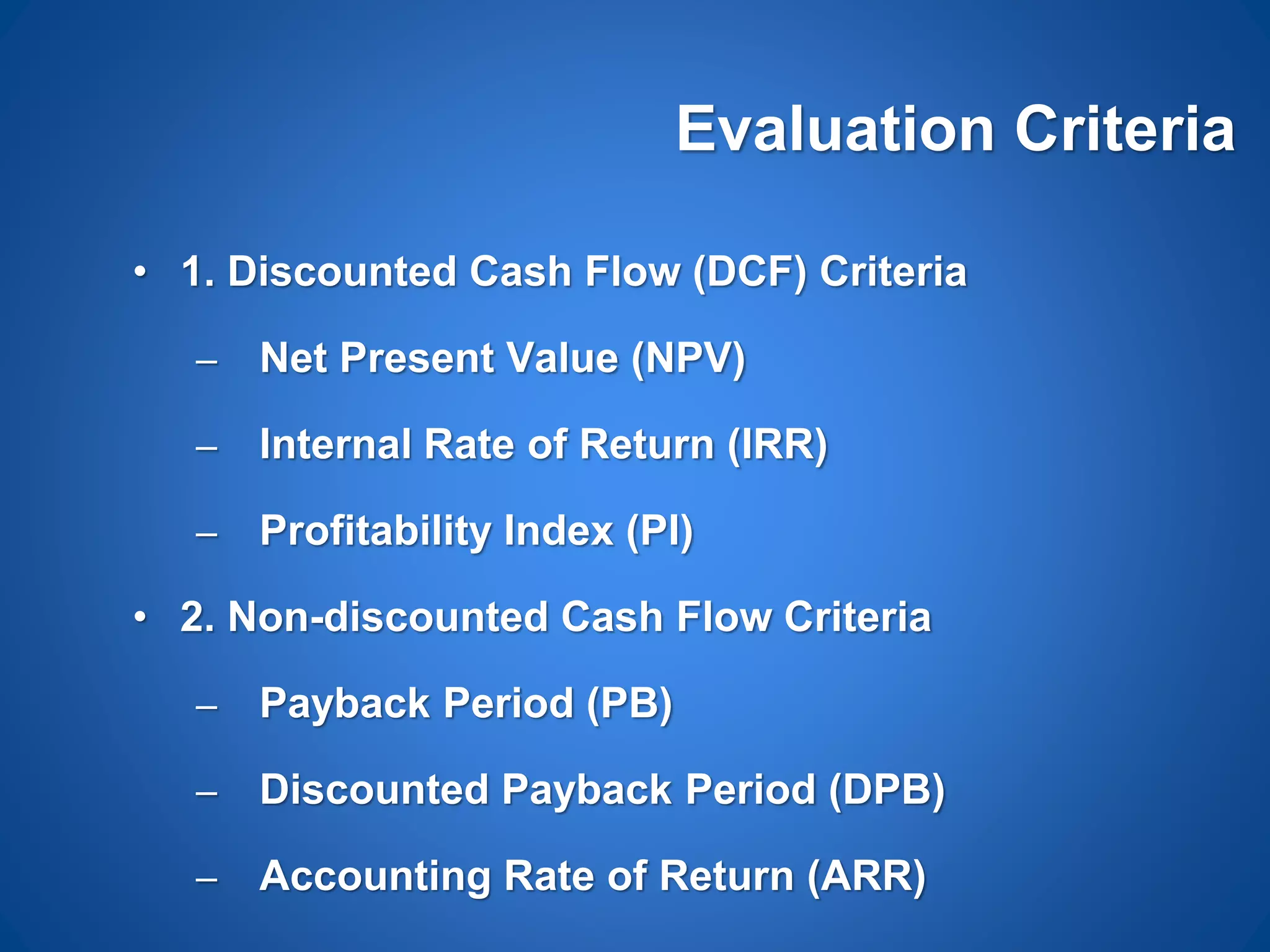

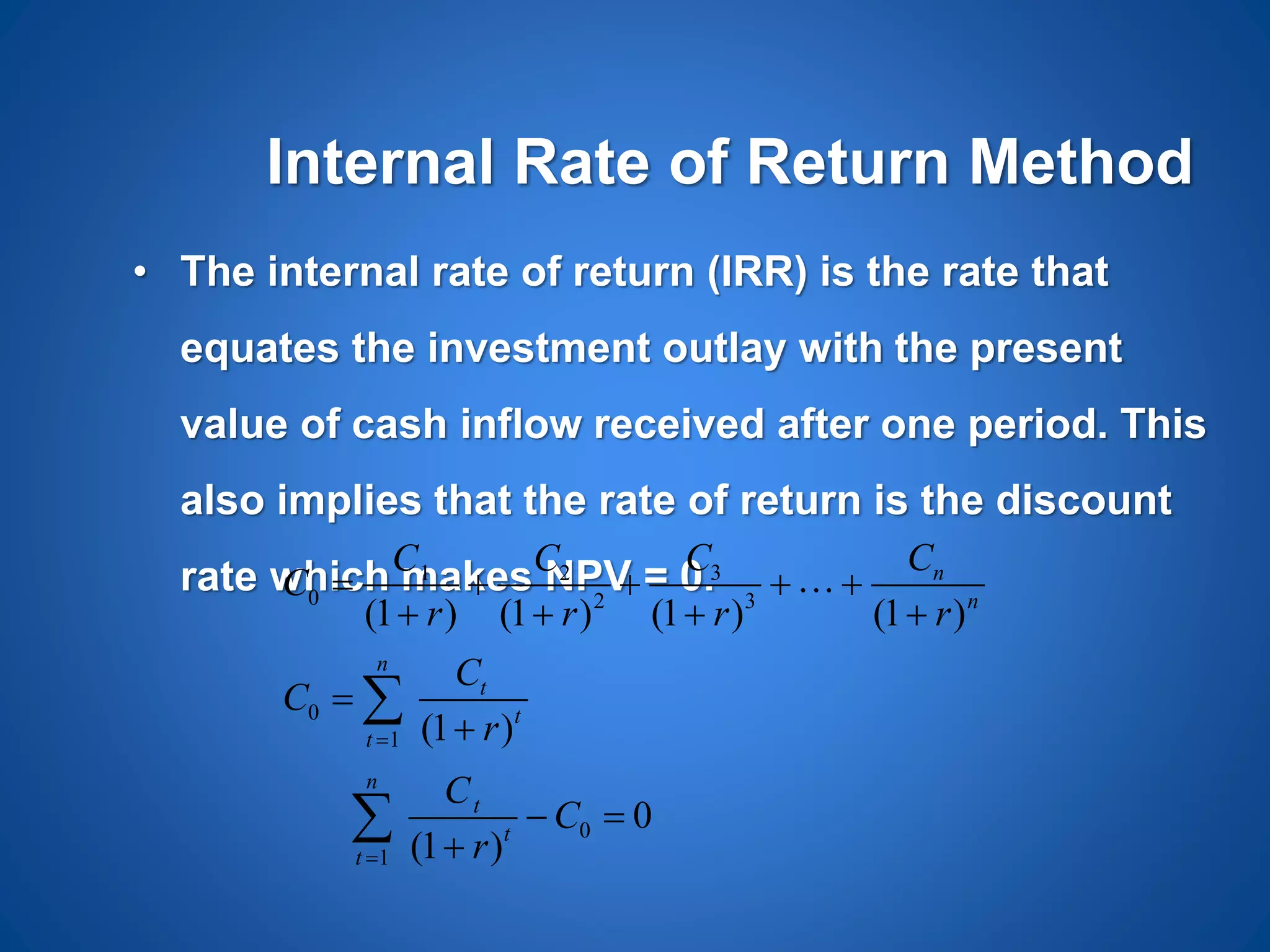

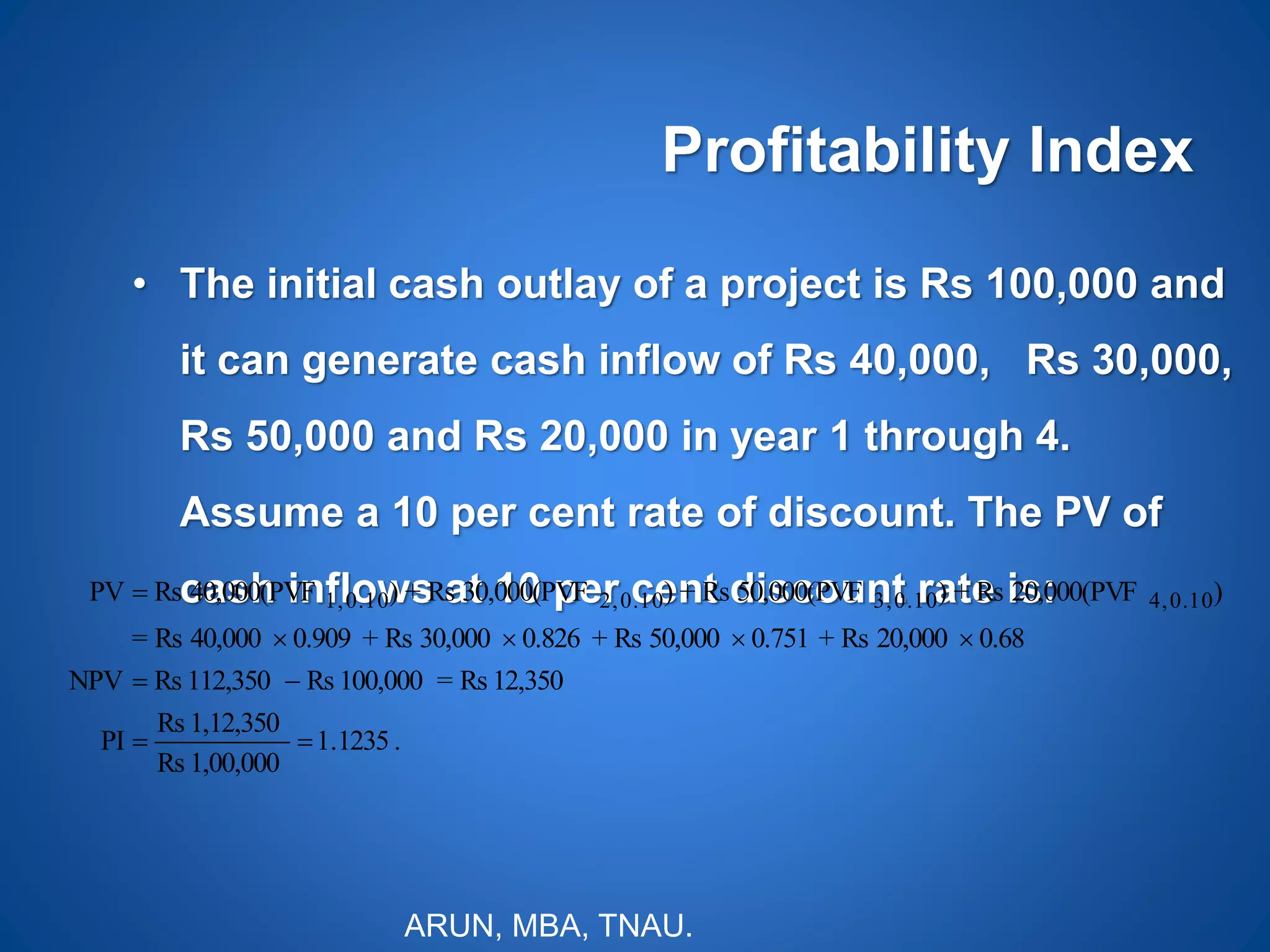

This document discusses various capital budgeting techniques used to evaluate long-term investment projects. It describes techniques such as net present value (NPV), internal rate of return (IRR), profitability index (PI), payback period, and accounting rate of return. For each technique, it provides the calculation method, acceptance criteria, and advantages and limitations of the approach. The key methods are NPV, IRR and PI, which incorporate the time value of money, while payback period and accounting rate of return do not fully consider cash flow patterns and the time value of money.