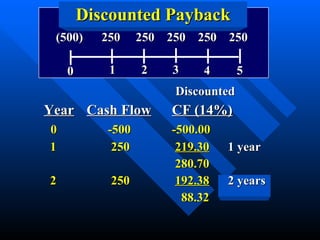

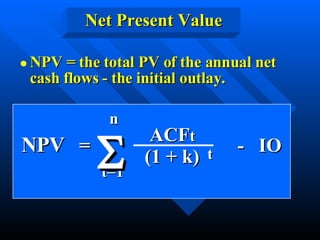

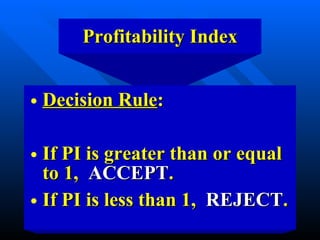

The document discusses various capital budgeting decision criteria for evaluating investment projects, including payback period, discounted payback period, net present value (NPV), profitability index (PI), and internal rate of return (IRR). It provides examples of how to calculate each metric and the decision rules for accepting or rejecting projects based on the criteria. For a sample problem, it calculates the project's IRR as 34.37%, NPV at a 15% discount rate as $510.52, and PI as 1.57 by taking the NPV and dividing it by the initial investment outlay.