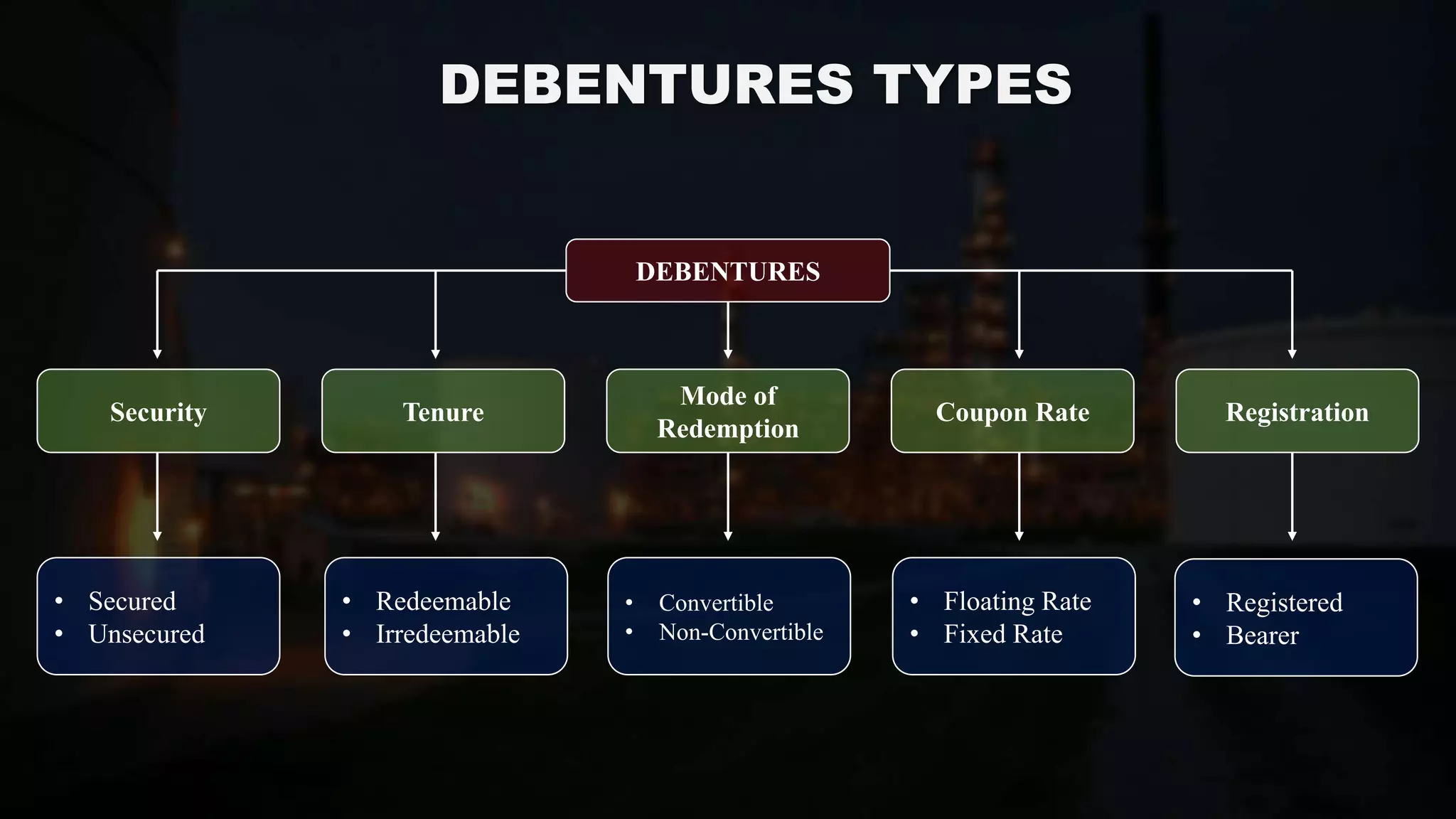

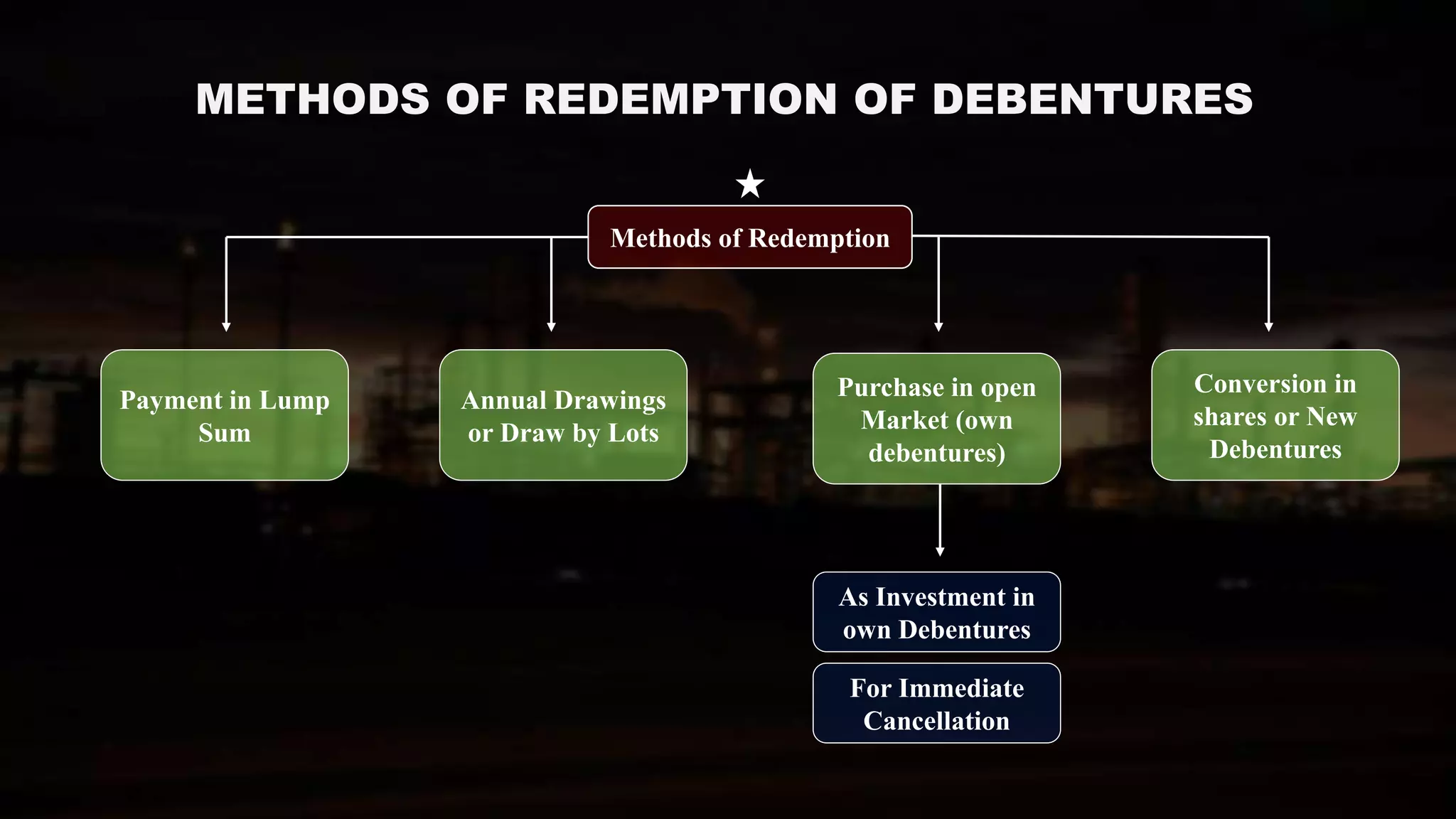

