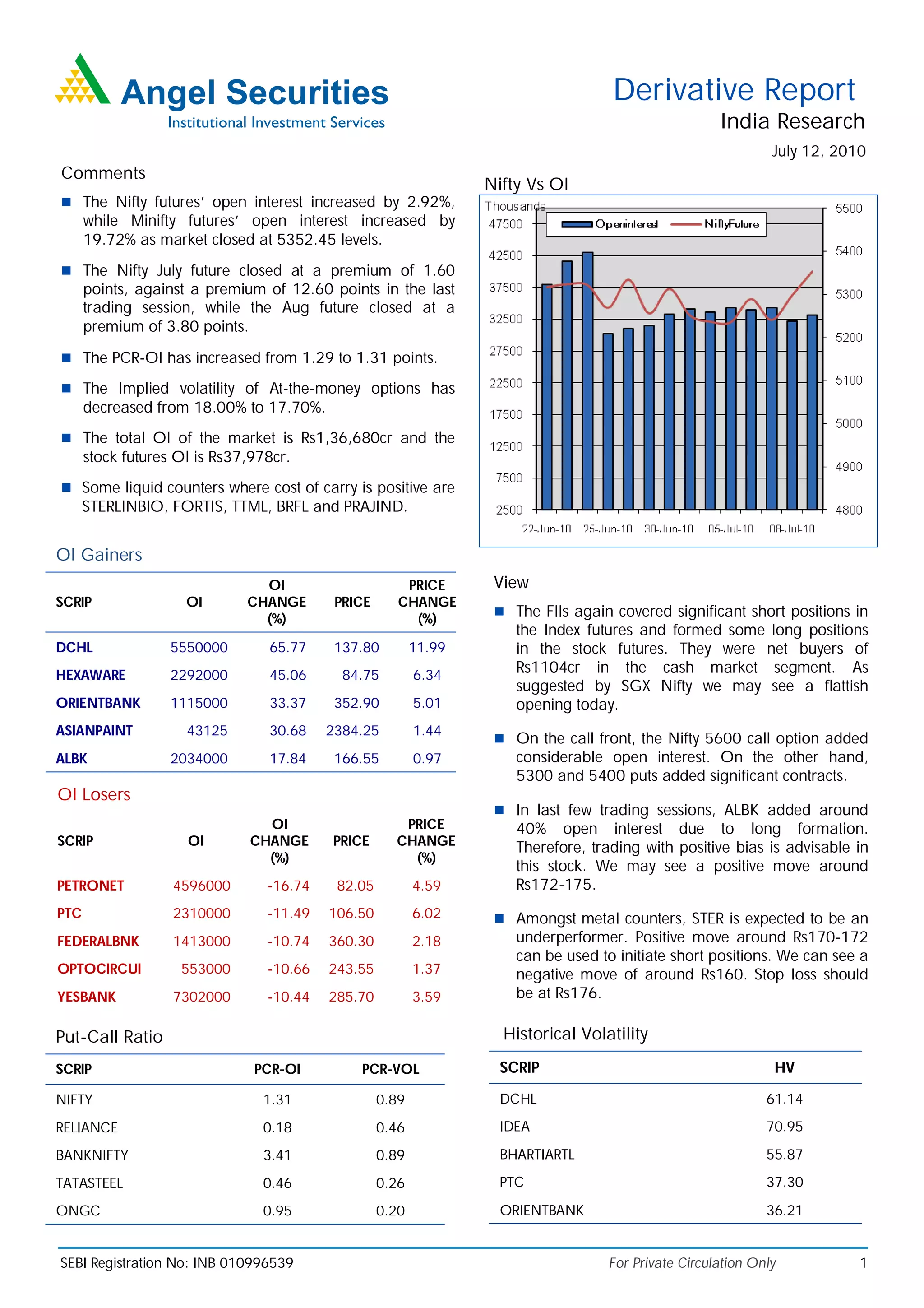

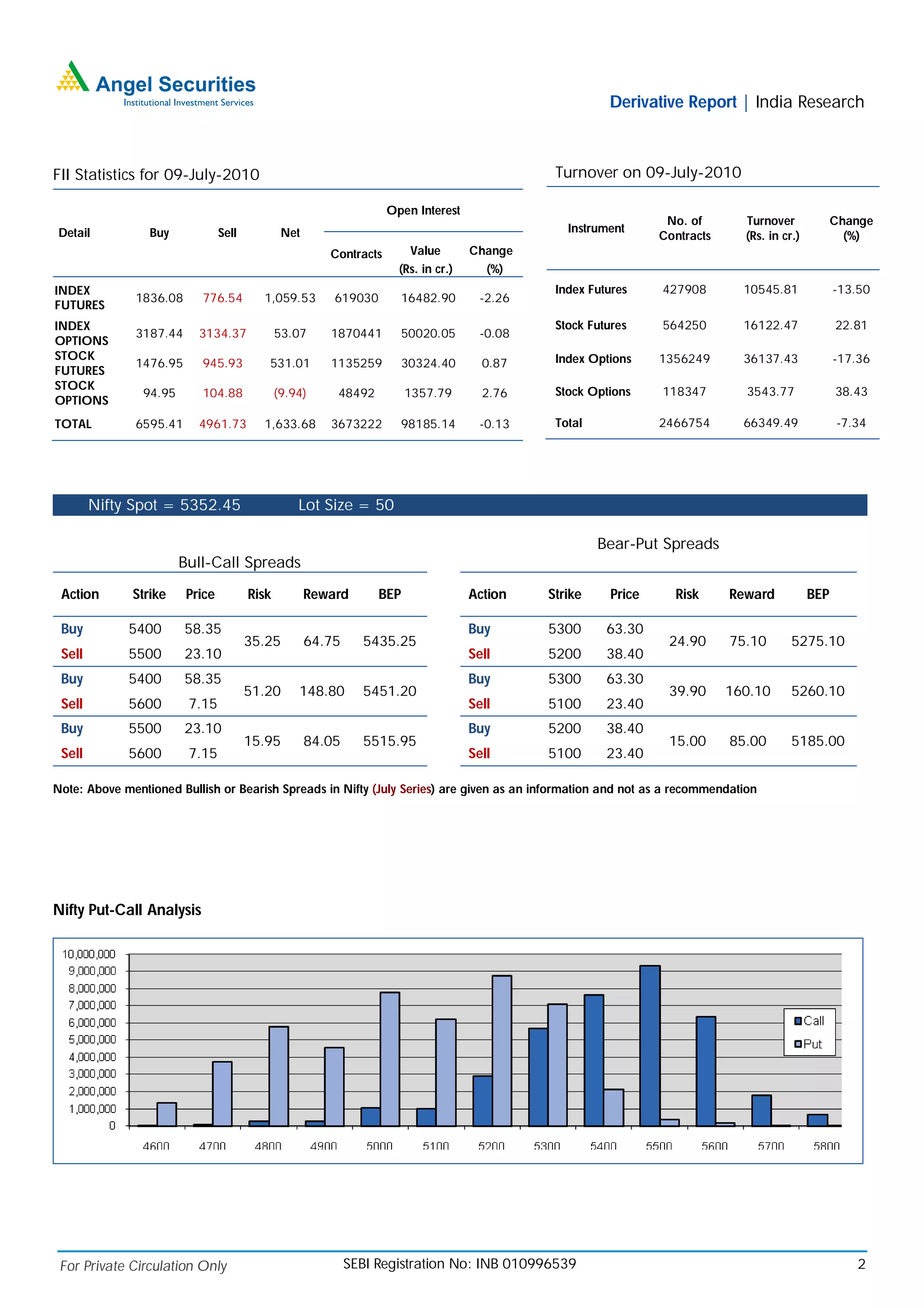

The document provides a summary of derivative market activity in India for July 12, 2010. Open interest in Nifty futures increased by 2.92% while Minifty futures increased by 19.72%. The Nifty July future closed at a premium of 1.60 points. Put-call ratio for Nifty increased to 1.31. Some stocks like DCHL and HEXAWARE saw significant increases in open interest, while stocks like PETRONET and PTC saw decreases. FIIs were net buyers in the cash market.