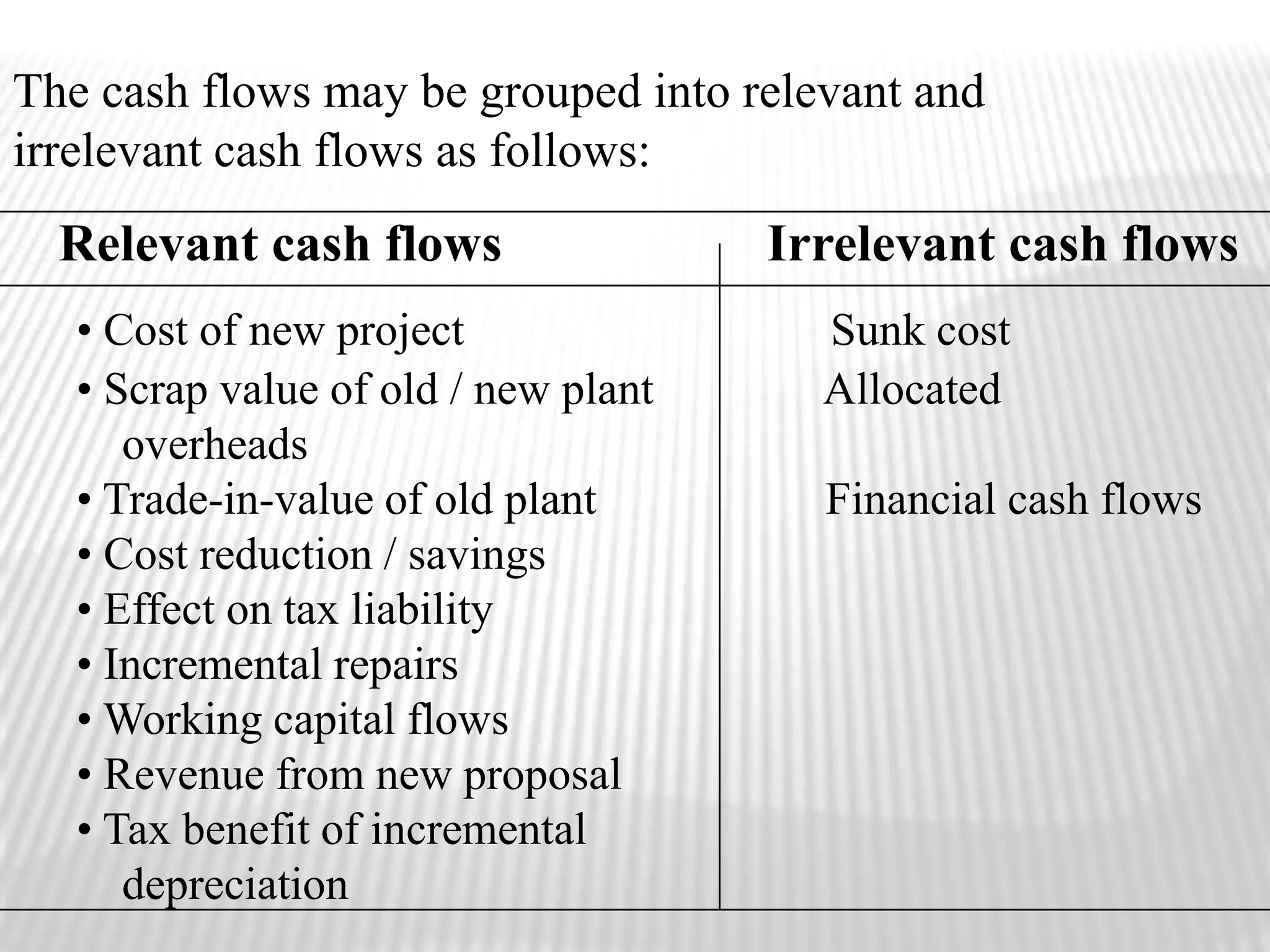