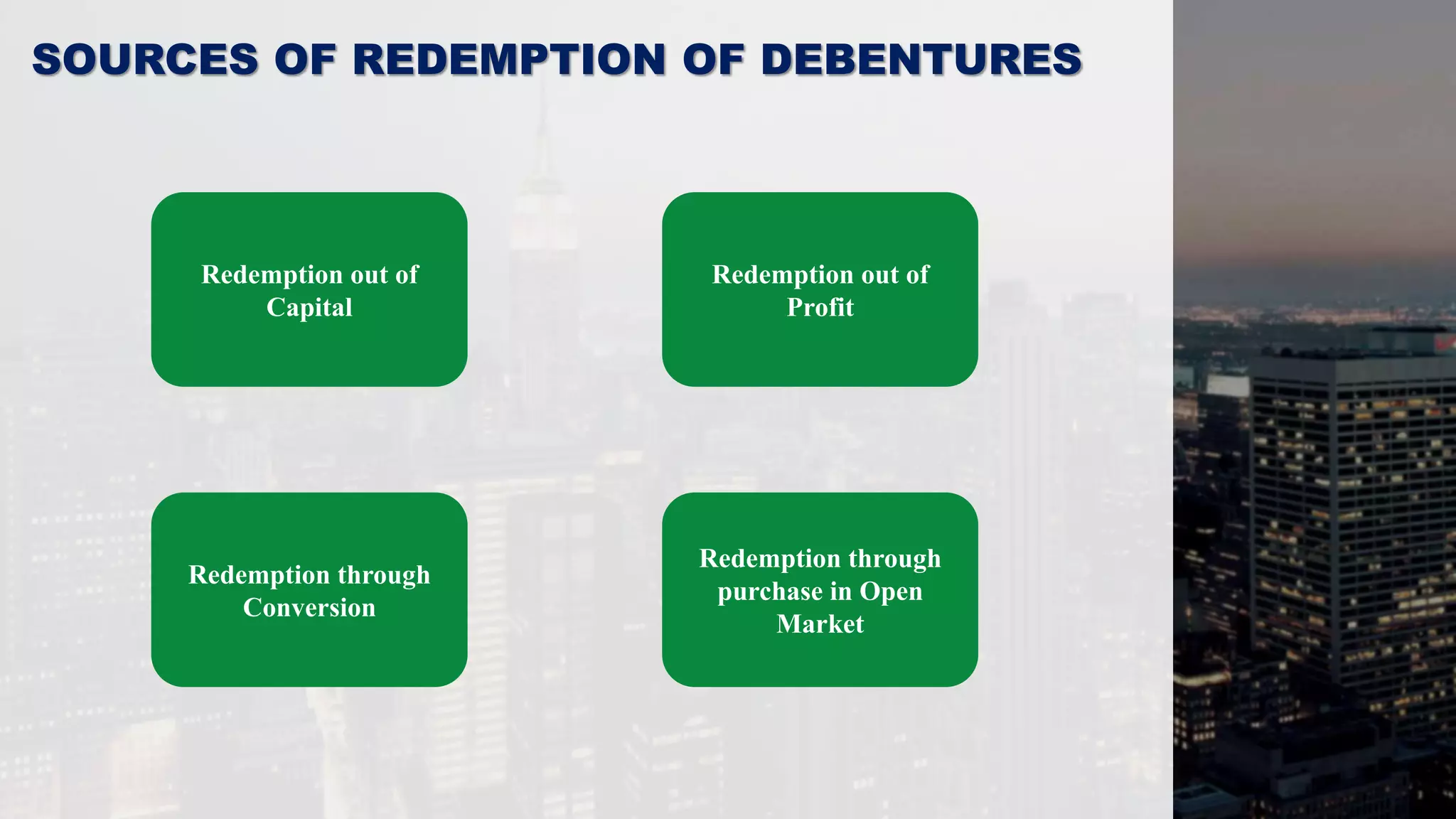

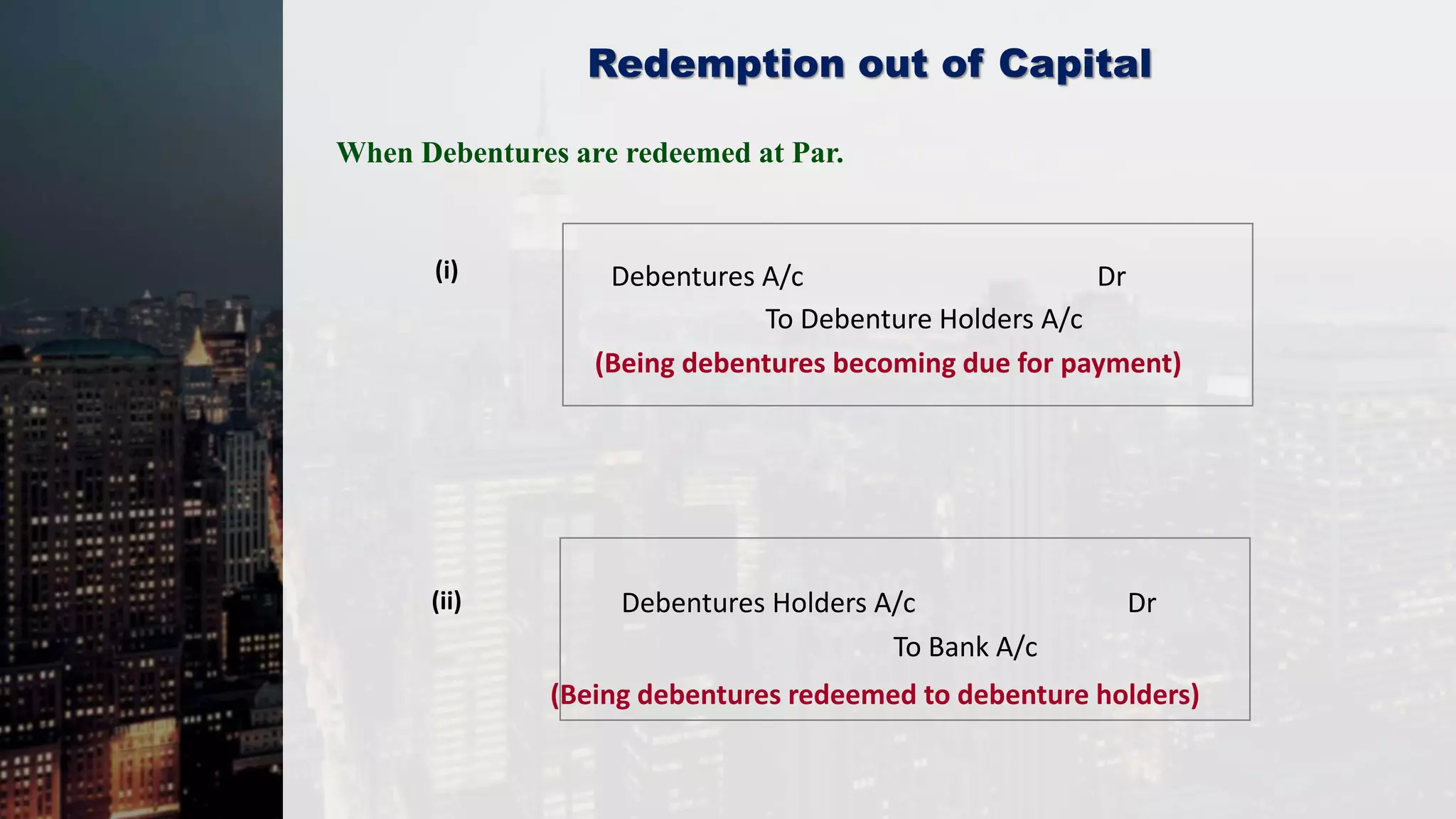

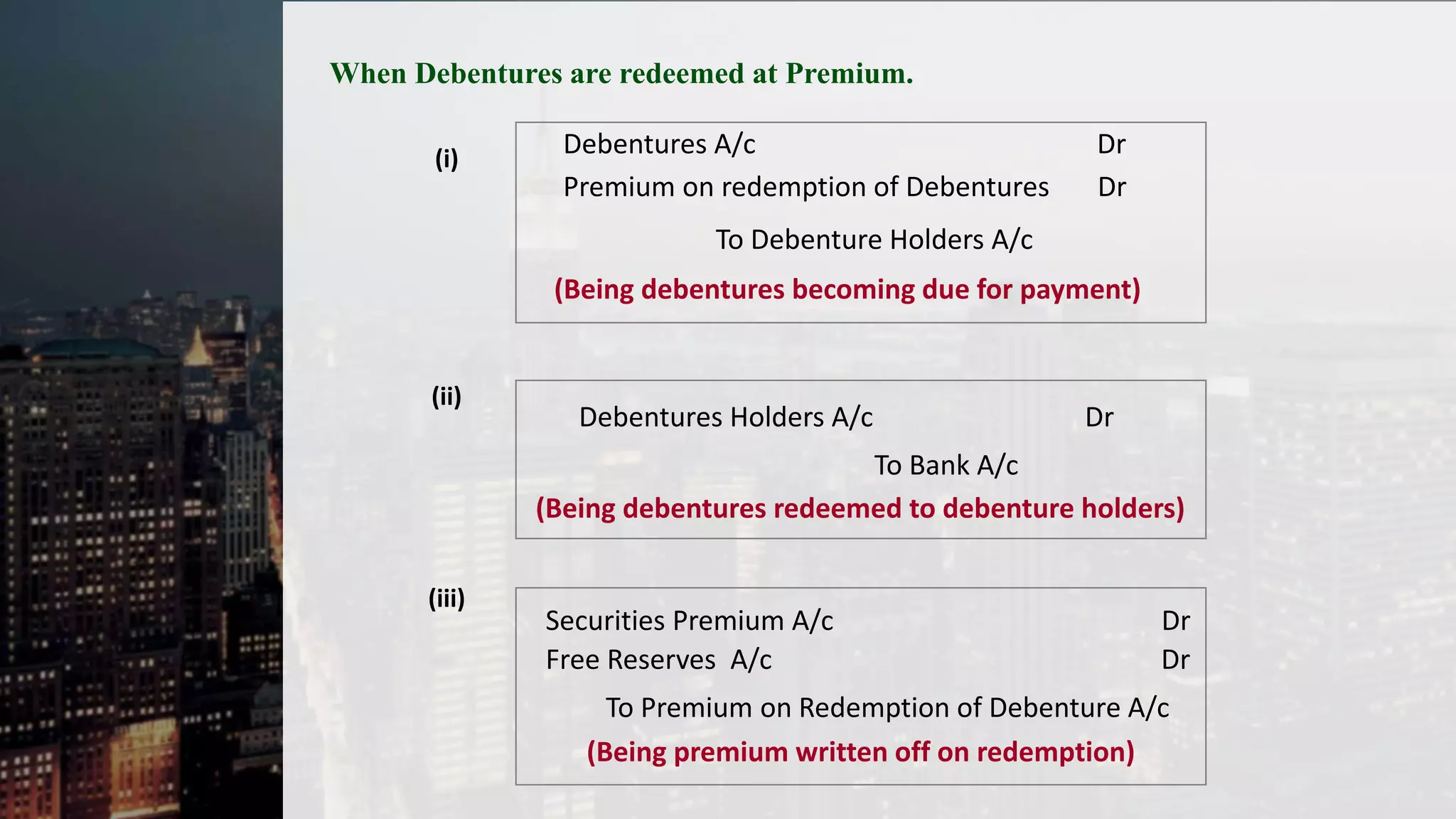

