Embed presentation

Downloaded 379 times

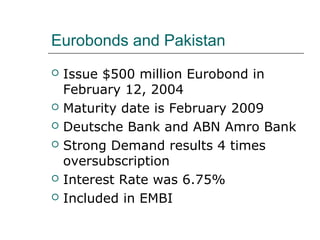

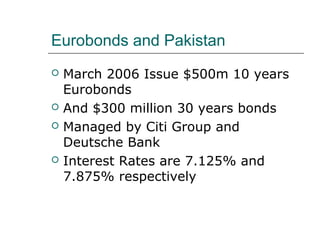

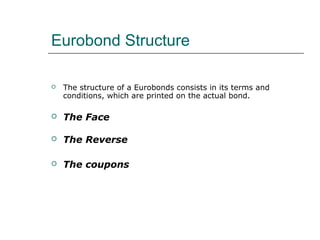

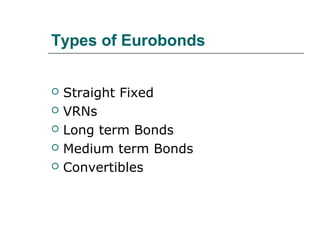

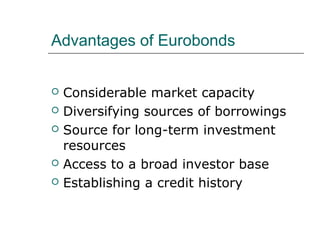

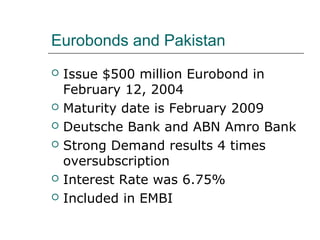

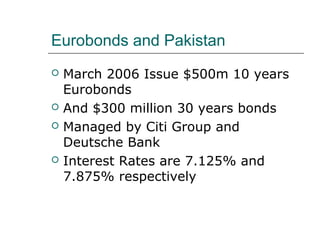

A Eurobond is a bond issued and traded outside the country whose currency it is denominated in, and outside the regulations of a single country. Eurobonds are usually issued by non-European entities for sale in Europe. They have standardized rules regarding trading, payments, listing, and taxation. Eurobonds provide advantages like considerable market capacity, diversifying borrowing sources, and access to broad investor bases for issuers. Pakistan has issued several Eurobonds since 2004 to raise capital from international markets.