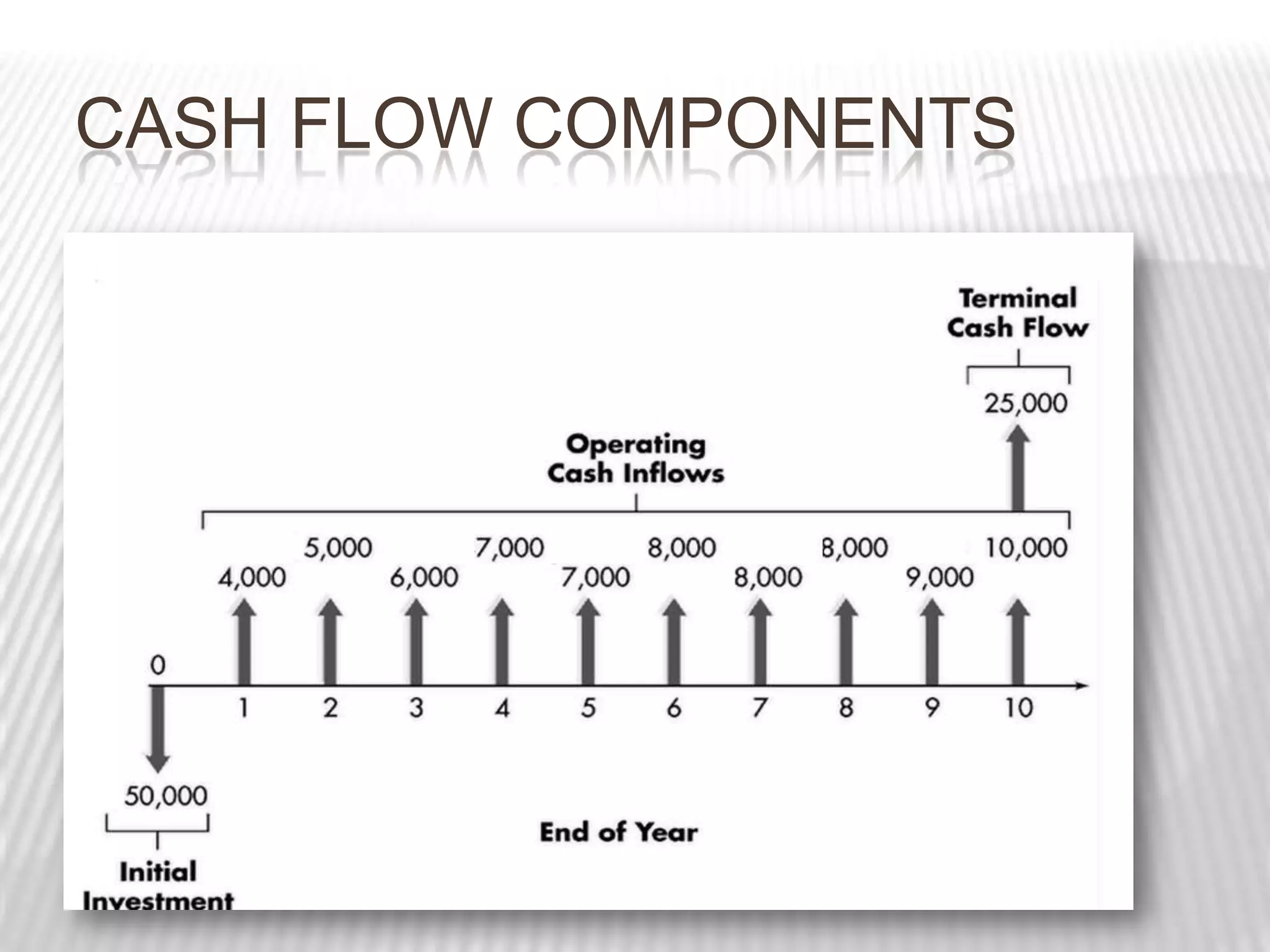