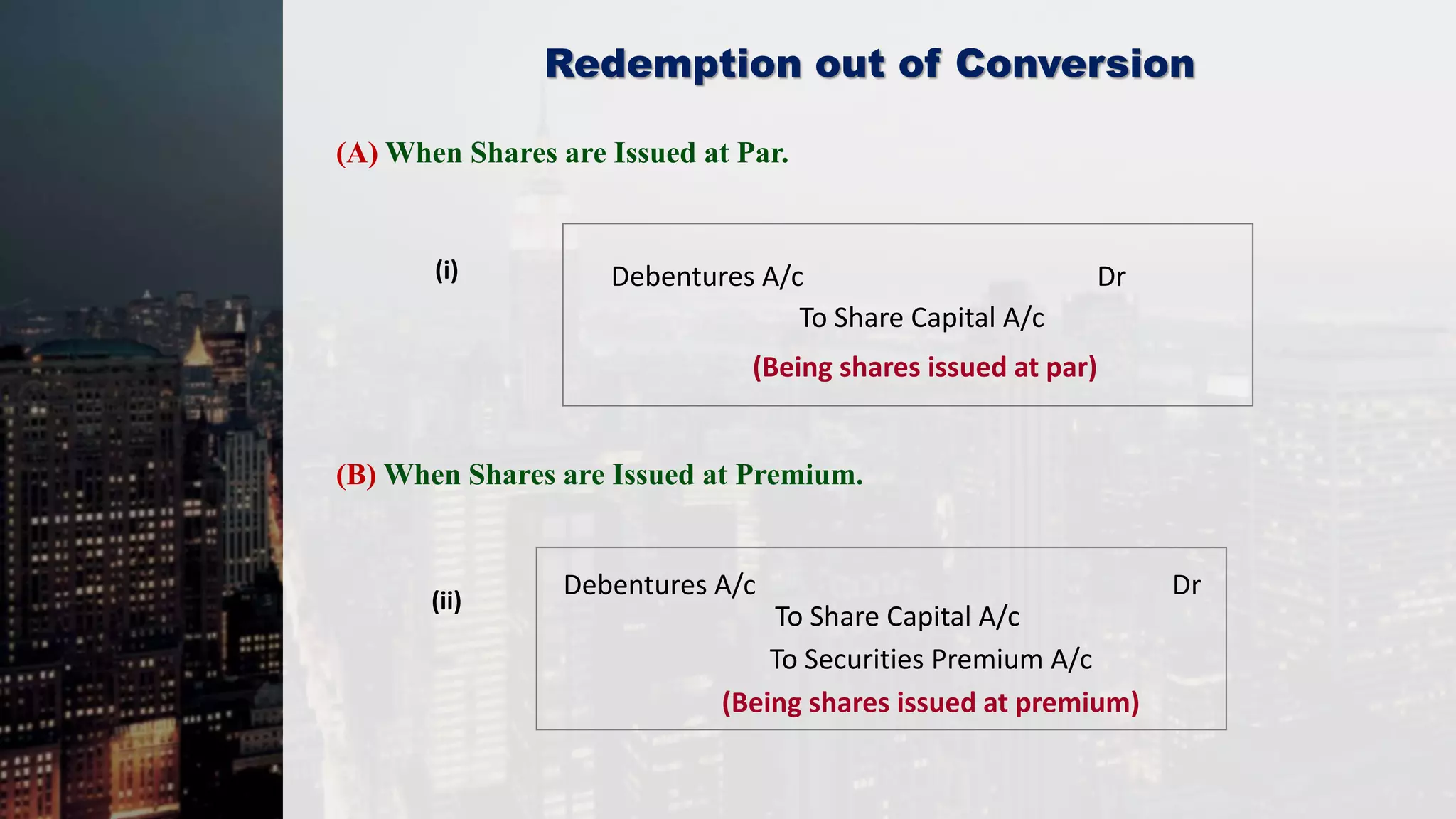

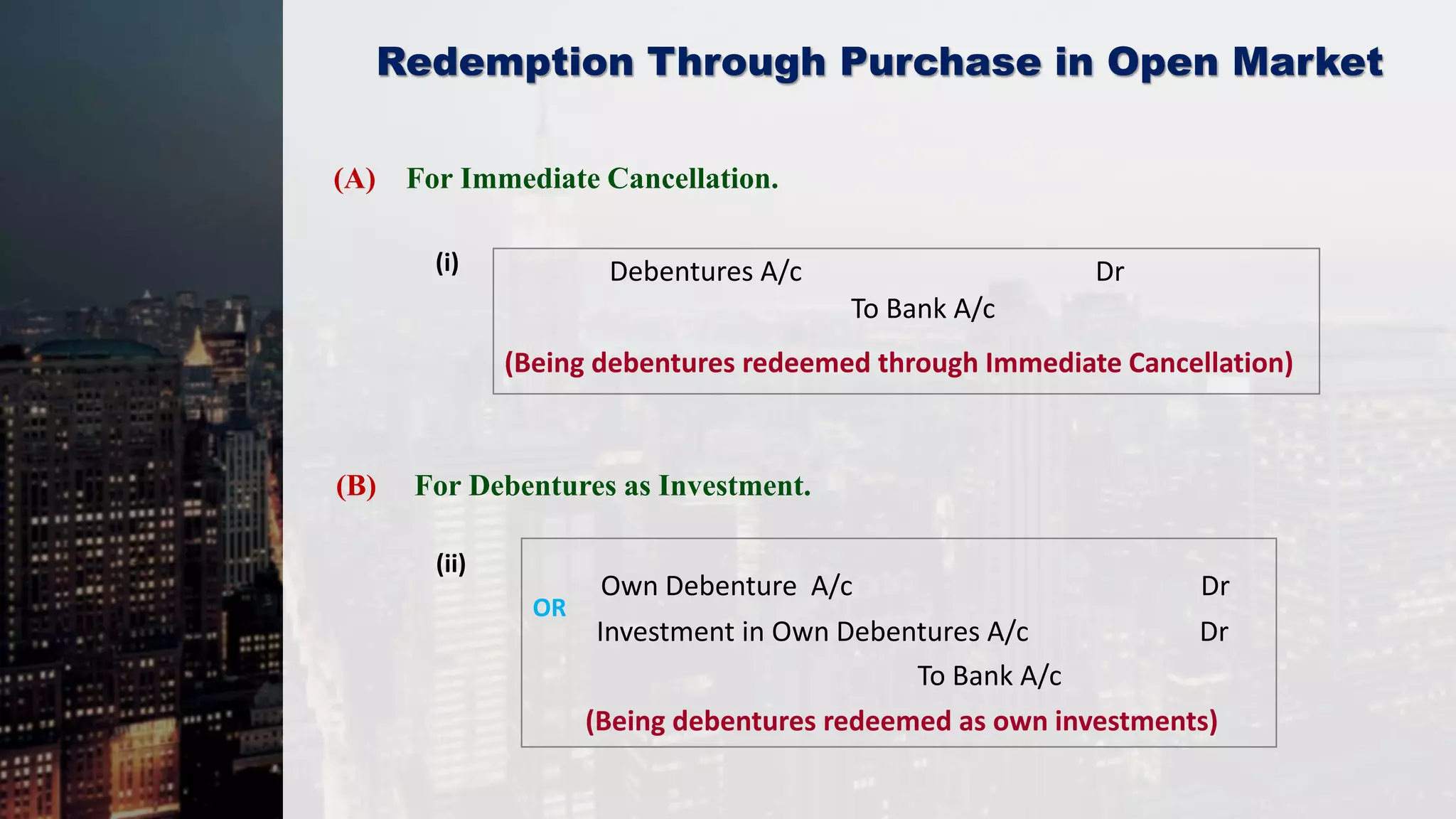

