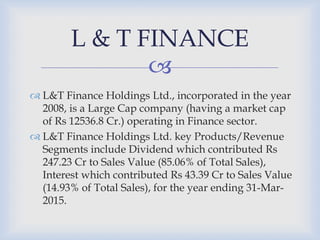

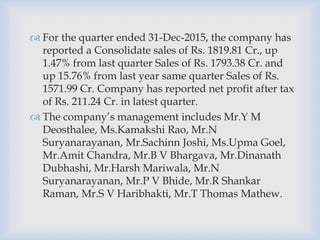

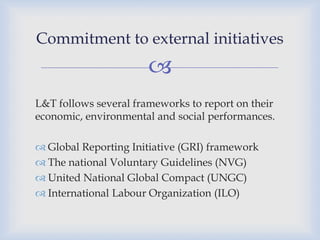

L&T Finance Holdings Ltd is a large NBFC operating in finance sector in India. It provides various financial services including loans, insurance, factoring etc. The company follows frameworks like GRI, NVG, UNGC to report on economic, environmental and social performances. It ensures ethics and transparency in business operations and incorporates social/environmental factors. The company focuses on talent acquisition and development, transparency, learning and good governance in its HR policy.