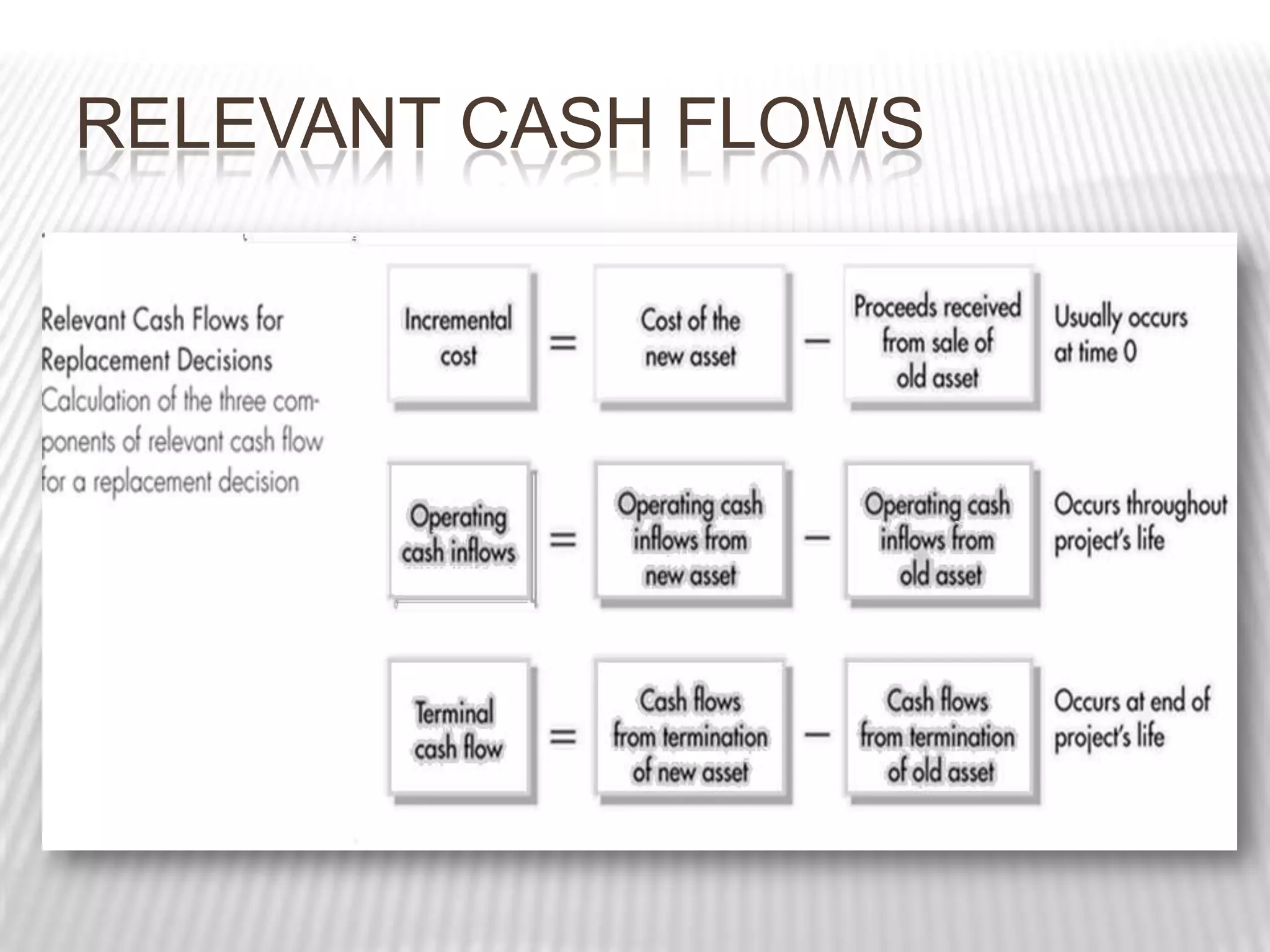

