The document provides a summary of derivative market activity in India for September 16, 2010. Key points include:

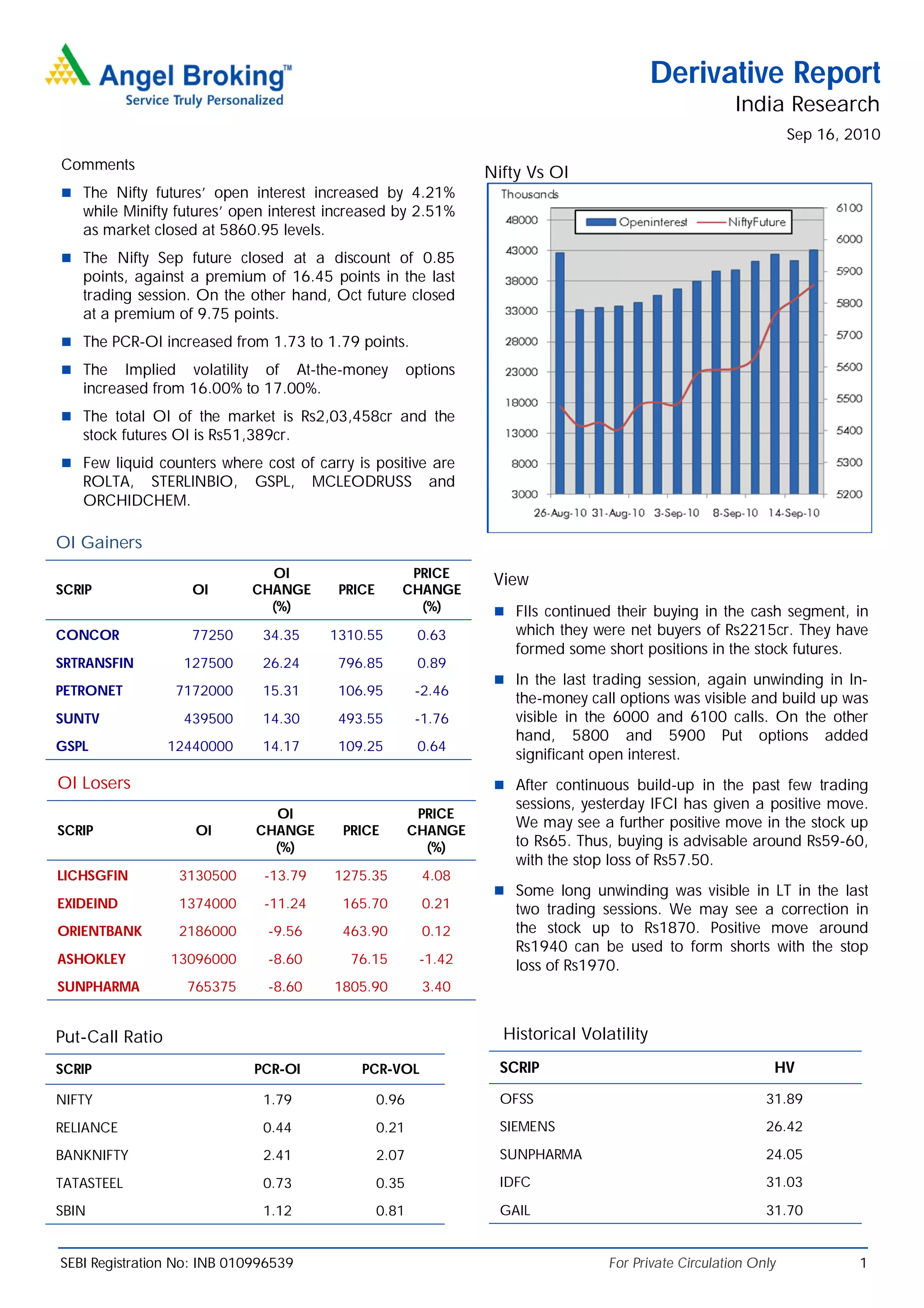

- Open interest for Nifty futures increased 4.21% while for Minifity futures it rose 2.51% as the market closed at 5860.95.

- Nifty September futures closed at a discount of 0.85 points versus a premium of 16.45 points previously. October futures closed at a premium of 9.75 points.

- Total open interest in the market was Rs. 2,03,458 crore with stock futures open interest at Rs. 51,389 crore.