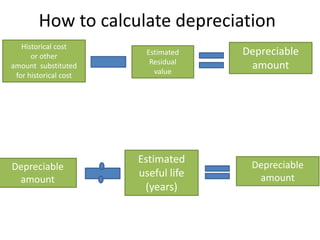

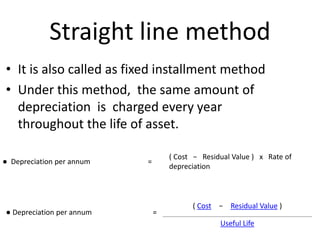

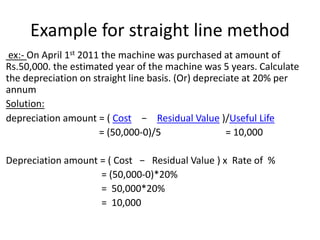

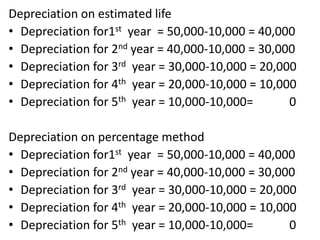

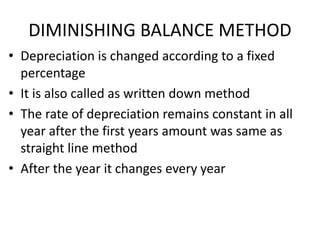

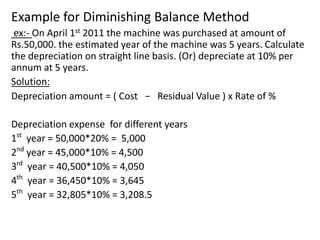

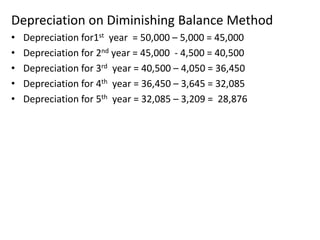

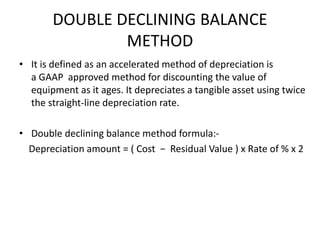

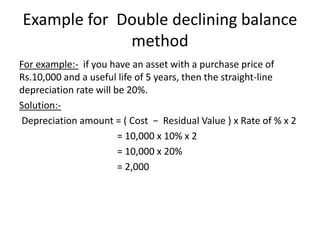

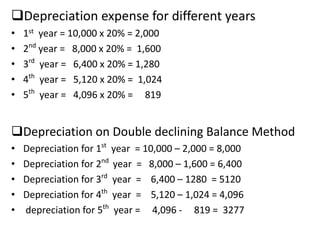

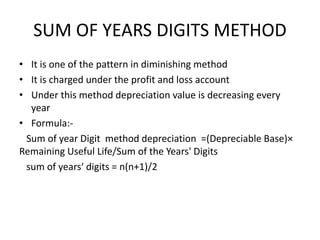

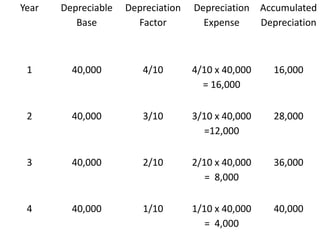

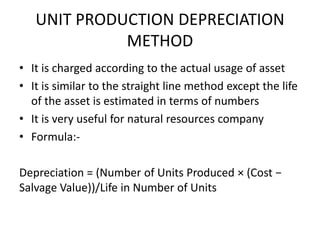

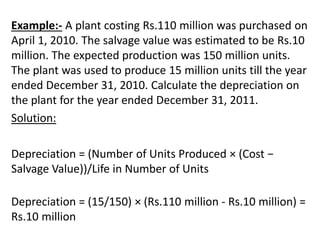

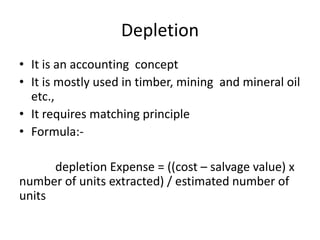

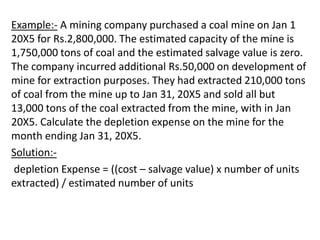

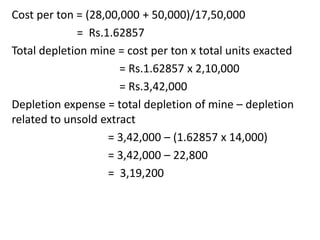

This document discusses various concepts and methods of depreciation. It defines depreciation as a measure of the wearing out or loss of value of an asset due to use over time. The objectives and causes of depreciation are also outlined. Several methods for calculating depreciation are explained, including straight-line, diminishing balance, and sum of years digits. Specific formulas and examples are provided to illustrate how to apply these depreciation methods. The document also discusses unit production and depletion methods which are used to allocate depreciation based on units produced or extracted.