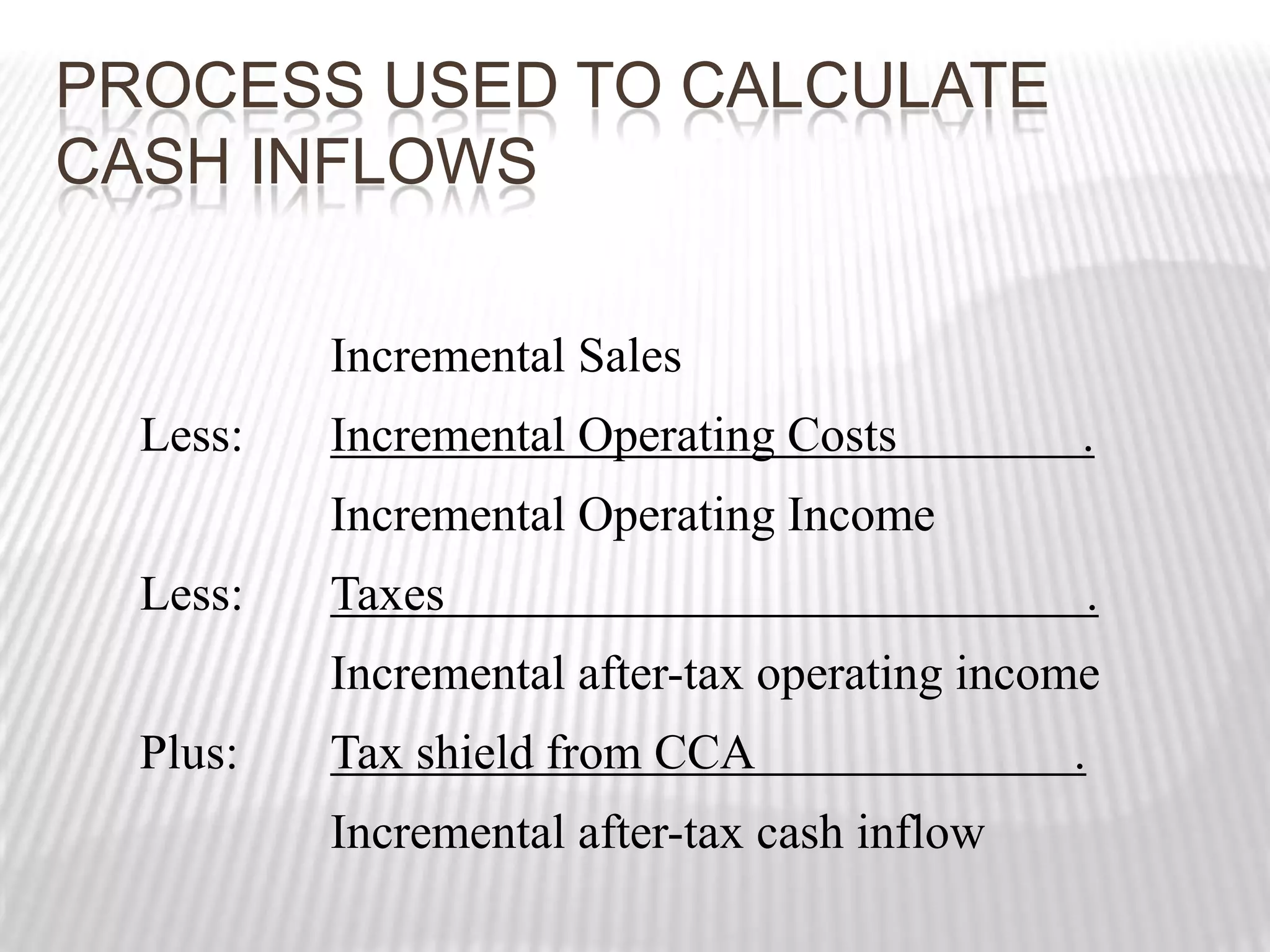

