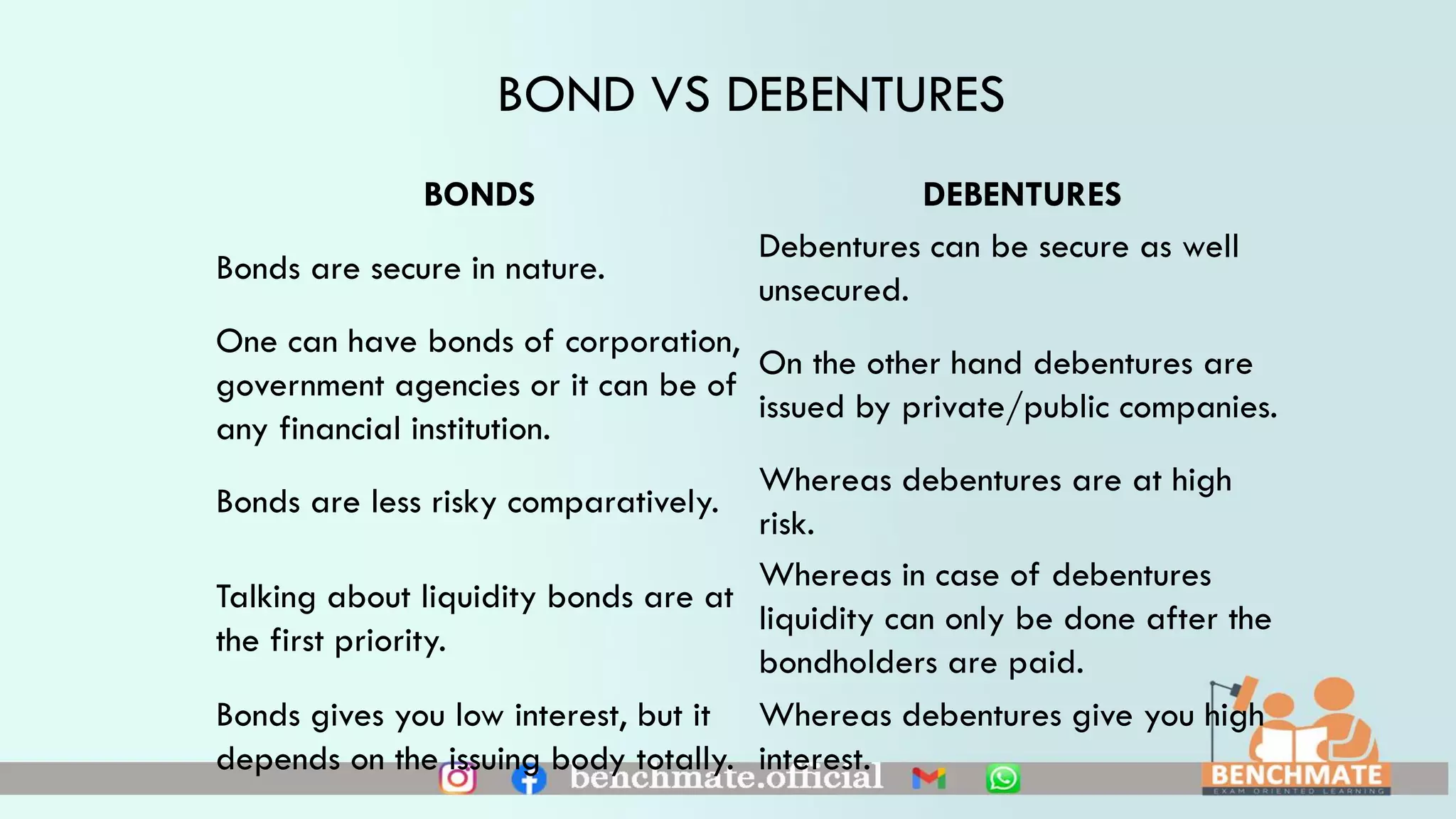

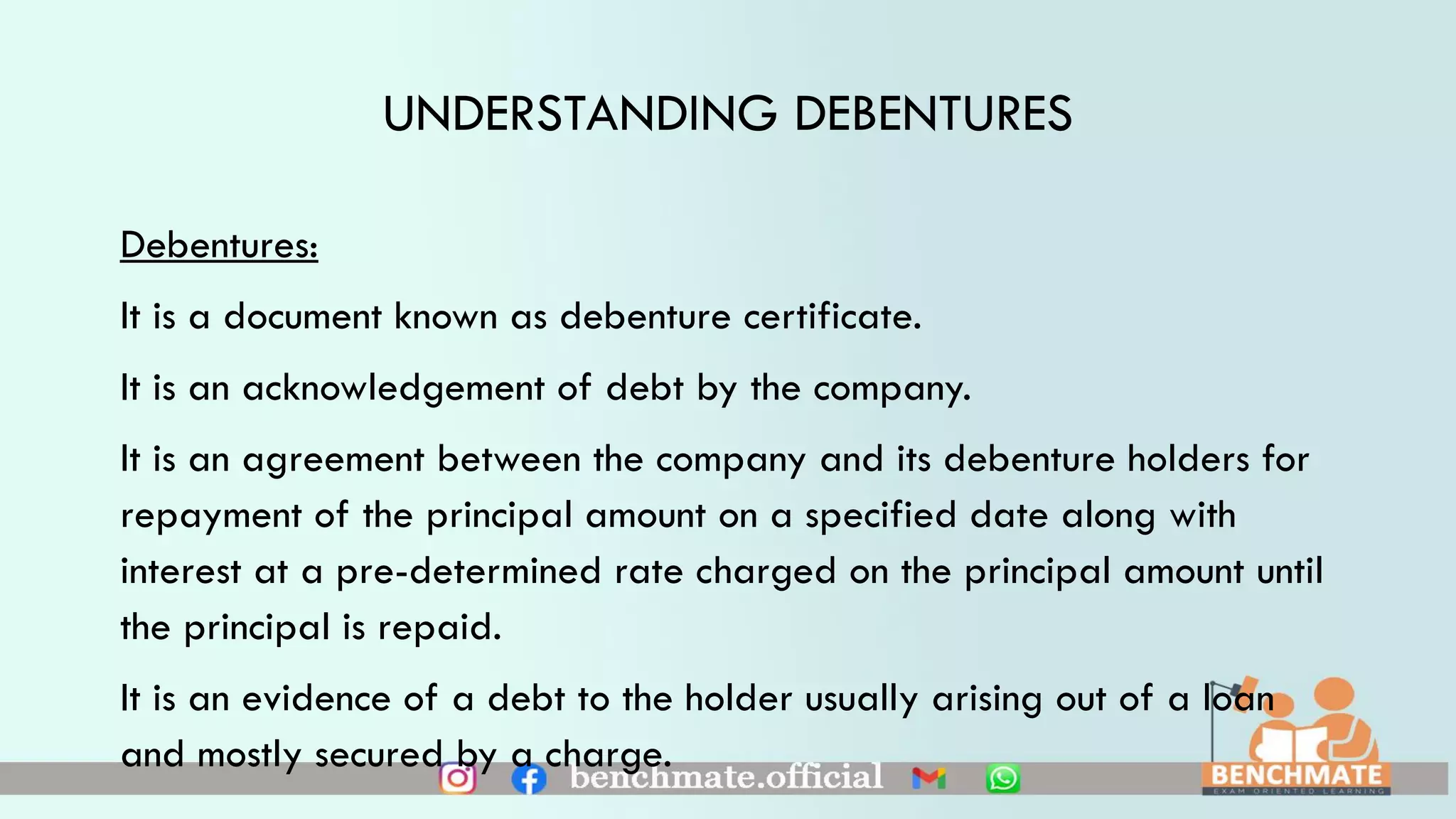

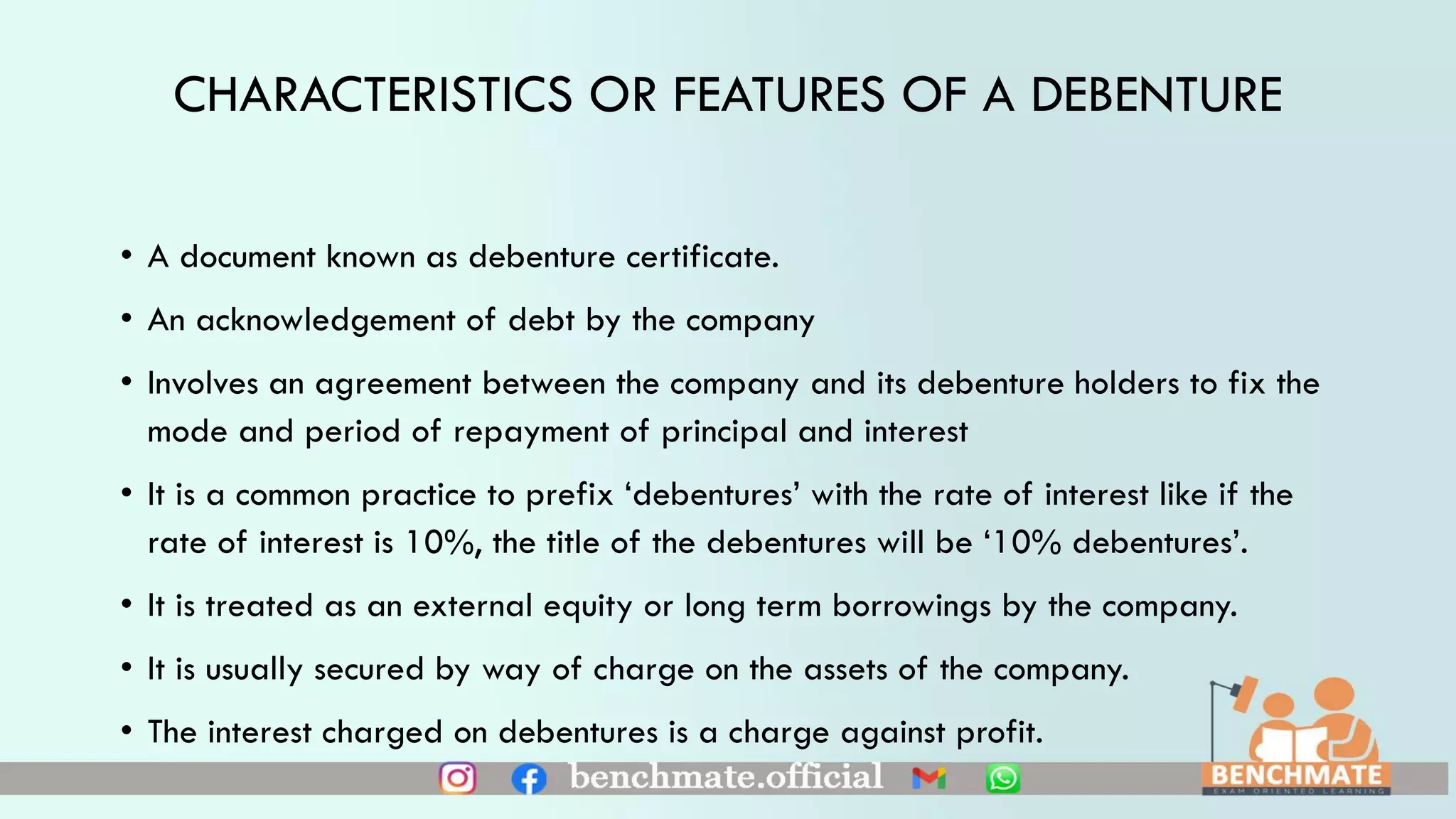

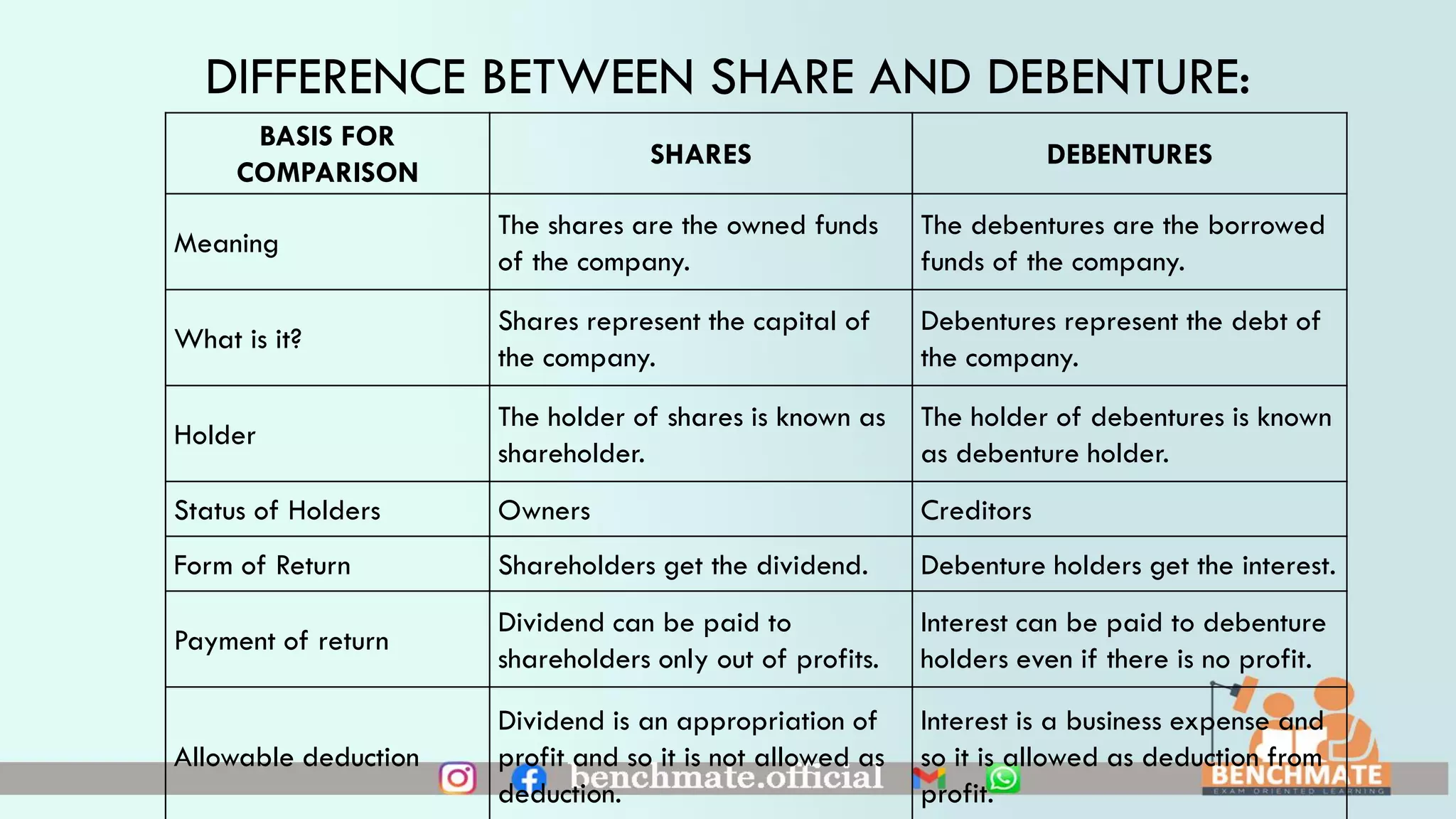

