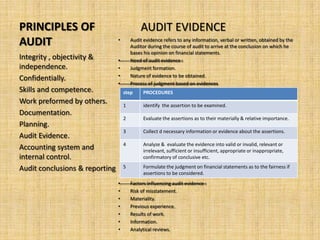

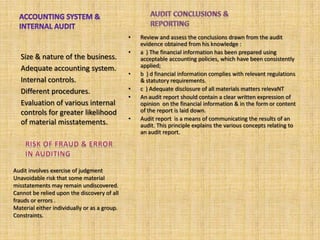

The document provides an introduction and overview of auditing. It defines auditing as examining accounting records to establish if they accurately reflect transactions. The key objectives of auditing are reporting, detecting and preventing frauds and errors. The specific objectives can depend on whether it is an internal audit or audit for other purposes like obtaining a bank loan. Auditing aims to verify that accounting policies are followed and financial statements present a true and fair view.