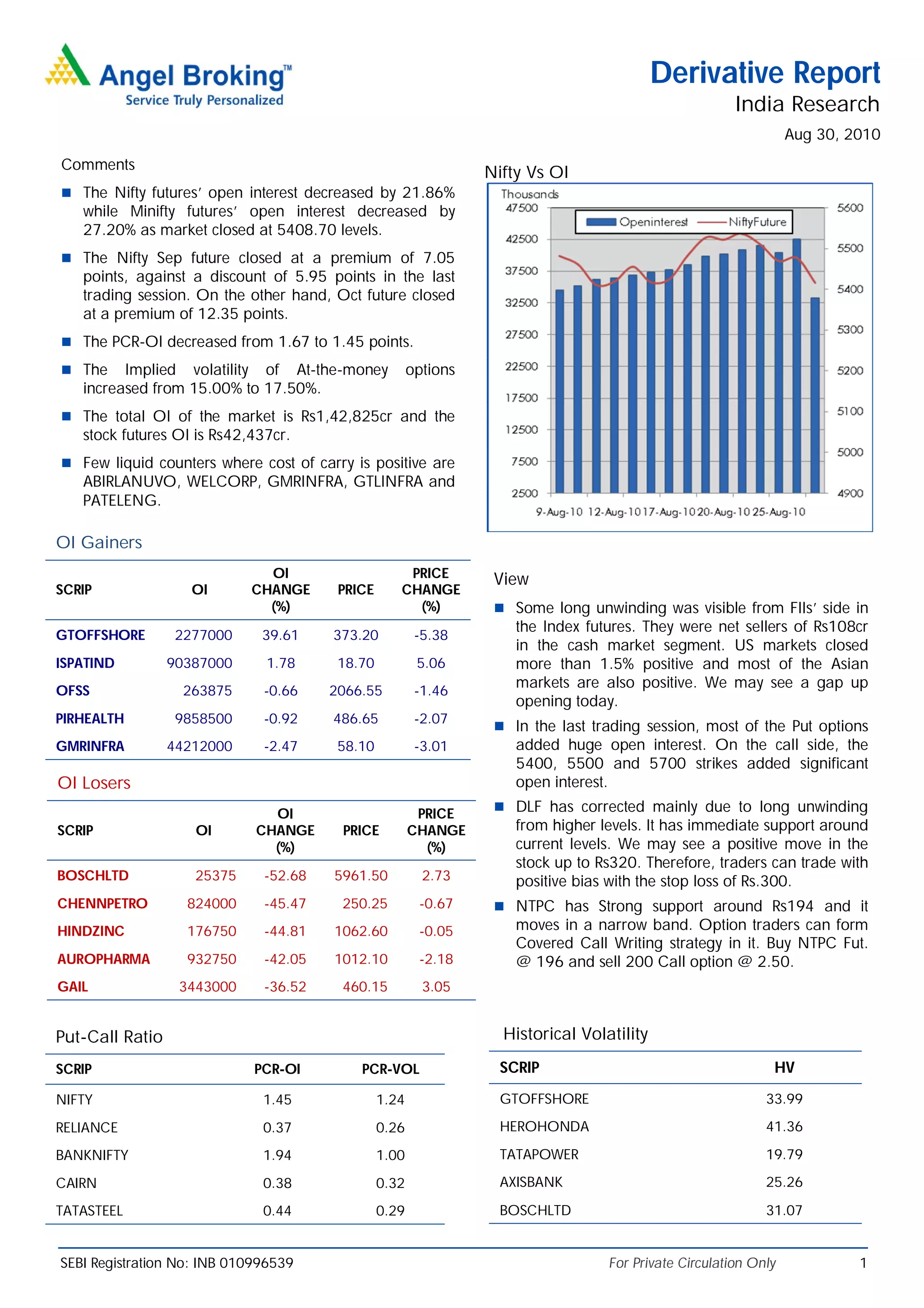

The derivative report summarizes developments in the Indian derivatives market for August 30, 2010. Open interest for Nifty futures decreased by 21.86% while open interest for Minifity futures decreased by 27.20% as the market closed at 5408.70 levels. Implied volatility of at-the-money options increased from 15% to 17.5%. Some liquid stocks with positive cost of carry included ABIRLANUVO, WELCORP, GMRINFRA, GTLINFRA and PATELENG. The total open interest in the market was Rs. 1,42,825 crore with stock futures open interest at Rs. 42,437 crore.