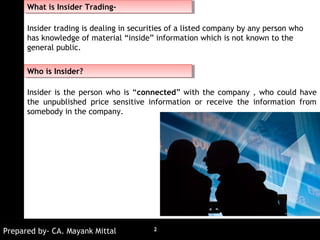

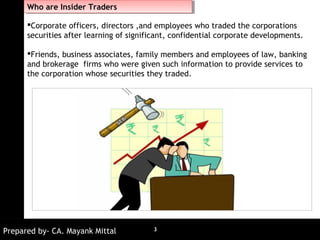

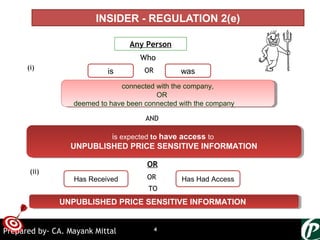

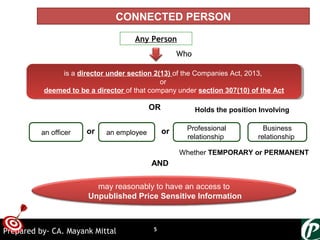

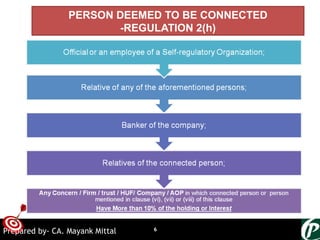

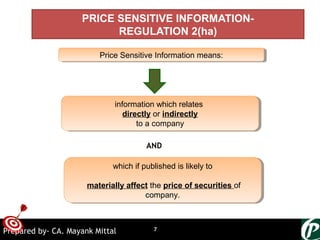

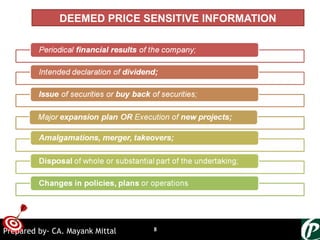

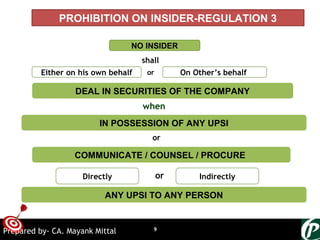

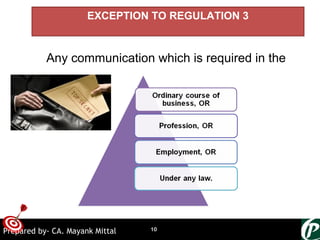

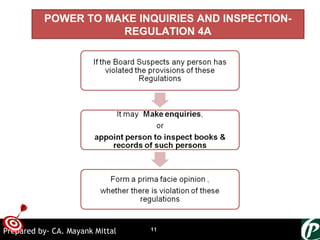

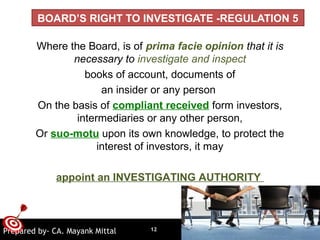

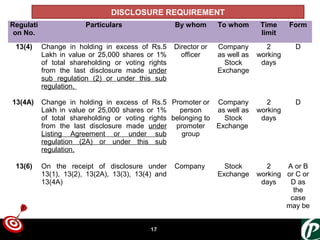

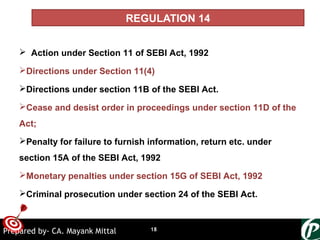

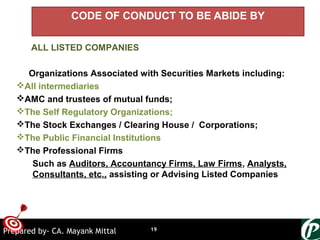

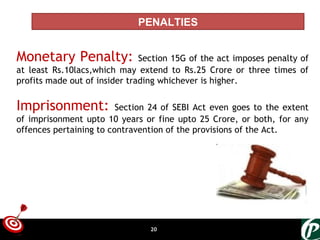

Insider trading involves trading in the securities of a company by individuals with access to non-public, material information about that company. Insiders include people connected to the company like directors, employees and family members. They are prohibited from trading based on unpublished price sensitive information. Insider trading regulations define insiders, unpublished price sensitive information, disclosure requirements and penalties for non-compliance. Violations are punishable by monetary penalties, imprisonment or both.