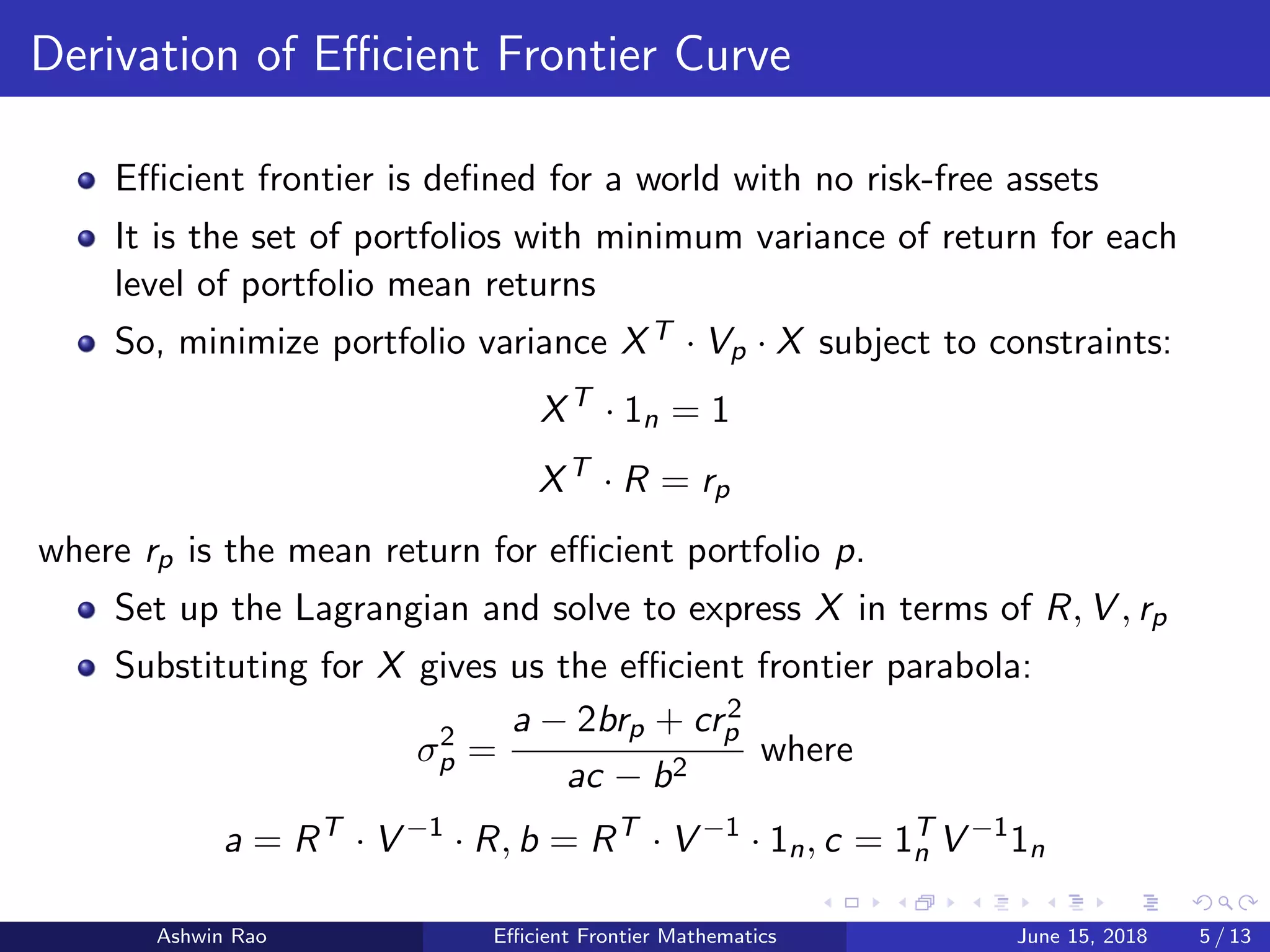

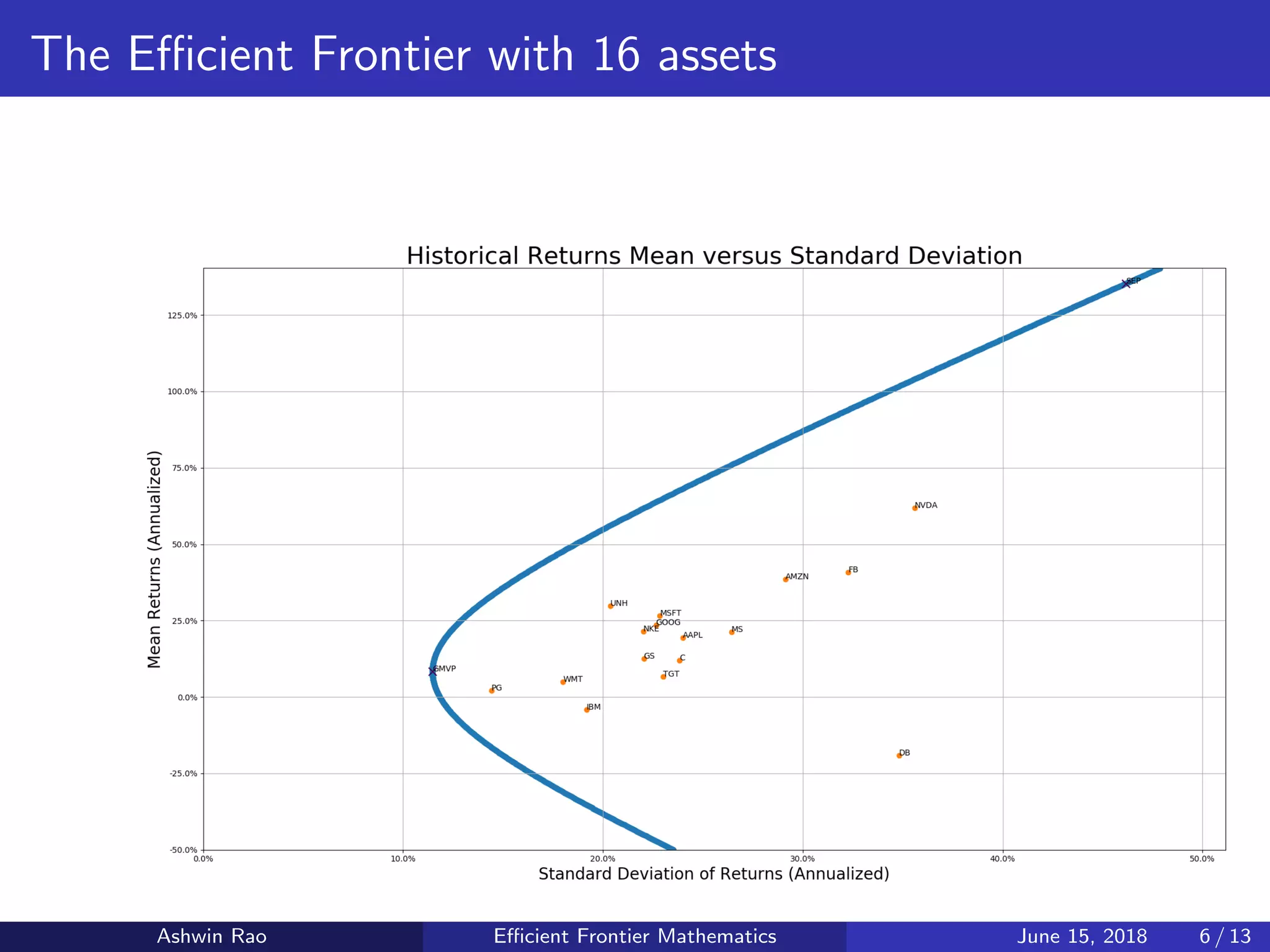

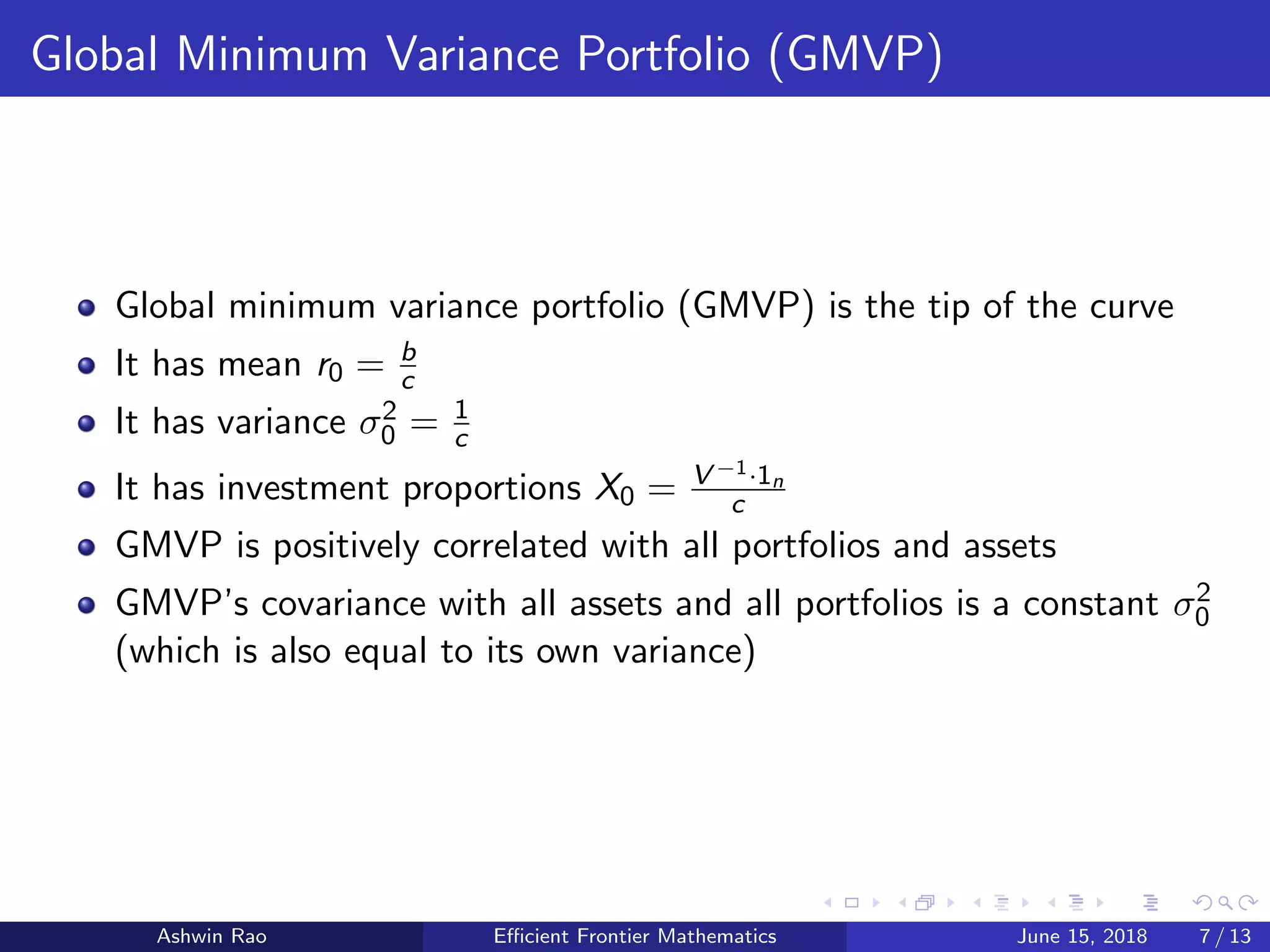