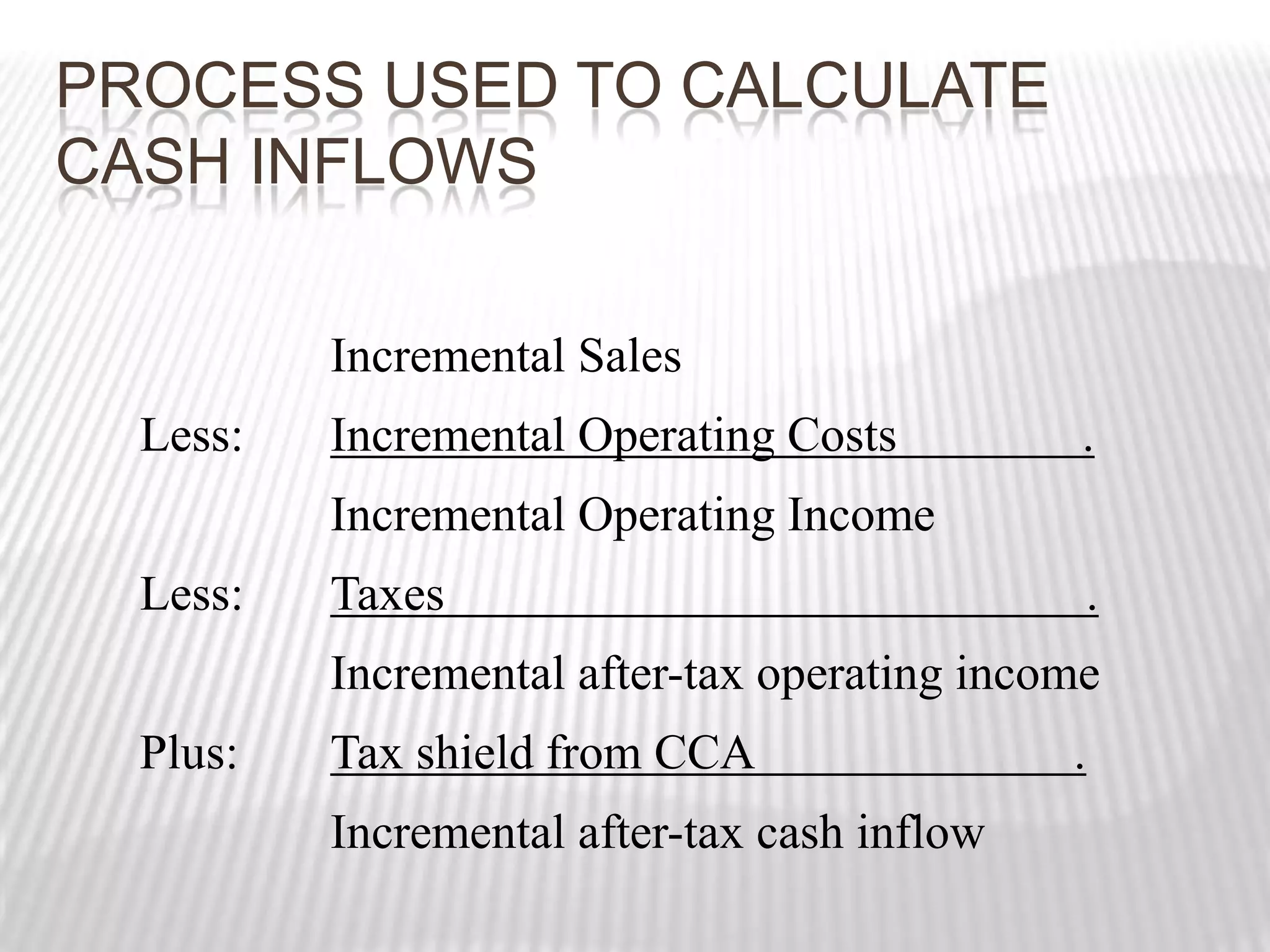

