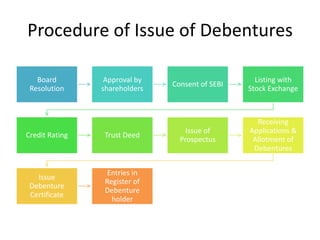

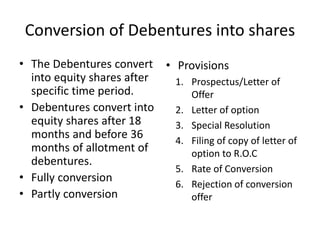

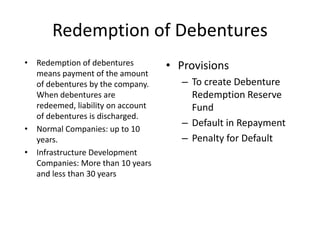

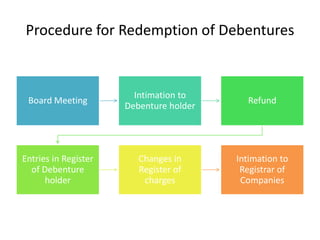

This document defines debentures and outlines their key characteristics. It notes that debentures are debt instruments used by companies to borrow money at a fixed interest rate. Debentures can be secured or unsecured, registered or bearer, redeemable or irredeemable, and convertible or non-convertible. The document also discusses statutory provisions regarding debenture issuance, conditions for valid issuance, procedures for issuance, conversion to shares, and redemption.