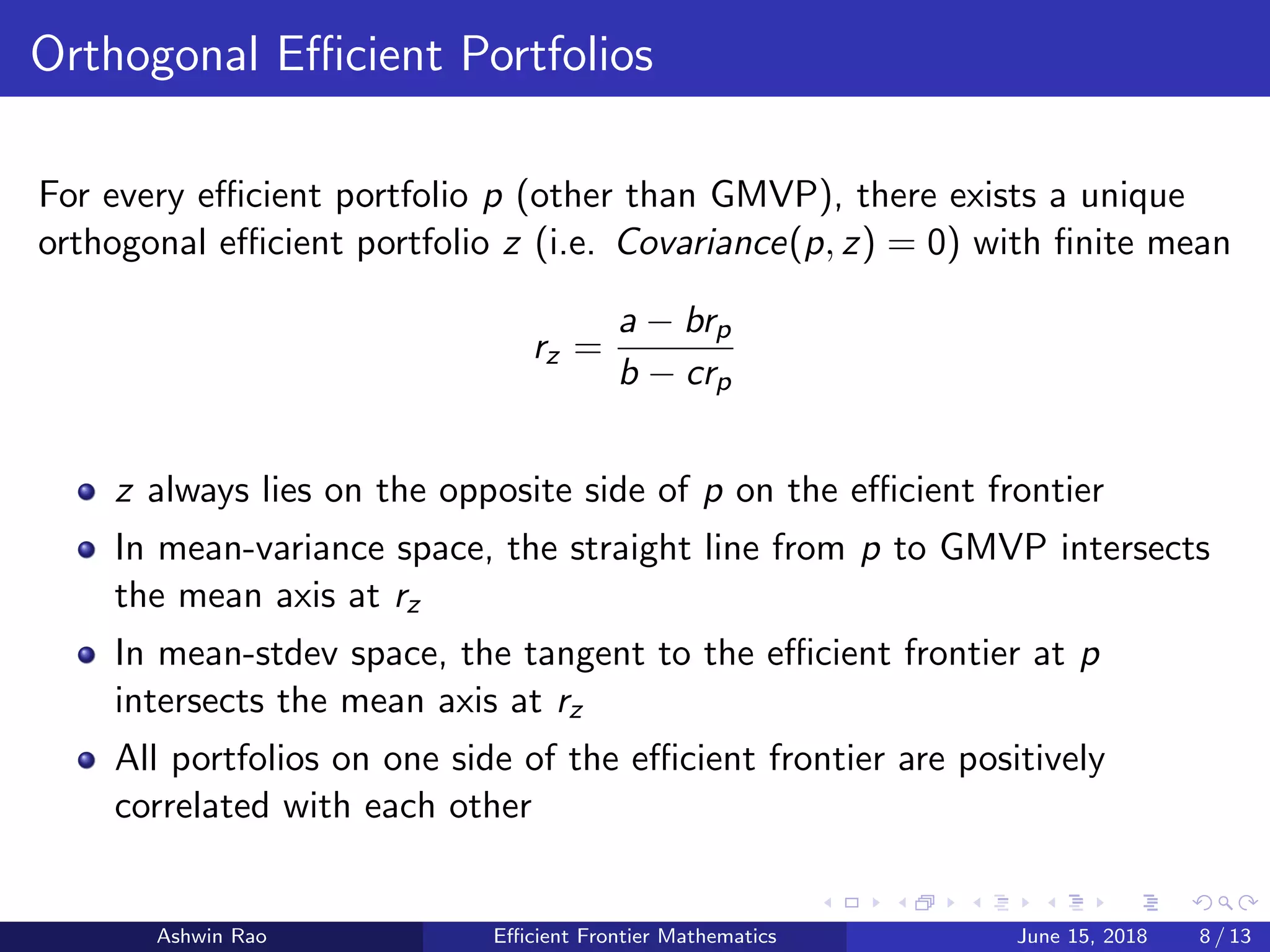

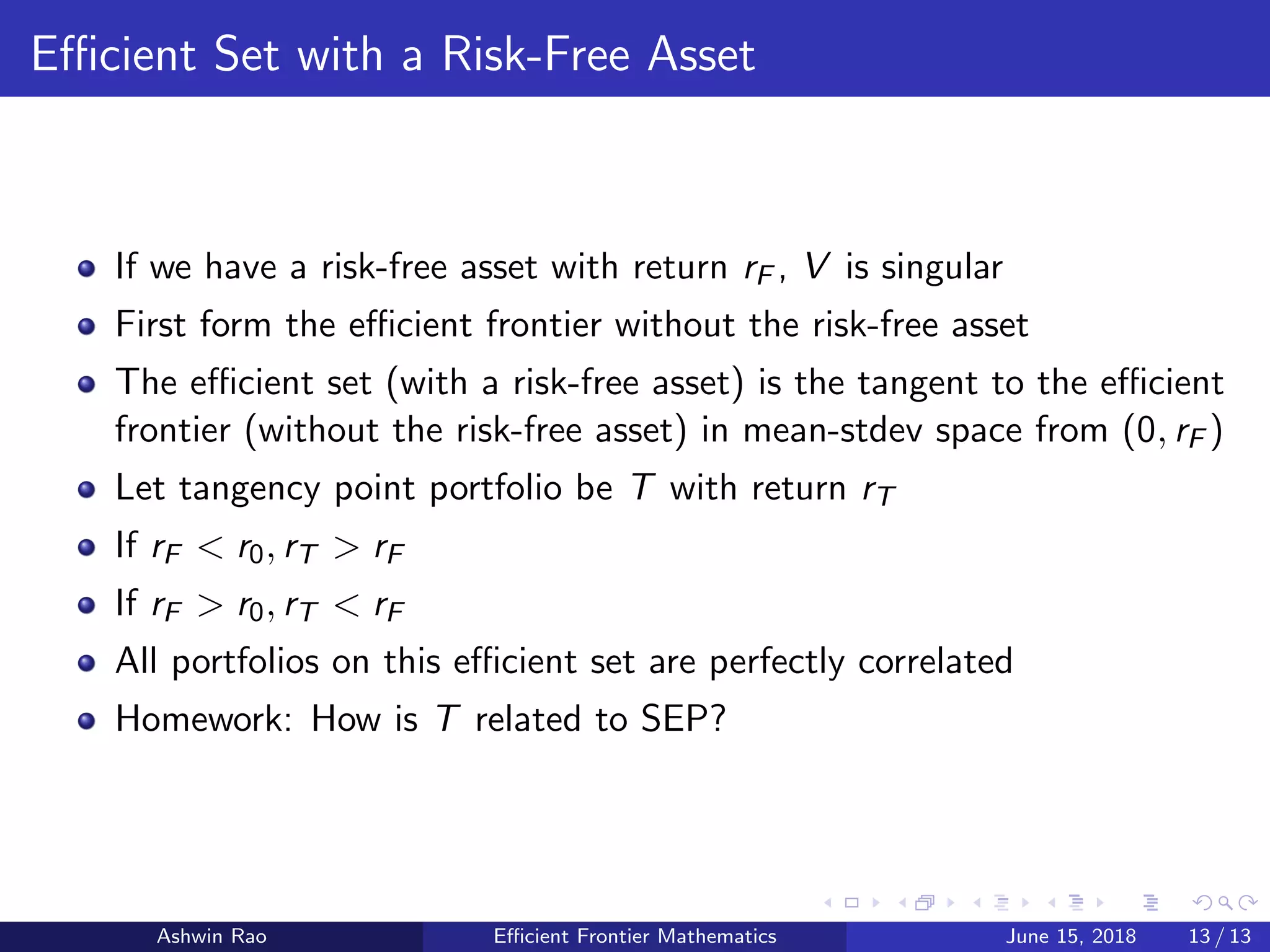

The document provides an overview of efficient frontier mathematics, covering key concepts such as the efficient frontier curve, global minimum variance portfolio, and the relationship between portfolio returns and variances. It delves into topics like the derivation of the efficient frontier, linear combinations of efficient portfolios, and the impact of risk-free assets. The document also discusses important theorems and corollaries related to covariance and beta coefficients in the context of portfolio management.