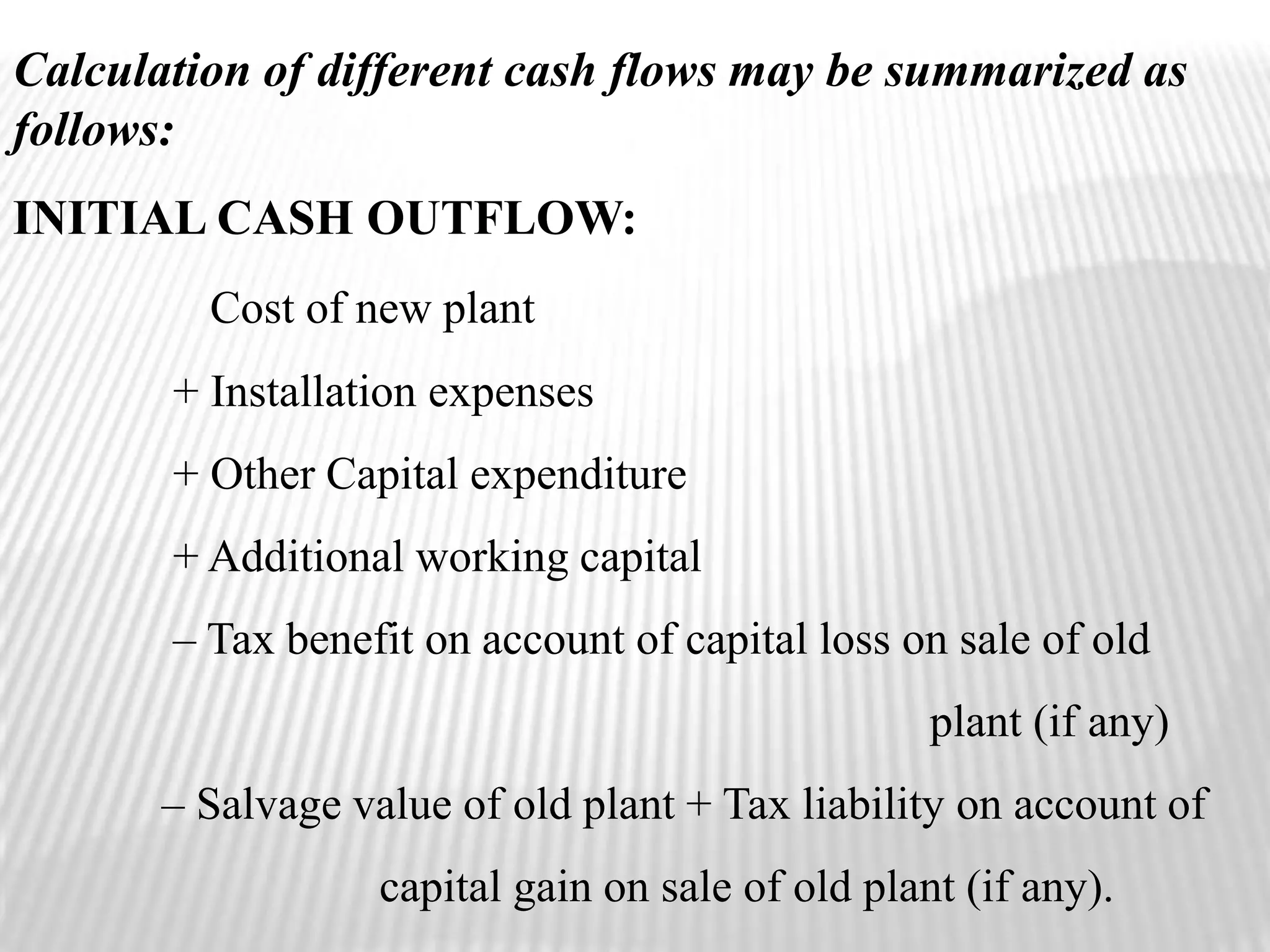