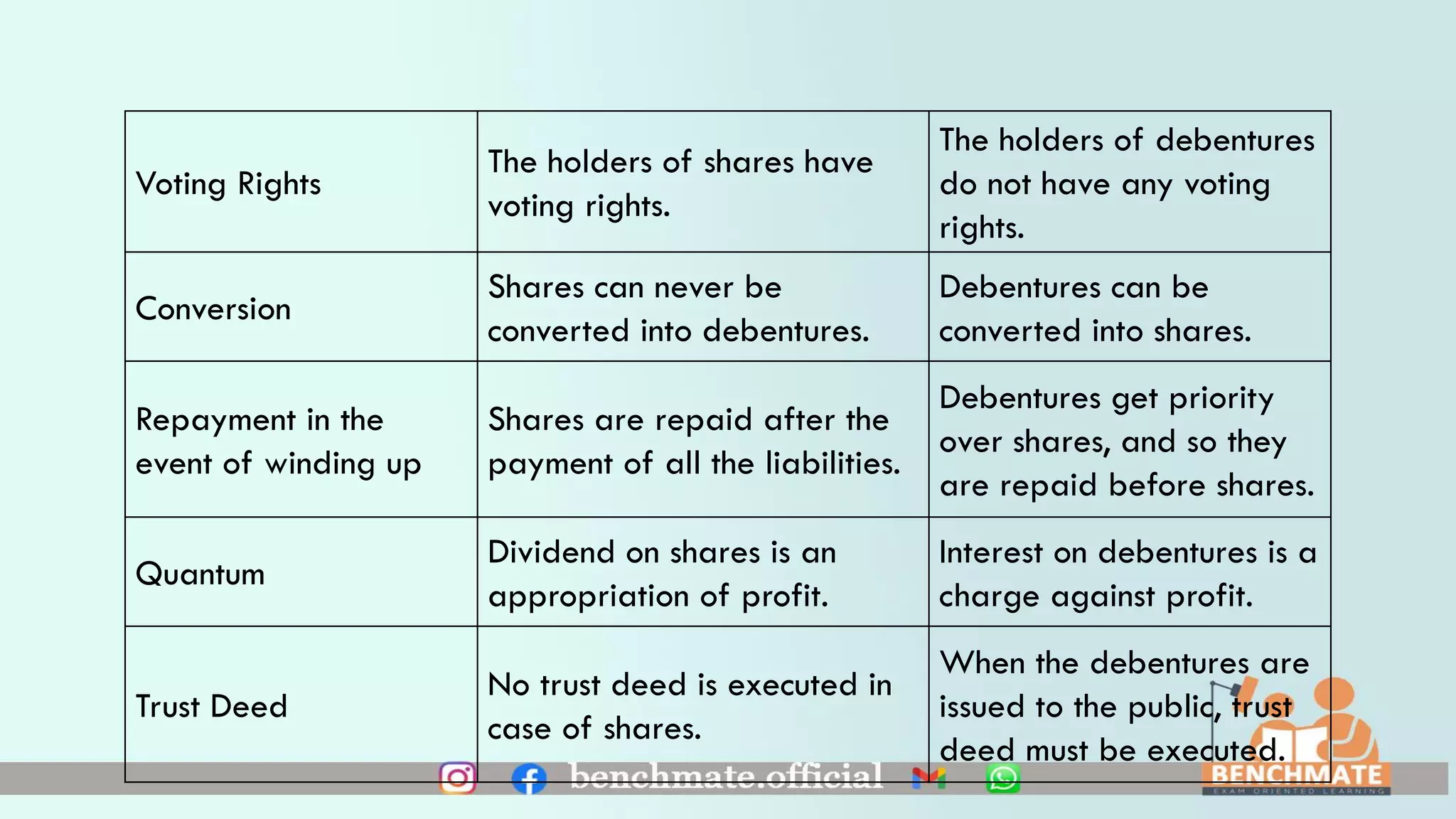

This document discusses debentures and compares them to bonds. It defines debentures as an acknowledgement of debt issued by a company under its common seal. Debentures can be secured or unsecured, whereas bonds are generally more secure. Debentures are issued by companies to raise funds, while bonds are typically issued by governments or large corporations. Debentures carry higher risk than bonds but also offer higher interest rates. The document outlines the key characteristics of debentures, including different types classified by security, redemption period, negotiability, priority, coupon rates, and convertibility. It also compares debenture holders to shareholders.