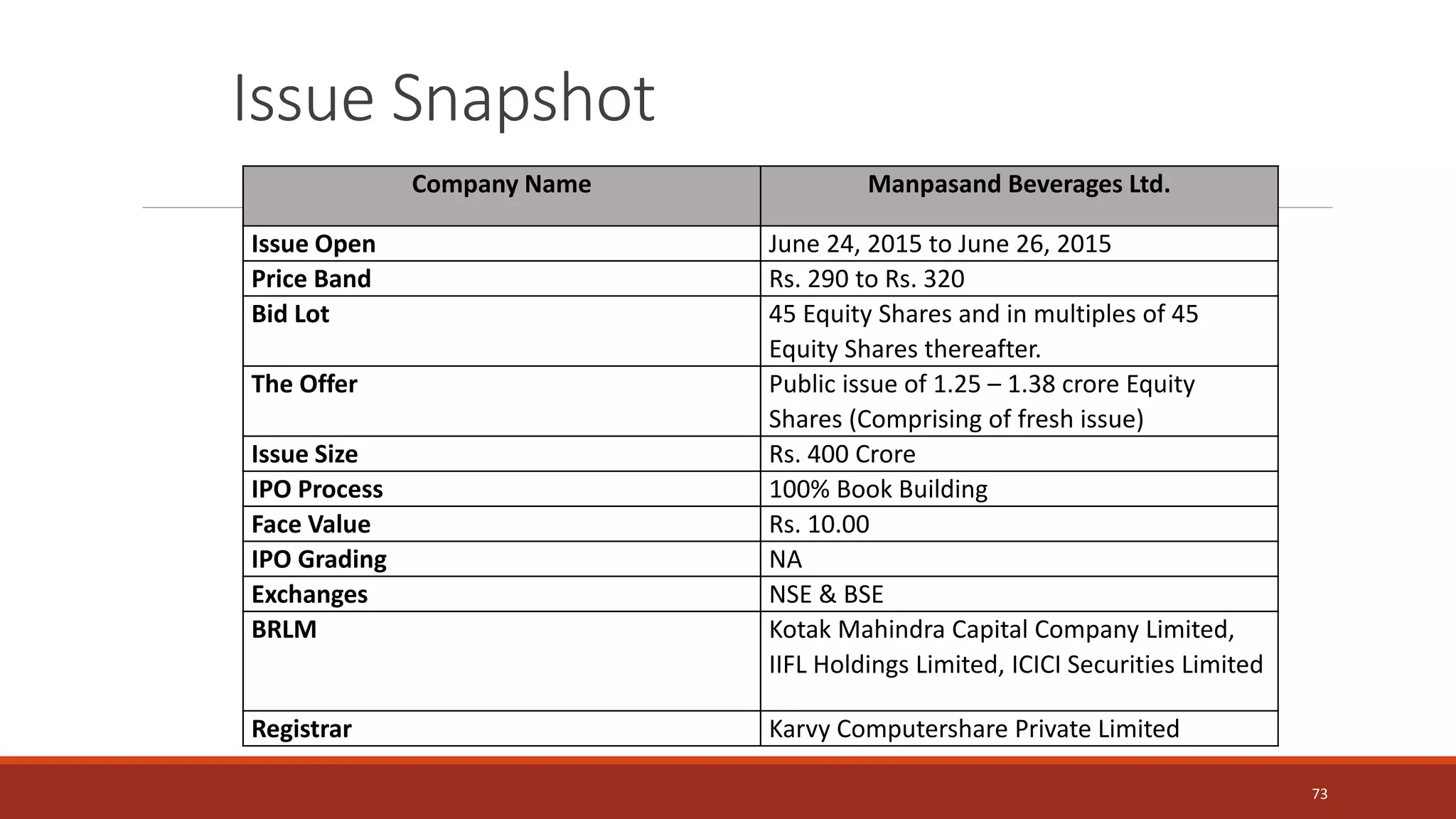

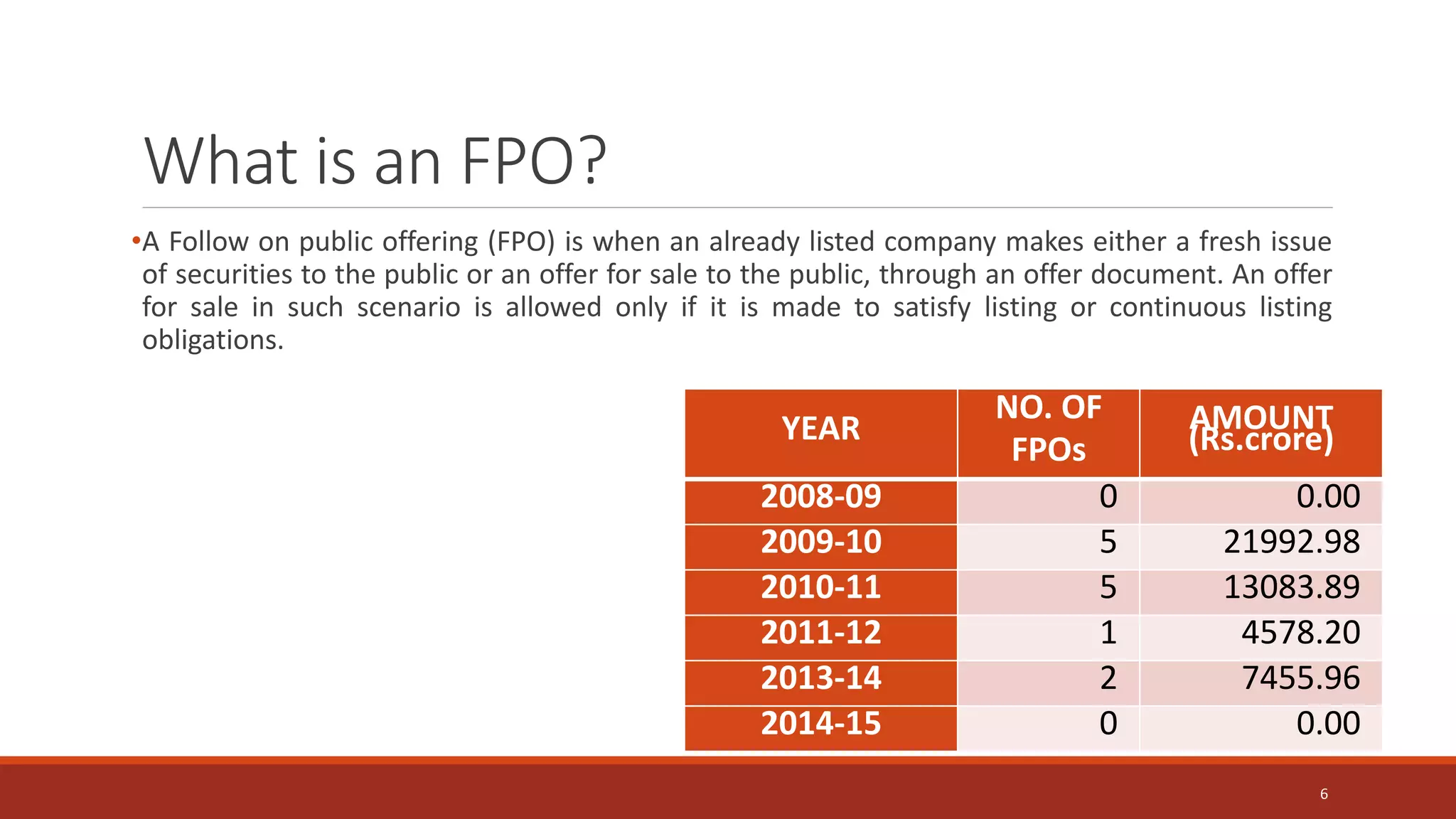

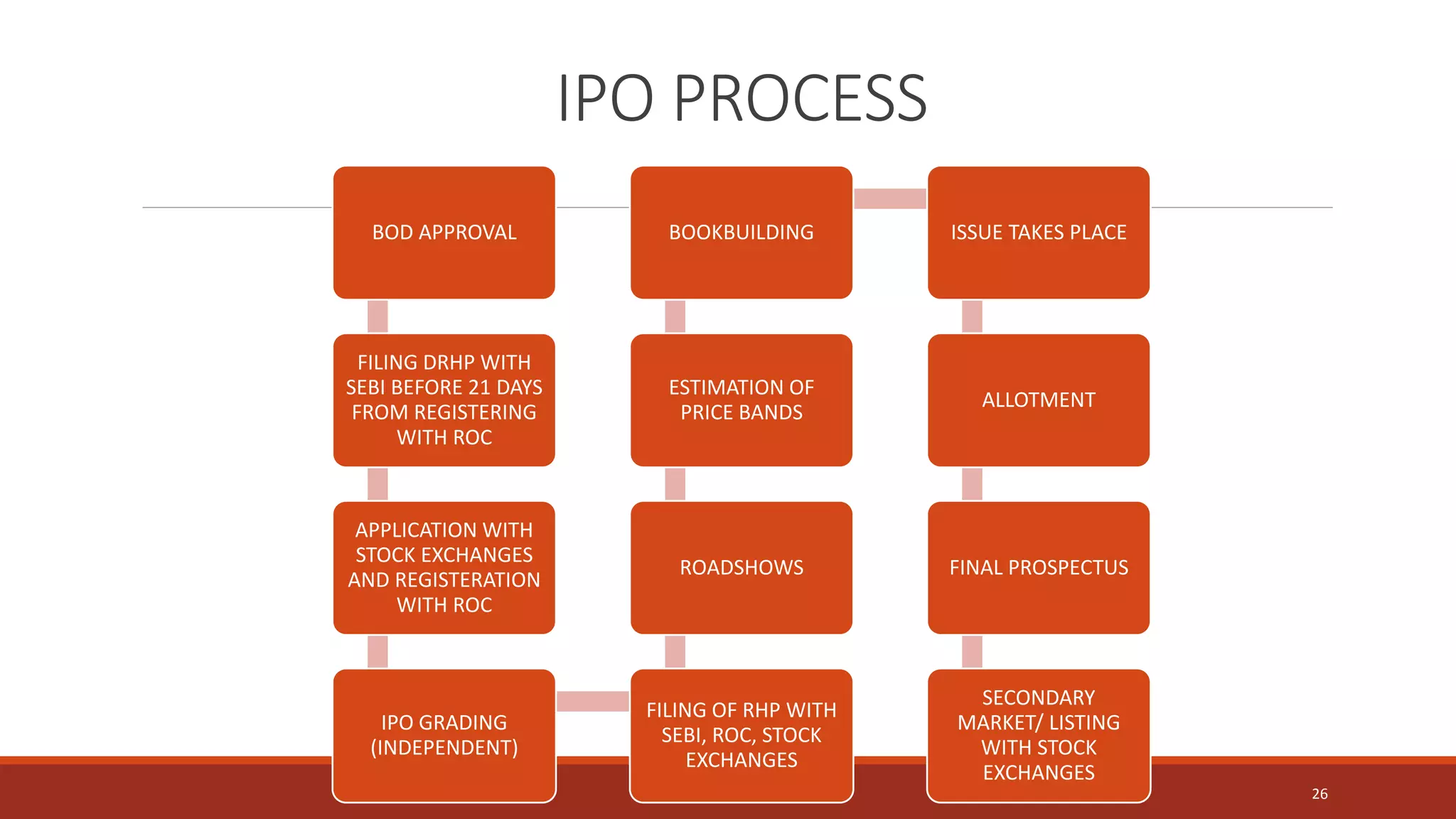

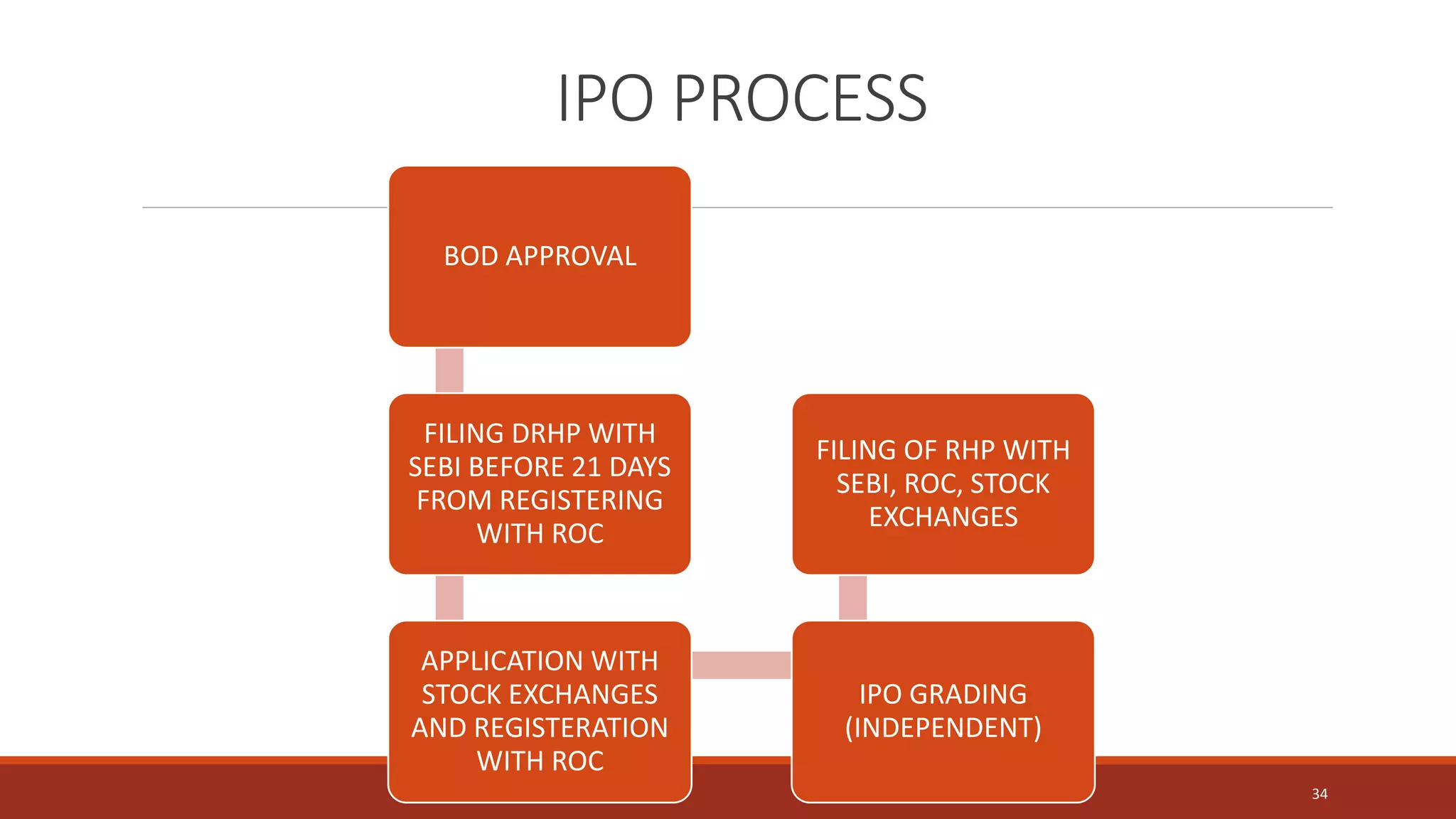

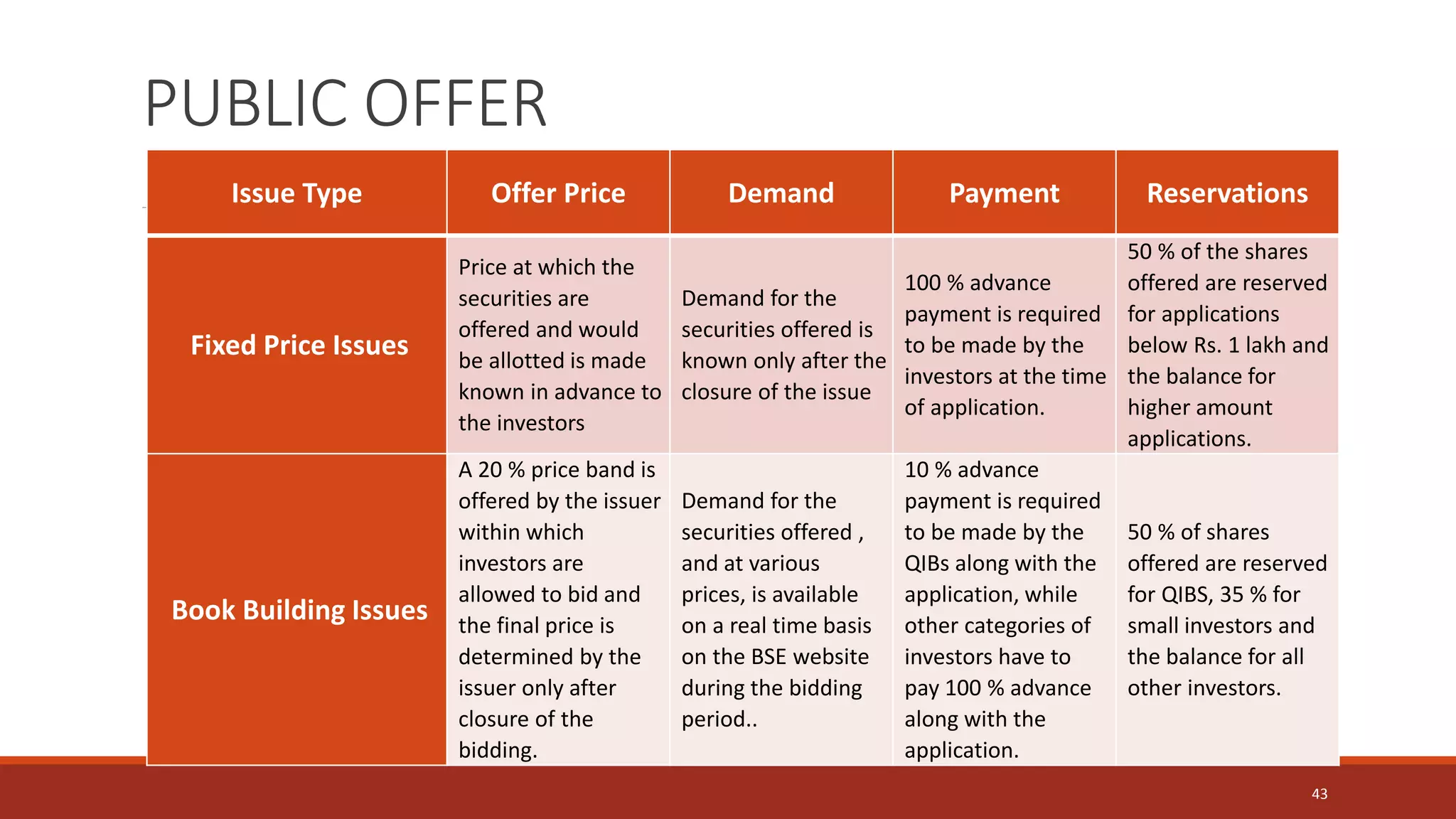