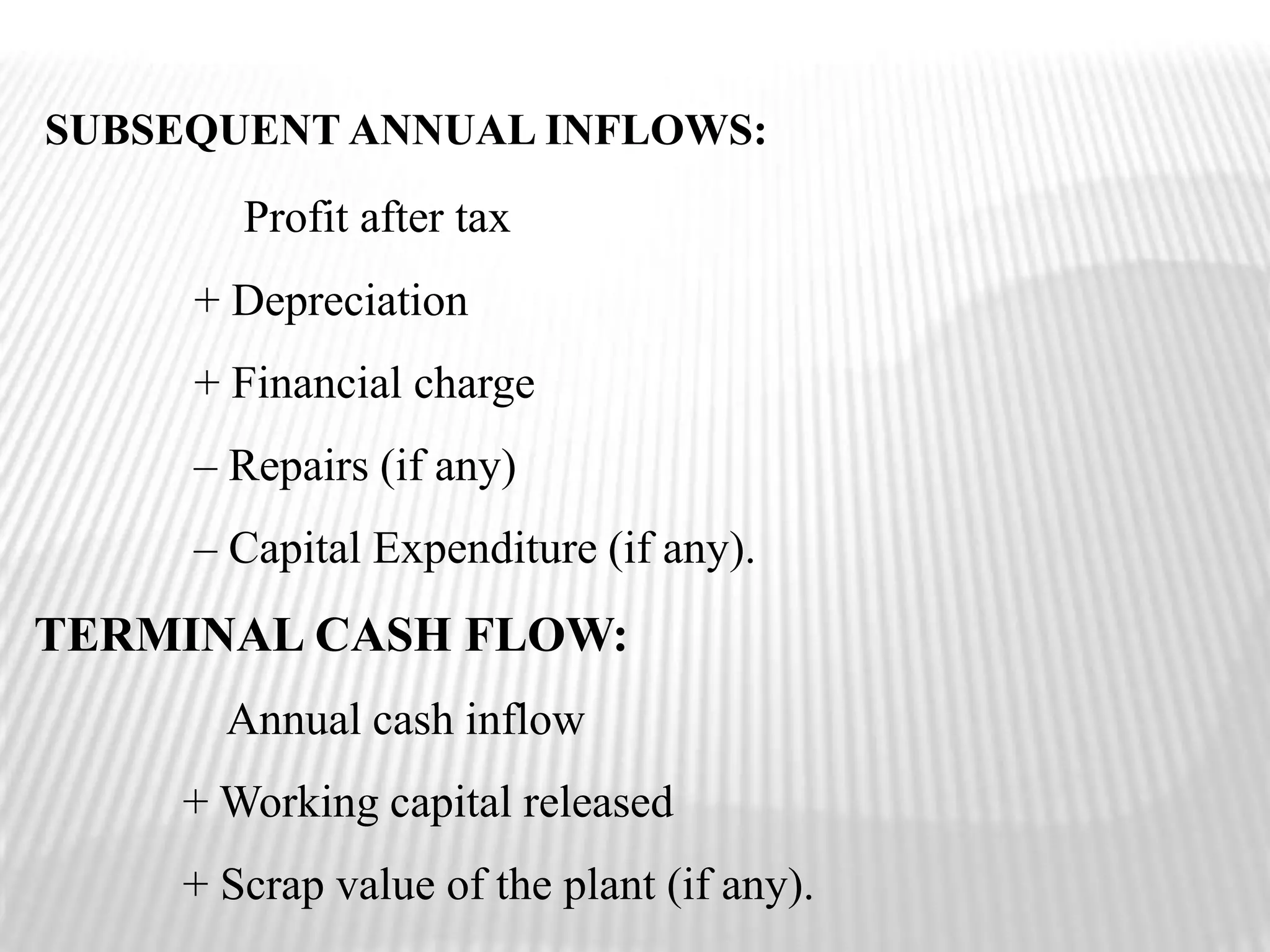