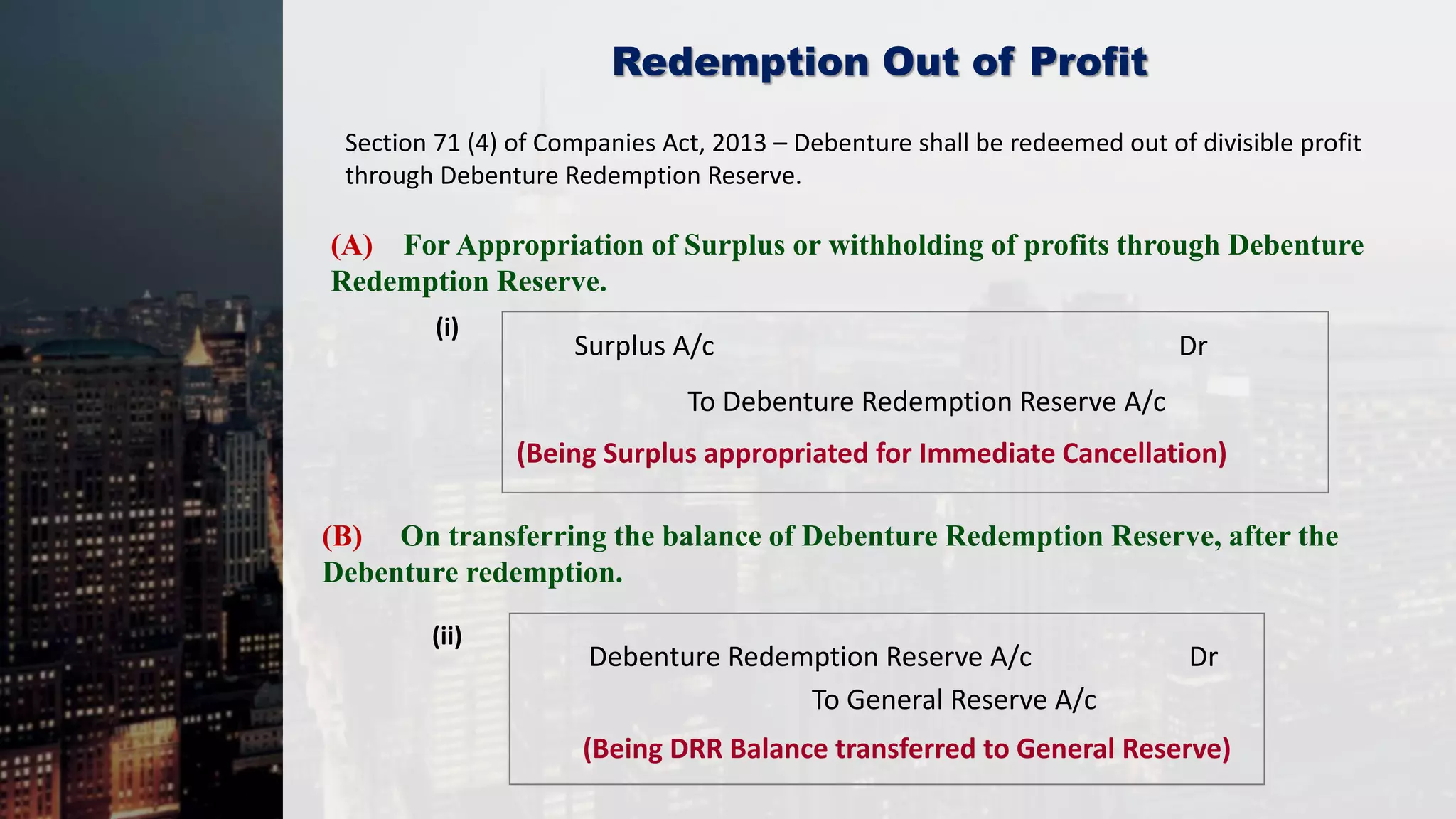

The document discusses debentures, detailing their definitions, types, and methods of redemption. Debentures are debt instruments issued by companies and governments, with holders receiving fixed interest rates, and can be categorized into secured, unsecured, redeemable, and convertible types. Various redemption methods and sources, including lump sum payments, annual drawings, and conversions to shares, are explained along with accounting entries for each method.