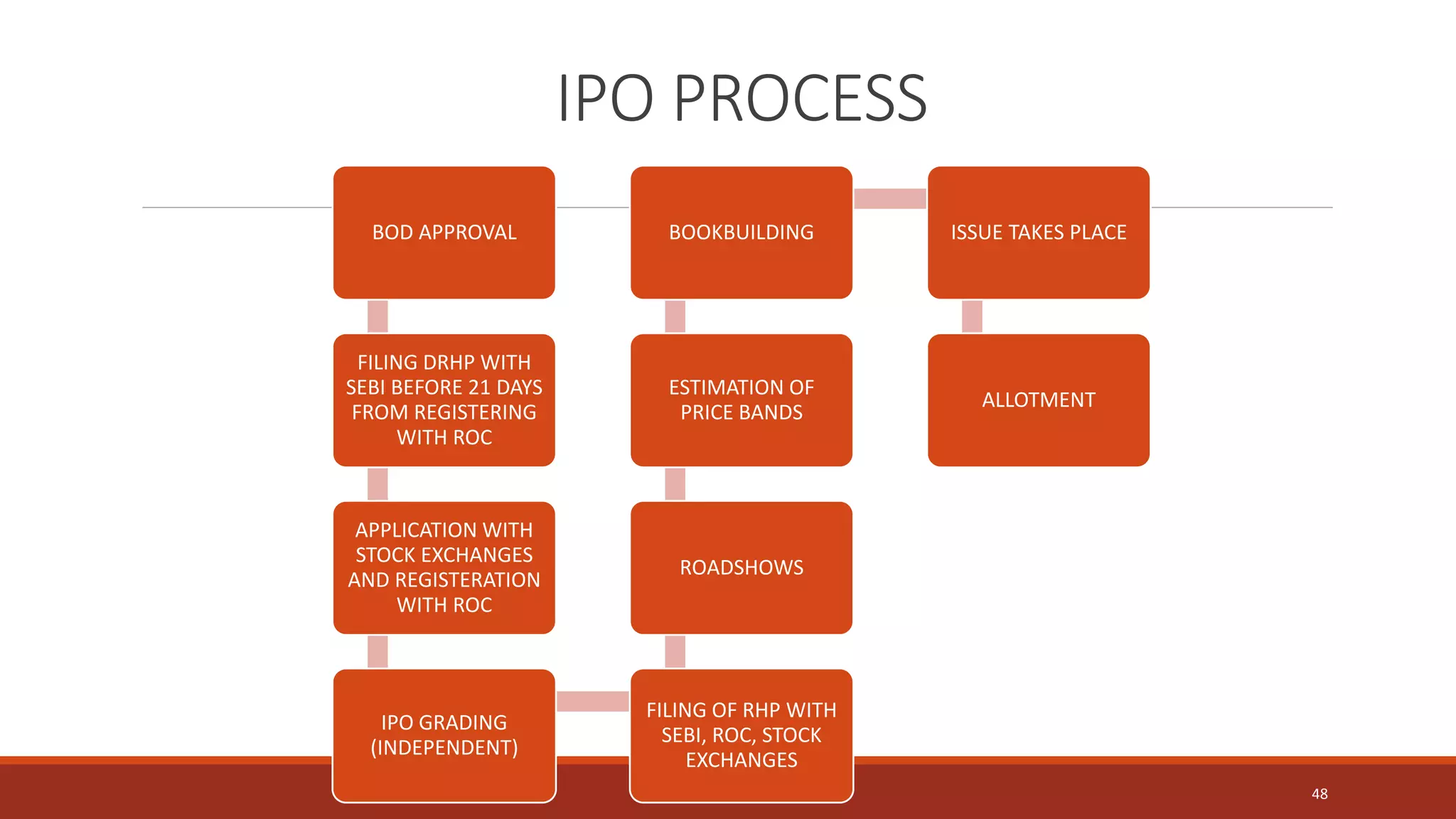

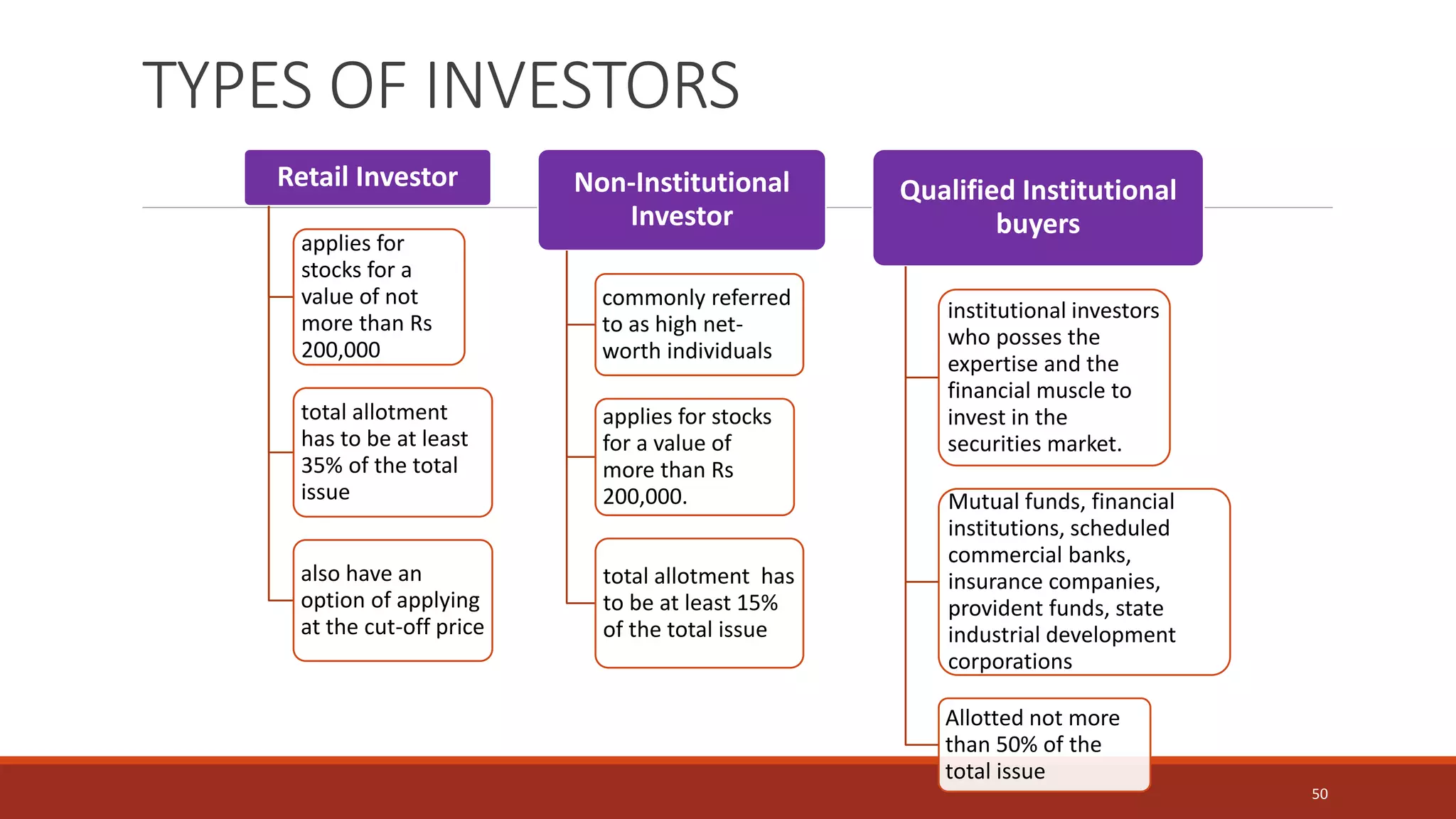

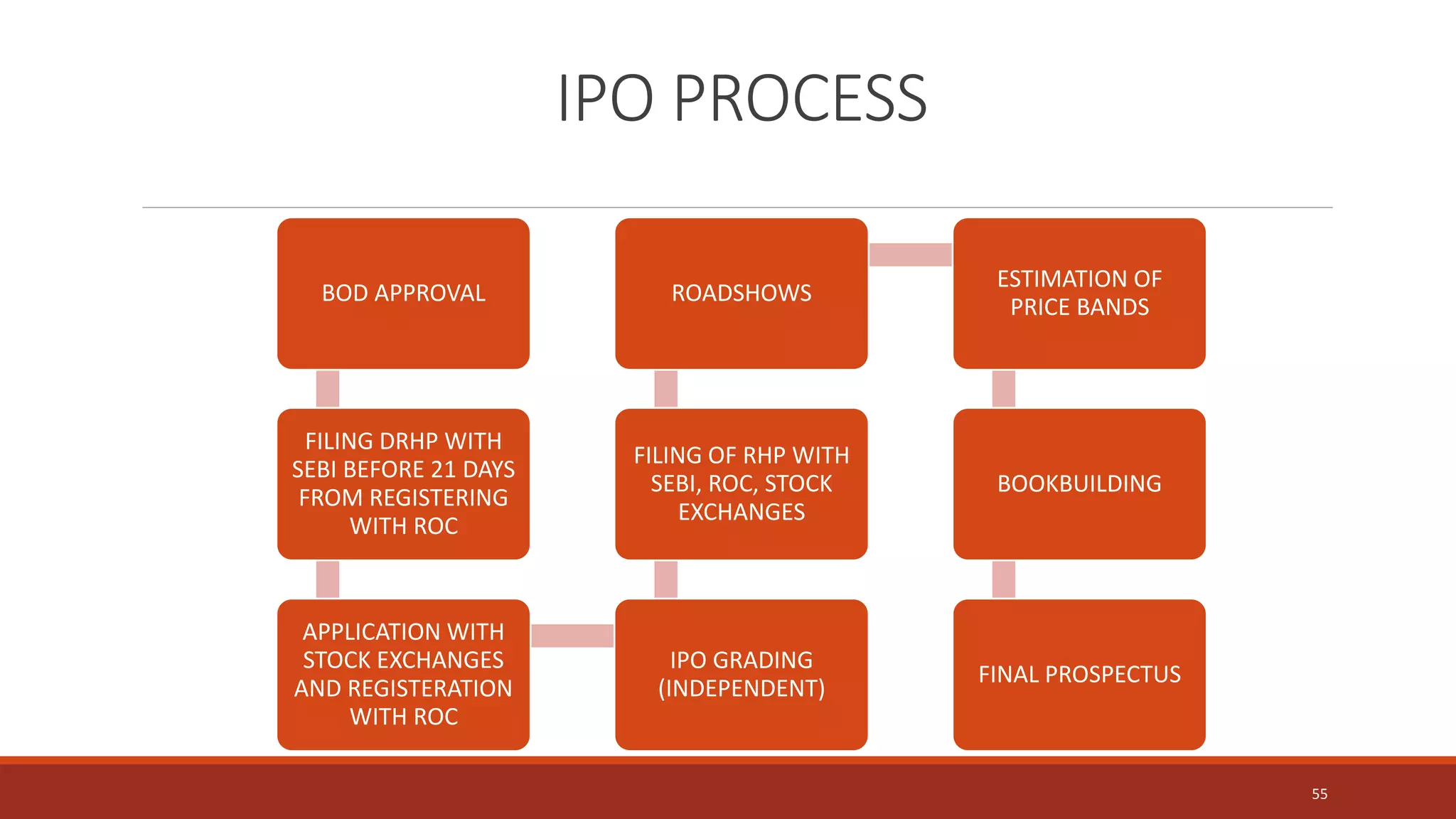

This document provides an overview of the IPO and FPO process in India. It defines IPO as the first sale of stock by a company to the public and FPO as when an already listed company makes a fresh issue of securities or an offer for sale. The key steps in the IPO process are Board approval, filing documents with SEBI and exchanges, IPO grading, setting the price band, book building, allotment and issuing the final prospectus. Intermediaries that help facilitate the process include merchant bankers, underwriters, syndicate members, registrars and bankers to the issue. The document also outlines SEBI regulations around eligibility criteria, minimum public shareholding and lock-in periods for IPOs and

![FINAL PROSPECTUS

•Final Prospectus is called the offer document

•Post SEBI Clearance of offer documents through various stages

•After bids are received and share price is fixed, the RHP is populated with the

price figures and submitted again to SEBI.

• The only difference between the RHP and the final prospectus is that for

(i) price of share, (ii) number of shares to be issued and (iii) issue size

•The RHP has blanks which mostly look like this – [•].

•These blanks are filled in the final prospectus

56](https://image.slidesharecdn.com/group2ipo-fpo-160218173239/75/IPO-FPO-Book-building-process-56-2048.jpg)