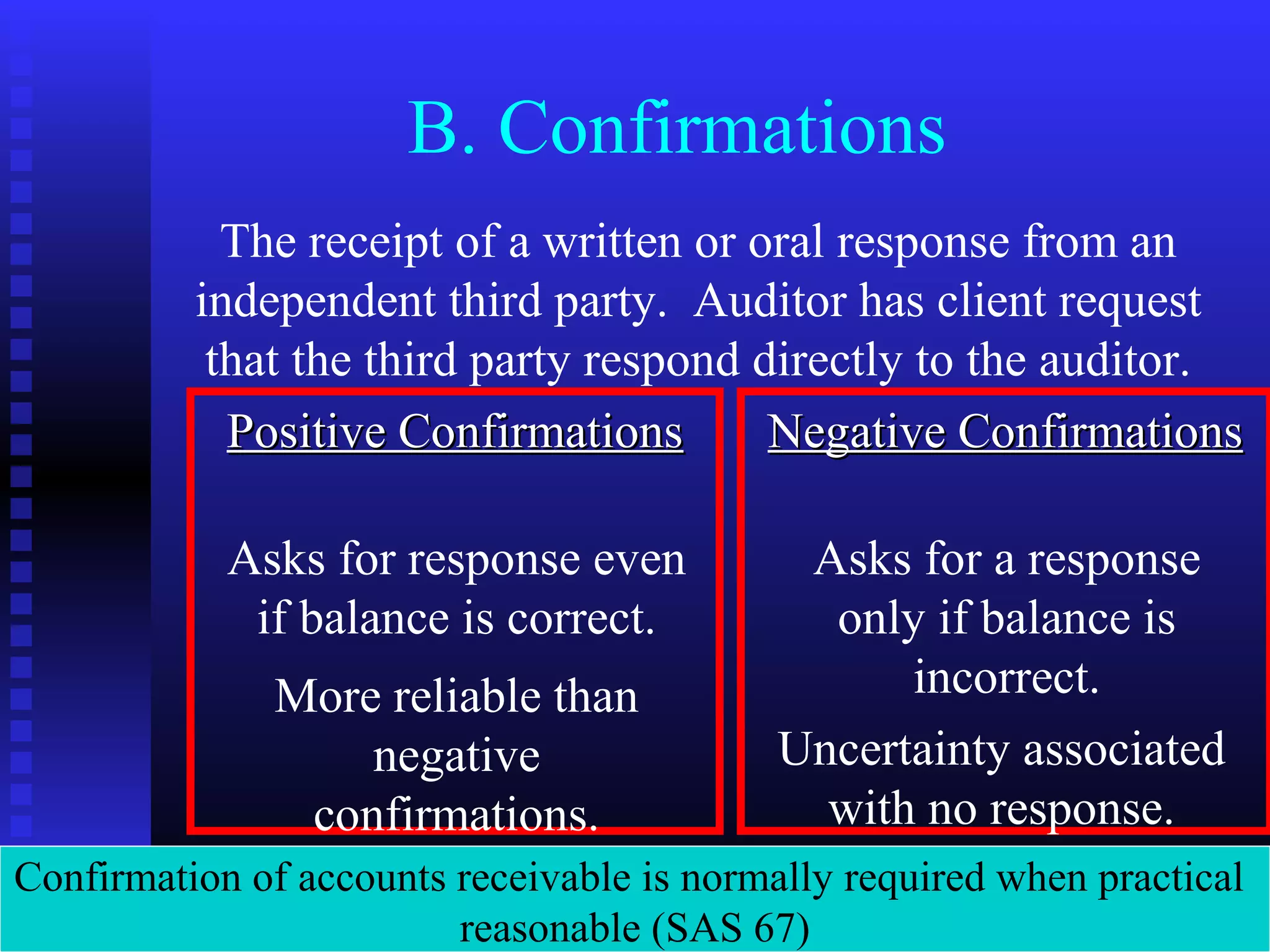

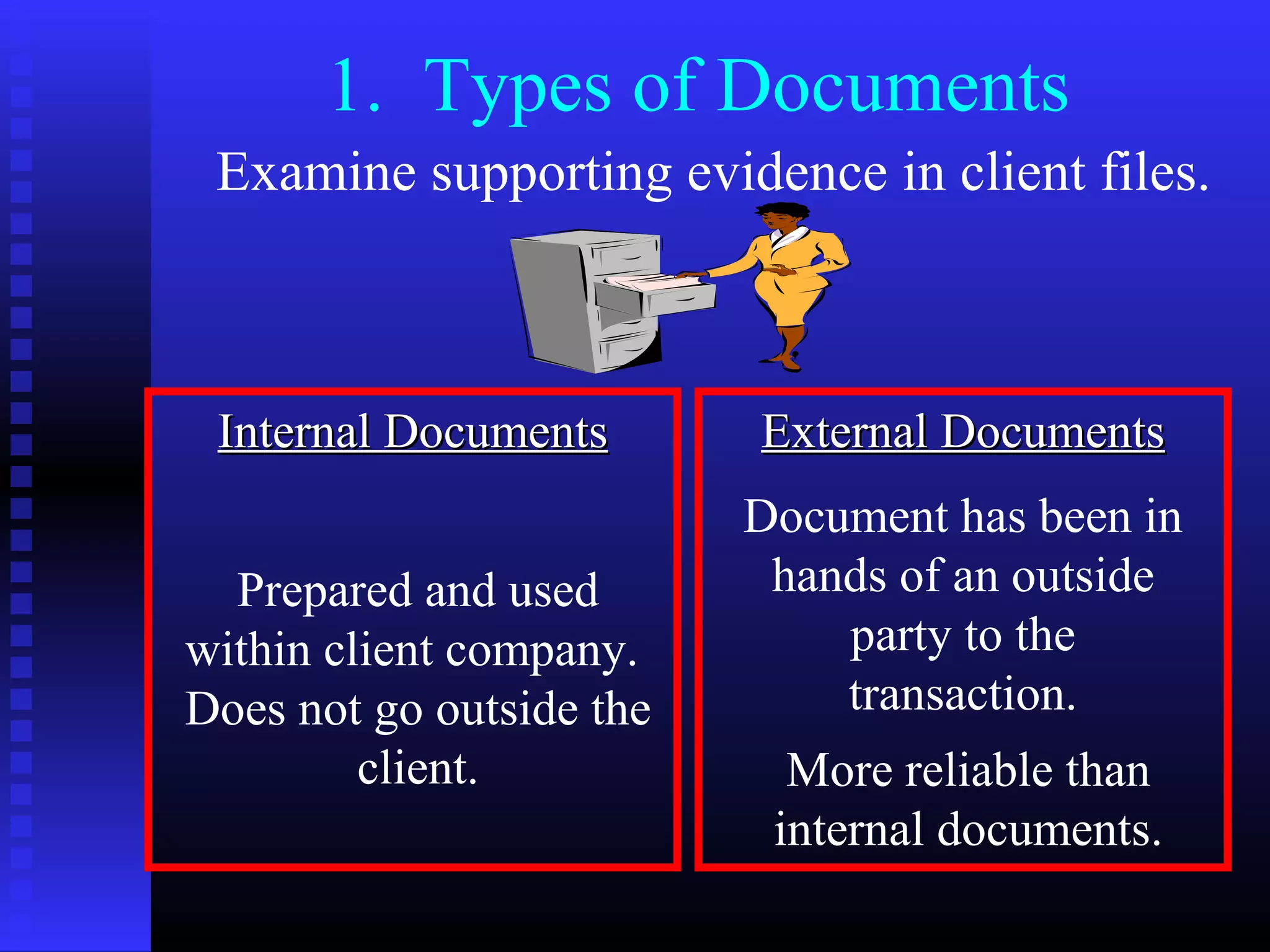

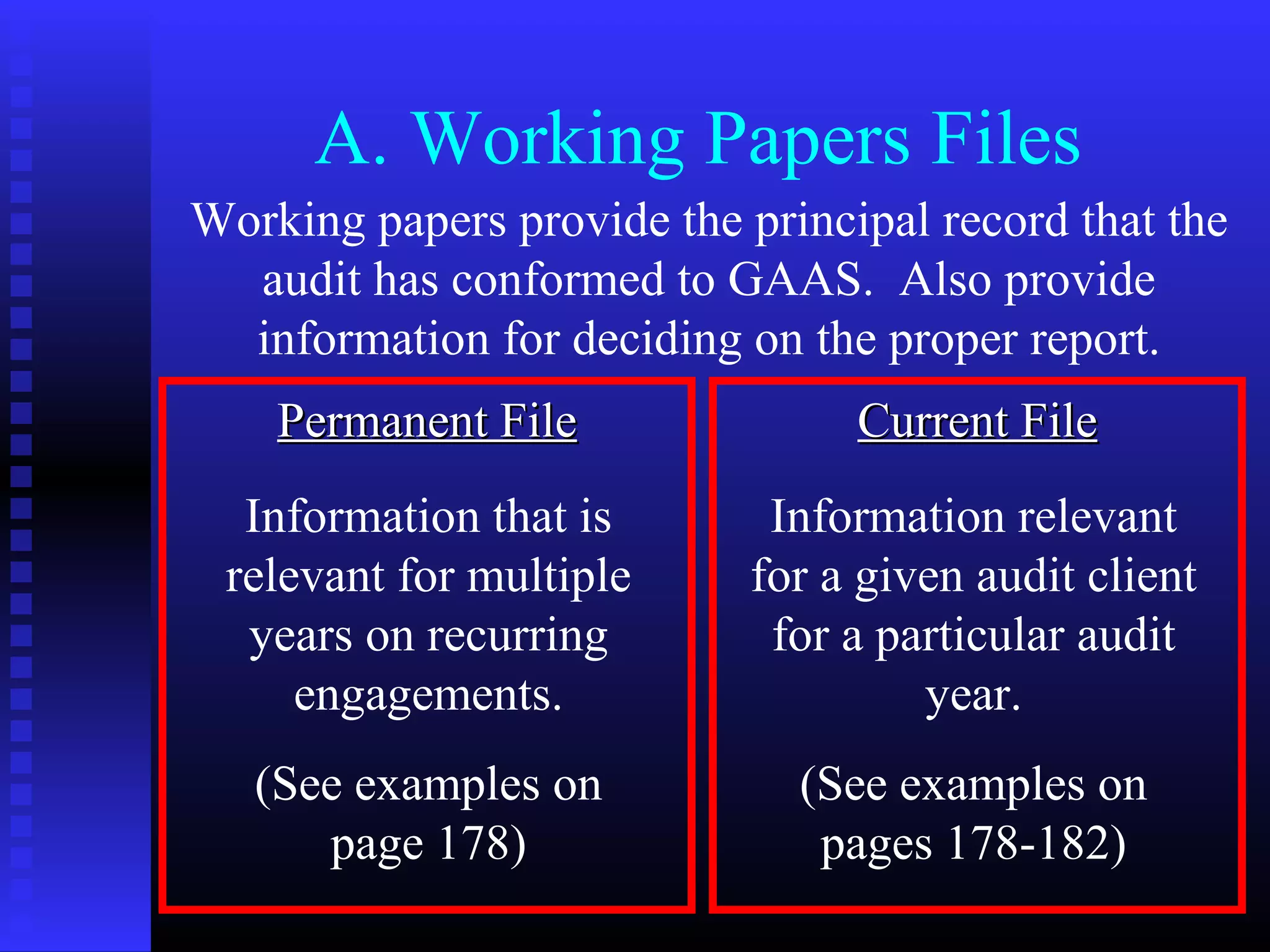

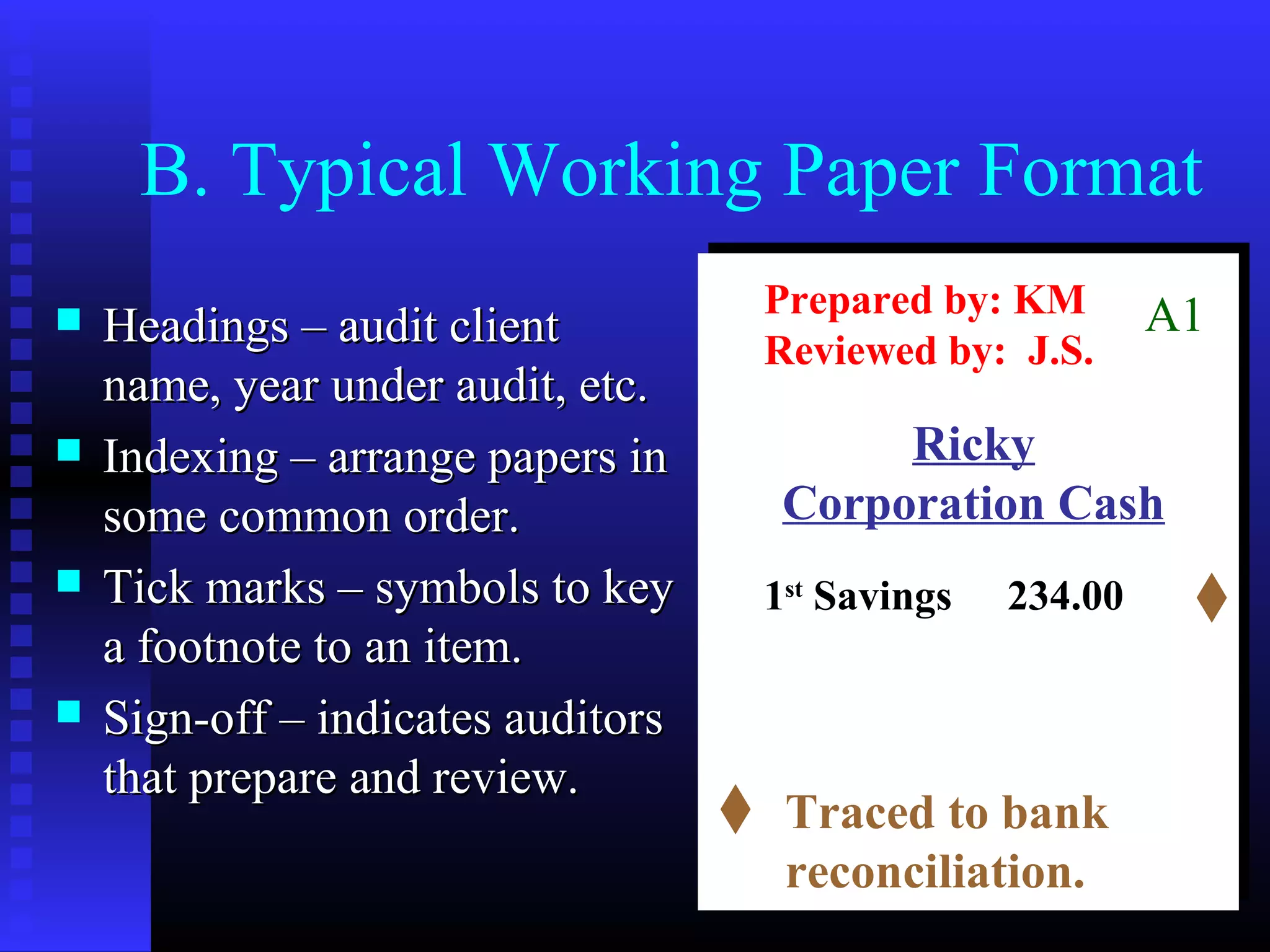

The document discusses audit evidence, types of audit evidence used in audits, and working papers. It defines audit evidence and examines factors that influence its persuasiveness, such as competence and sufficiency. The types of audit evidence covered include physical examination, confirmations, documentation, analytical procedures, inquiries, reperformance, and observation. The final section addresses typical working paper format, storage requirements, and ownership.