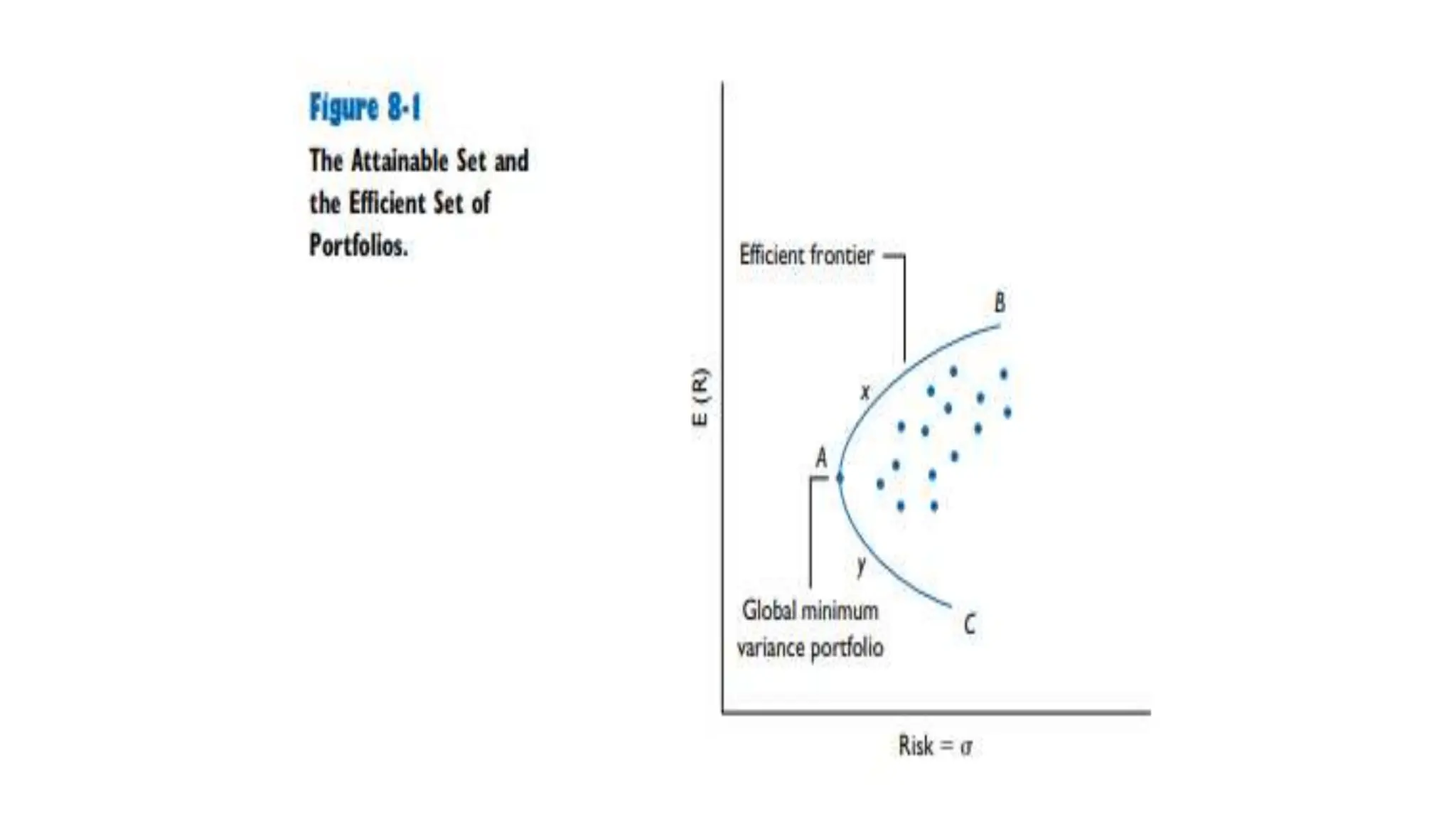

This document discusses portfolio theory and optimal portfolio selection using Markowitz principles. It explains that Markowitz developed the efficient frontier, which identifies efficient portfolios that offer the best risk-return tradeoff from a given set of assets. To select optimal portfolios, investors should identify the efficient frontier using expected returns, variances and covariances of the assets, then choose portfolios based on their risk tolerance along the efficient frontier. The asset allocation decision, which determines the weighting between different asset classes, is the most important investment decision according to portfolio theory.