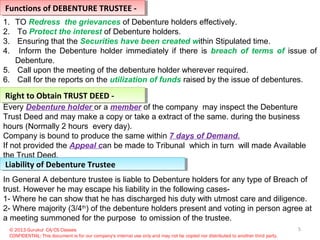

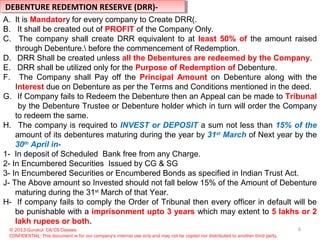

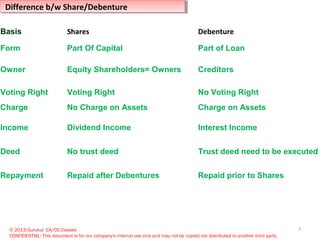

This document discusses debentures under Indian law. It defines debentures as instruments acknowledging a company's debt. Debentures can be secured or unsecured, with secured debentures requiring the creation of charges over company assets. A debenture trustee must be appointed to protect debenture holders' interests by ensuring assets are sufficient to repay debts and terms are followed. Companies must create a debenture redemption reserve from profits to repay debentures.