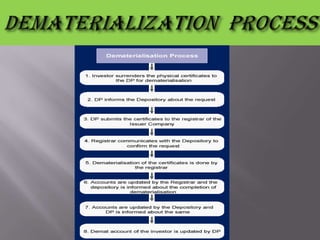

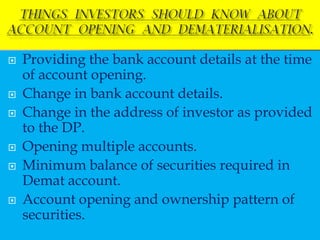

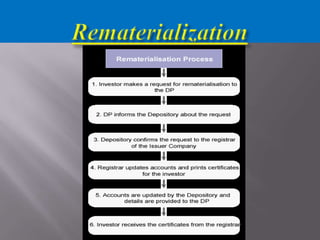

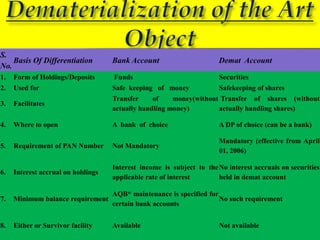

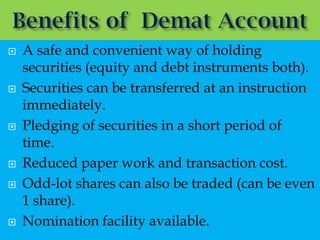

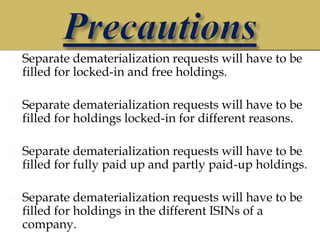

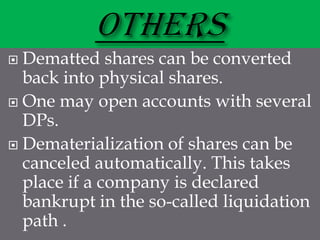

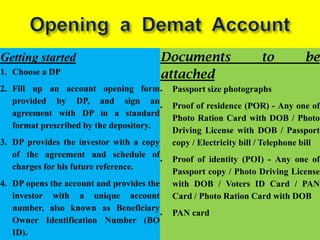

Dematerialization is the process of converting physical share certificates into electronic form and holding them in a Demat account with a Depository Participant (DP). To dematerialize shares, an investor fills a form with their DP and submits their share certificates. The shares will be credited to their Demat account within 15 days. A Demat account allows investors to buy and sell shares electronically without physical certificates.