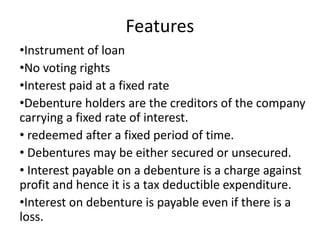

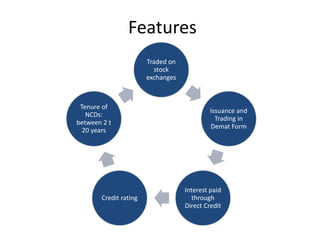

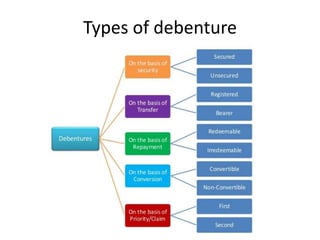

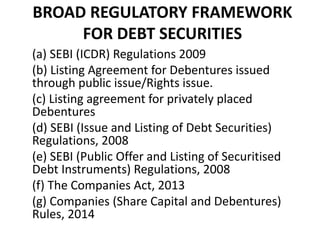

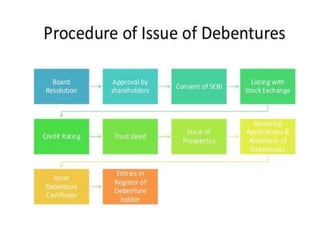

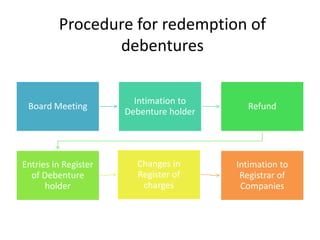

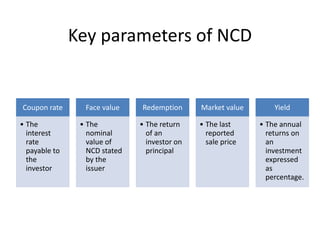

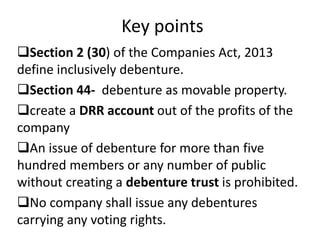

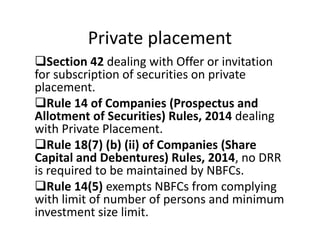

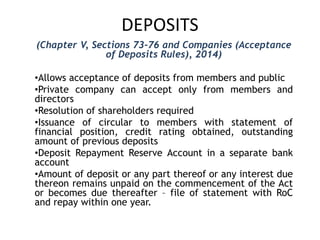

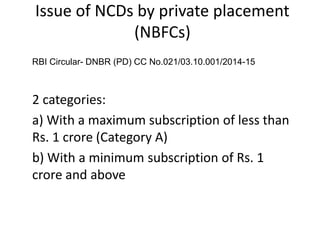

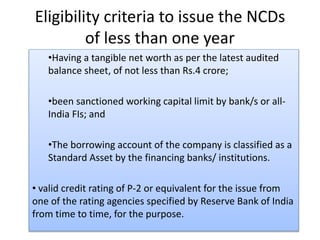

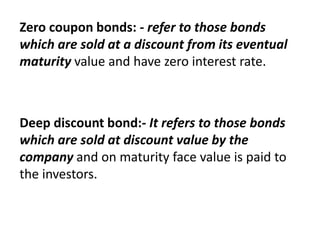

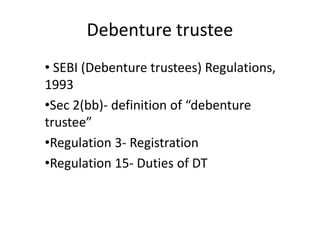

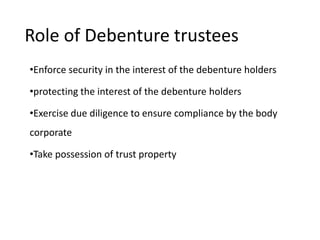

Non-convertible debentures (NCDs) are debt instruments issued by companies to raise funds for a fixed period with a commitment to repay the principal at the end. NCDs do not give voting rights to debenture holders and pay a fixed rate of interest. They can be secured against company assets or unsecured. NCDs are issued through public issues or private placements and traded on stock exchanges. Key parameters include coupon rate, face value, redemption, market value and yield. Companies must comply with regulatory requirements for issuing NCDs including credit ratings and debenture trustee oversight.