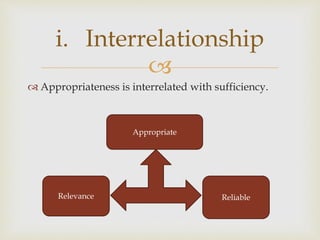

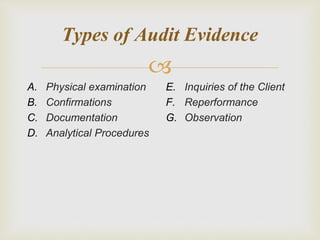

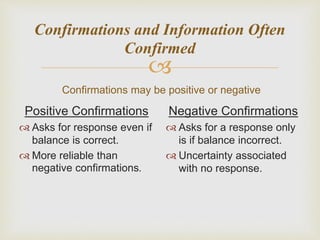

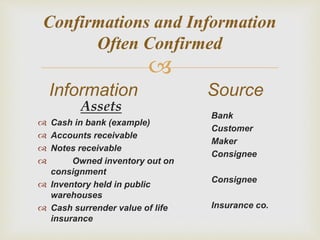

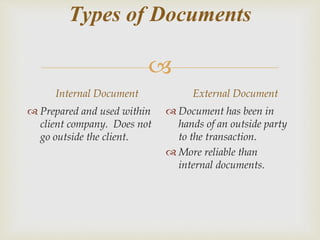

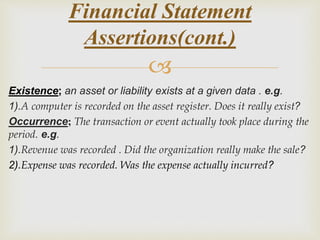

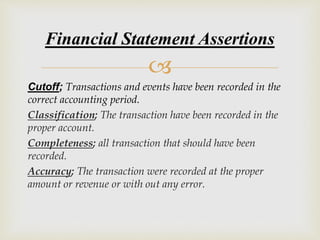

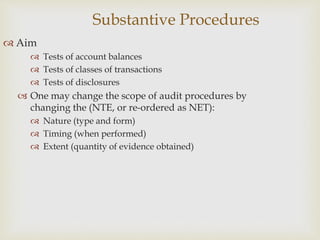

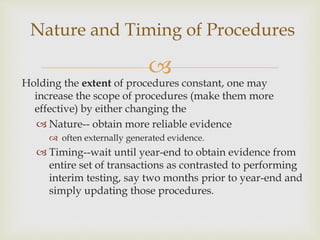

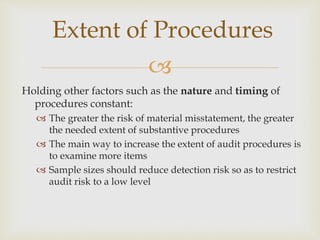

The document discusses audit evidence and procedures for gathering evidence. It defines audit evidence and its basic principles of independence, integrity, and objectivity. It describes the sources of audit evidence, including physical examination, confirmations, documentation, analytical procedures, inquiries, reperformance, and observation. It discusses factors like audit risk, reliance on controls, materiality, and reliability that influence evidence. It also covers the appropriateness, relevance, reliability, and direction of testing for audit evidence. Finally, it discusses substantive procedures used to detect material misstatements.