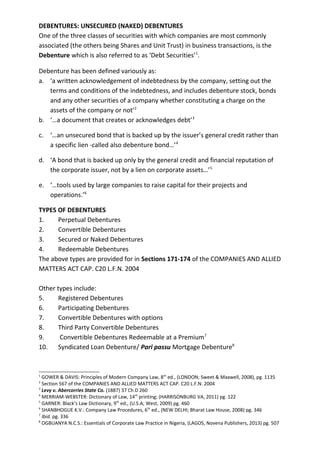

This document discusses unsecured or "naked" debentures, which are debt instruments issued by companies without any charge on the company's assets. The key points are:

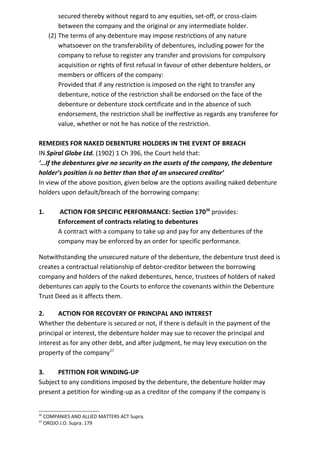

1. Naked debentures create a debtor-creditor relationship between the company and lender without security over company assets. They are valid instruments for borrowing.

2. Creating a naked debenture involves board approval, preparing and executing loan documents like a debenture trust deed, and registering the debenture.

3. A debenture trust deed is still used to protect debenture holders' rights and appoint trustees, even though there is no security. The deed must meet requirements in the Companies Act.