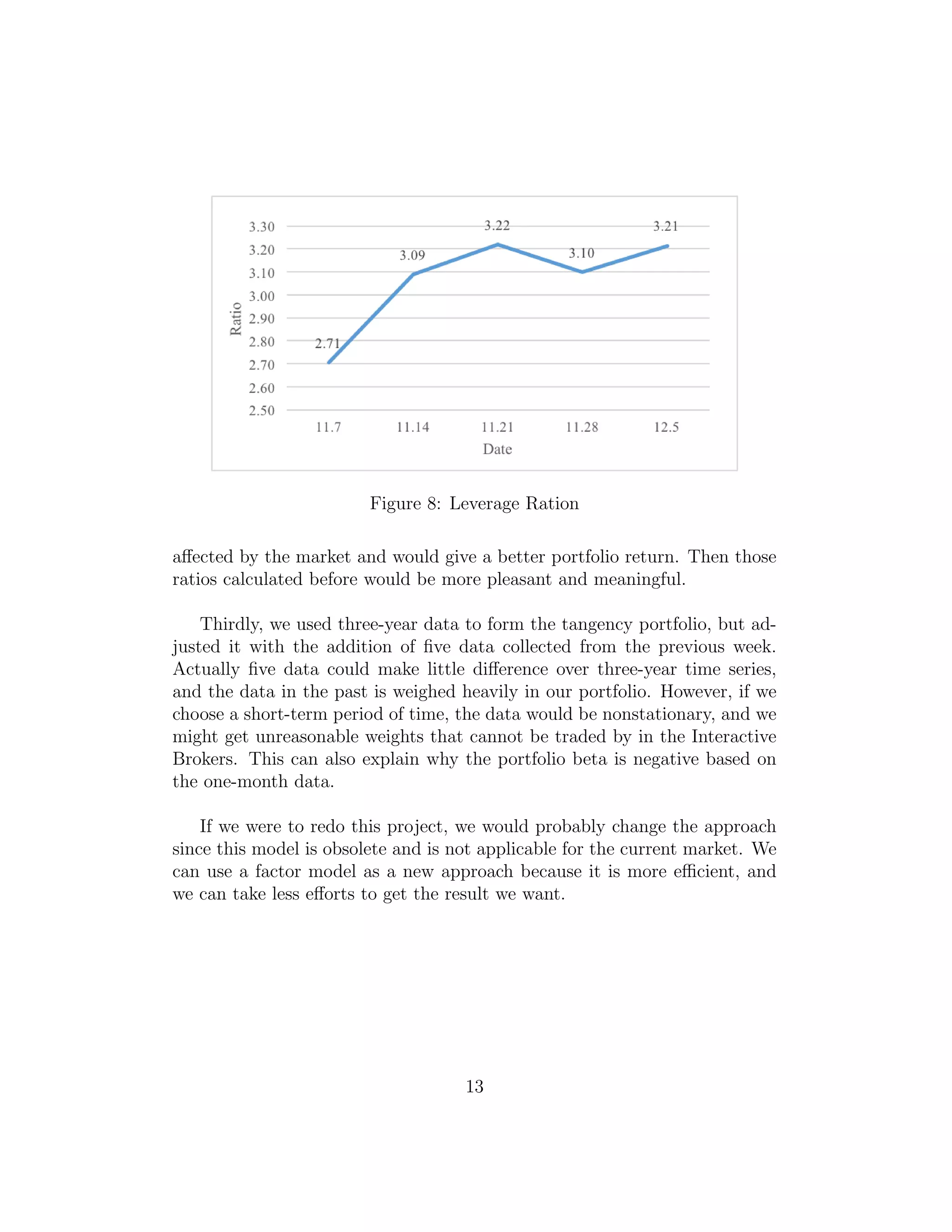

4 Leverage Analysis

The leverage is the use of various financial instruments or borrowed capi-

tal to increase the potential return of an investment, and is calculated as

|marketvalue|

$987,953

. High leverage ratios will bring high risks in the portfolio invest-

ment. We plot the leverage ratios below, and found that the leverage ratio

increases in general. Given that we had a loss of $86025 when we closed all

positions, we can assume such a scenario may exist: the price of one asset

increased in the last week, then we should buy more shares of it on the next

Monday, but the stock price begins to decrease after we enlarge its weight.

We certainly lose money in this scenario, and probably lose more with a high

leverage ratio. In addition, the fact that an asset has an increasing price

after we sell it will also reduce the portfolio value.

Date 11.7 11.14 11.21 11.28 12.5

Leverage Ratio 2.71 3.09 3.22 3.10 3.21

Table 5: Leverage Ratio

5 Conclusions

For this portfolio management, our critical mistake is that we chose a too

short period of time and ignored the margin violation at the beginning, so

we had to reconstruct a new portfolio and could not avoid losing some wealth.

Secondly, some of our stocks are highly correlated, such as AAPL and

HPQ (electronic products), or JPM and IBKR (finance). Our portfolios may

not be diversified greatly while diversification can reduce the unsystematic

risk[6]

which is a component of total risk together with systematic risk. If our

portfolio involves as many fields as possible, the portfolio may not be easily

12](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-13-2048.jpg)

![6 Factor Modeling

6.1 Fit the returns distribution to both a normal and

a t density

In our factor modeling project, the two factors we chose are 10-year bond

yield and big value[7]

. Through calculation, we found that CAPM with both

two factors and the French and Fama model with both two factors worked

well, also CAPM was better than French and Fama model in that case.

Therefore, we select CAPM with those two factors here.

For the new model, we constructed the new portfolio. Based on the stock

data, we can compute the portfolio daily return from January 1st

, 2016 to

October 31st

, 2016. The next step is to find a better distribution to fit the

return. We chose the normal distribution and the student-t distribution.

Based on the maximum of the likelihood function, our fitted parameters

are as below.

µ σ ν

Normal Distribution -0.0202489 0.165538 NaN

Student-t Distribution -0.0176197 0.150507 12.1176

Table 6: Parameter for Fitted Data

6.2 Perform a goodness-of-fit hypothesis test

For each of the distribution, based on the parameter before, we measured

the goodness of fit with the Chi-square test statistic. The null hypothesis is

to accept the fitted distribution.

p Decision

Normal Distribution 0.3115 Accept

Student-t Distribution 0.1290 Accept

Table 7: Decision for Hypothesis Test

Under the confidence level of α = 0.05, these two distribution can be

accepted to simulate the return of the portfolio.

14](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-15-2048.jpg)

![References

[1] David Ruppert(2004), Statistics and Finance:An Introduction

[2] Yahoo Finance. Yahoo Finance Historical Prices.

Retrieved from: https://finance.yahoo.com/

[3] Federal Reserve Bank of St.Louis 3-Month London Interbank Offered

Rate, based on U.S. Dollar.

Retrieved from: https://fred.stlouisfed.org/

[4] Bloomberg. Bloomberg Terminal SPX Index.

[5] Investopedia. S&P 500 Index Definition.

Retrieved from: http://www.investopedia.com/terms

[6] Kaplan(2016). Unsystematic risk CFA level 1 schweser notes.

[7] Kenneth R. French. Big Value Data.

Retrieved from: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/

15](https://image.slidesharecdn.com/f1e2adf5-7dba-4d94-9a76-883092a6db66-170111215408/75/ma574-final-paper-16-2048.jpg)