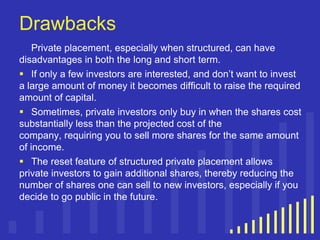

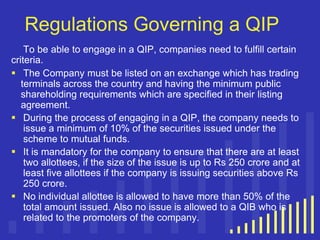

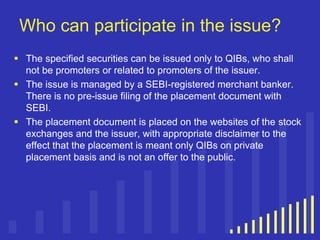

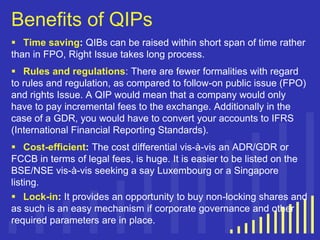

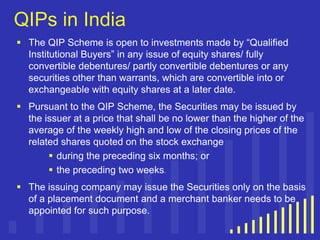

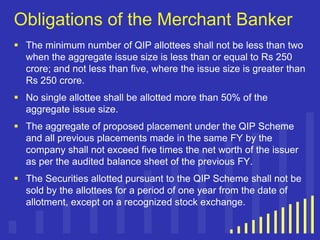

This document summarizes private placements, which are a type of private funding where securities are sold to a small number of chosen investors rather than through a public offering. It describes the types of private placements including traditional long-term loans, structured placements with stock price protections, stock options, bonds, and promissory notes. The advantages are choosing investors, less regulatory requirements than public offerings, and more flexibility. Drawbacks include difficulty raising large amounts, investors requiring lower share prices, and structured placements reducing future shares available. It also describes Qualified Institutional Placements in India which allow listed companies to issue securities privately to qualified institutional buyers through a faster process than other private placement methods.