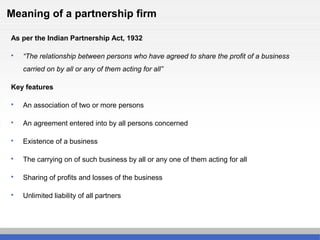

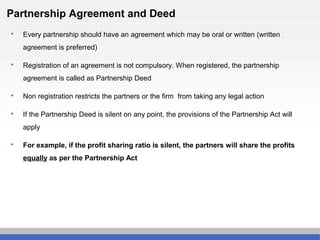

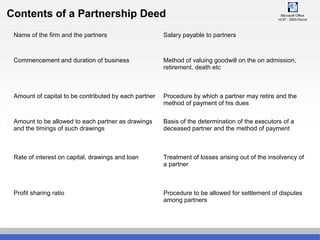

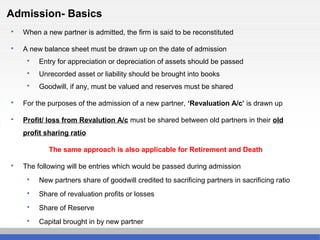

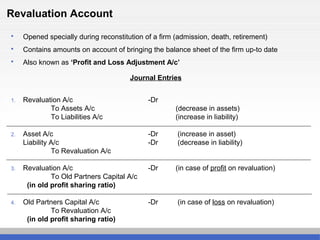

1. The document discusses accounting for partnerships, including the basics of partnerships, partnership agreements, contents of partnership deeds, profit and loss appropriation accounts, valuation of goodwill, admission and retirement of partners.

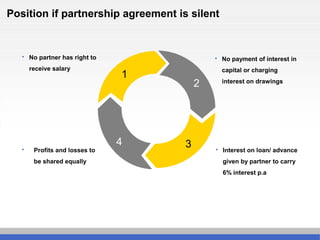

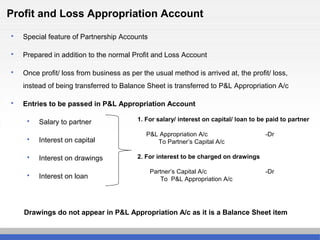

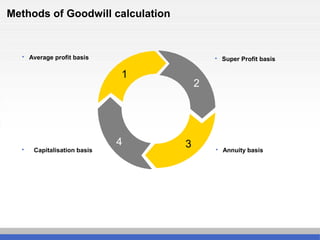

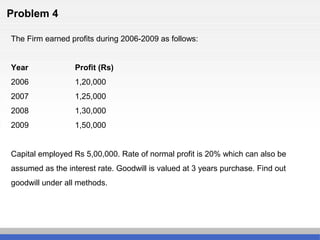

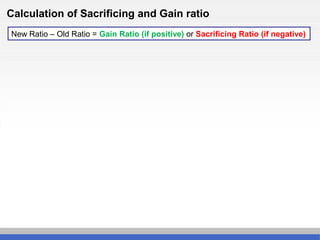

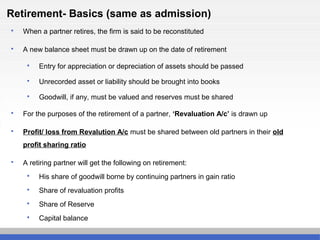

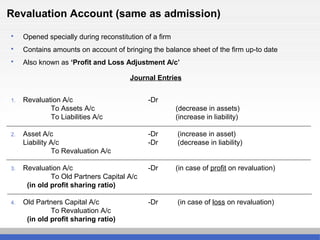

2. Key aspects include meaning of partnerships, partnership agreements, profit and loss sharing, treatment of interest on capital and drawings, revaluation accounts used during admission and retirement, and calculations related to goodwill.

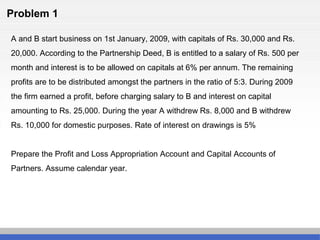

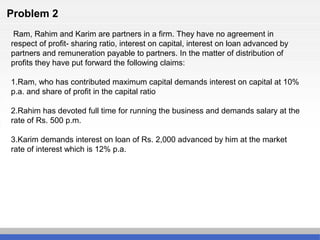

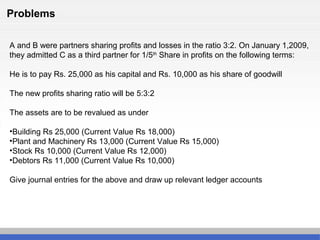

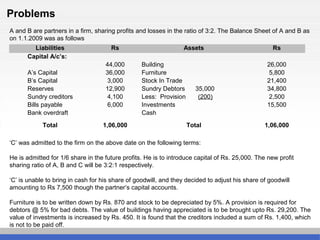

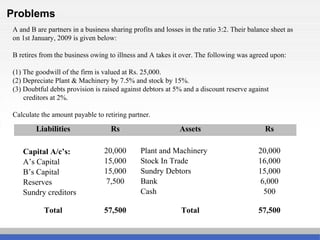

3. Examples and problems are provided to illustrate accounting entries for partnerships including admission of new partners, retirement of existing partners, treatment of revaluation of assets and liabilities, and allocation of goodwill.