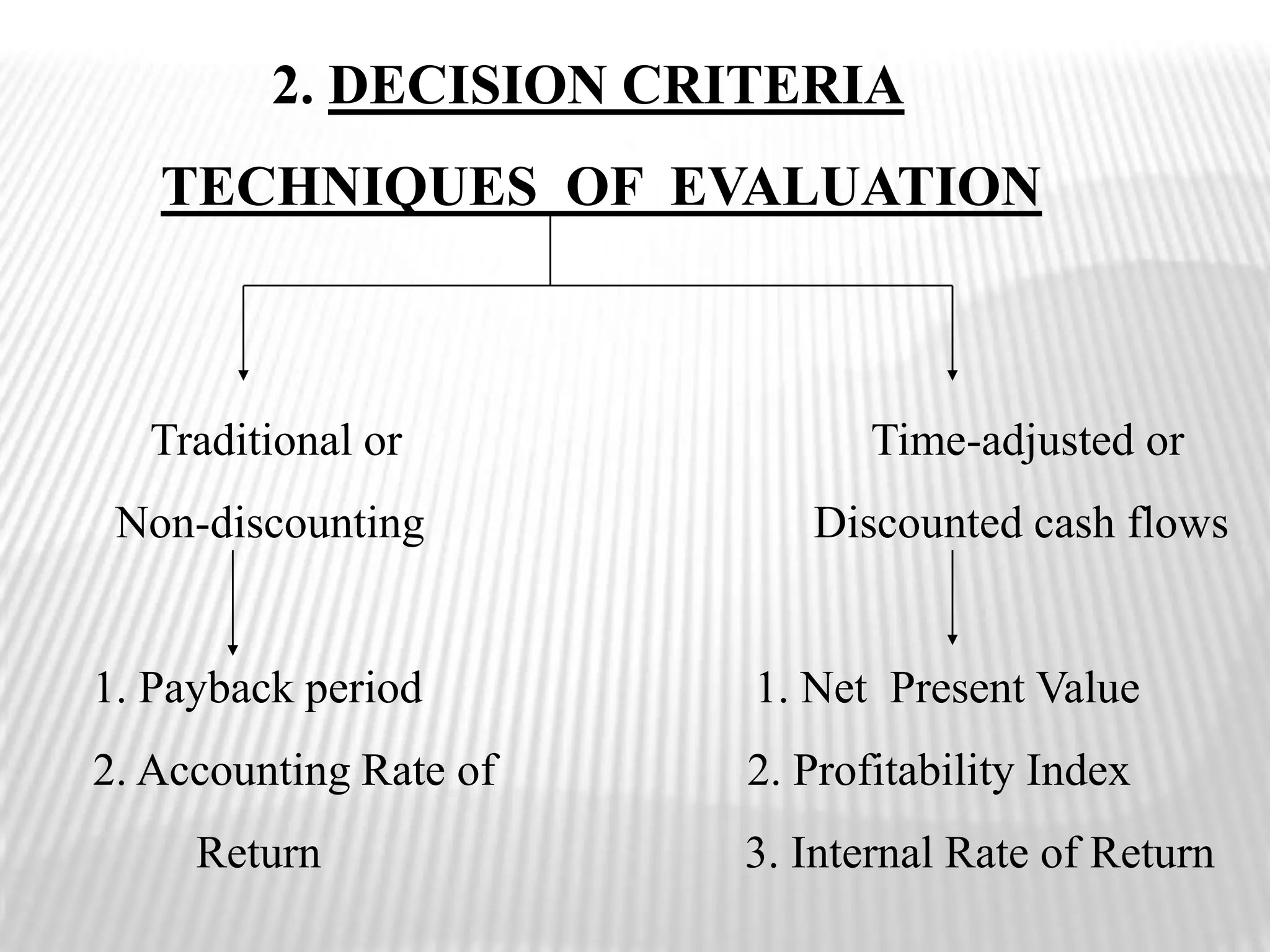

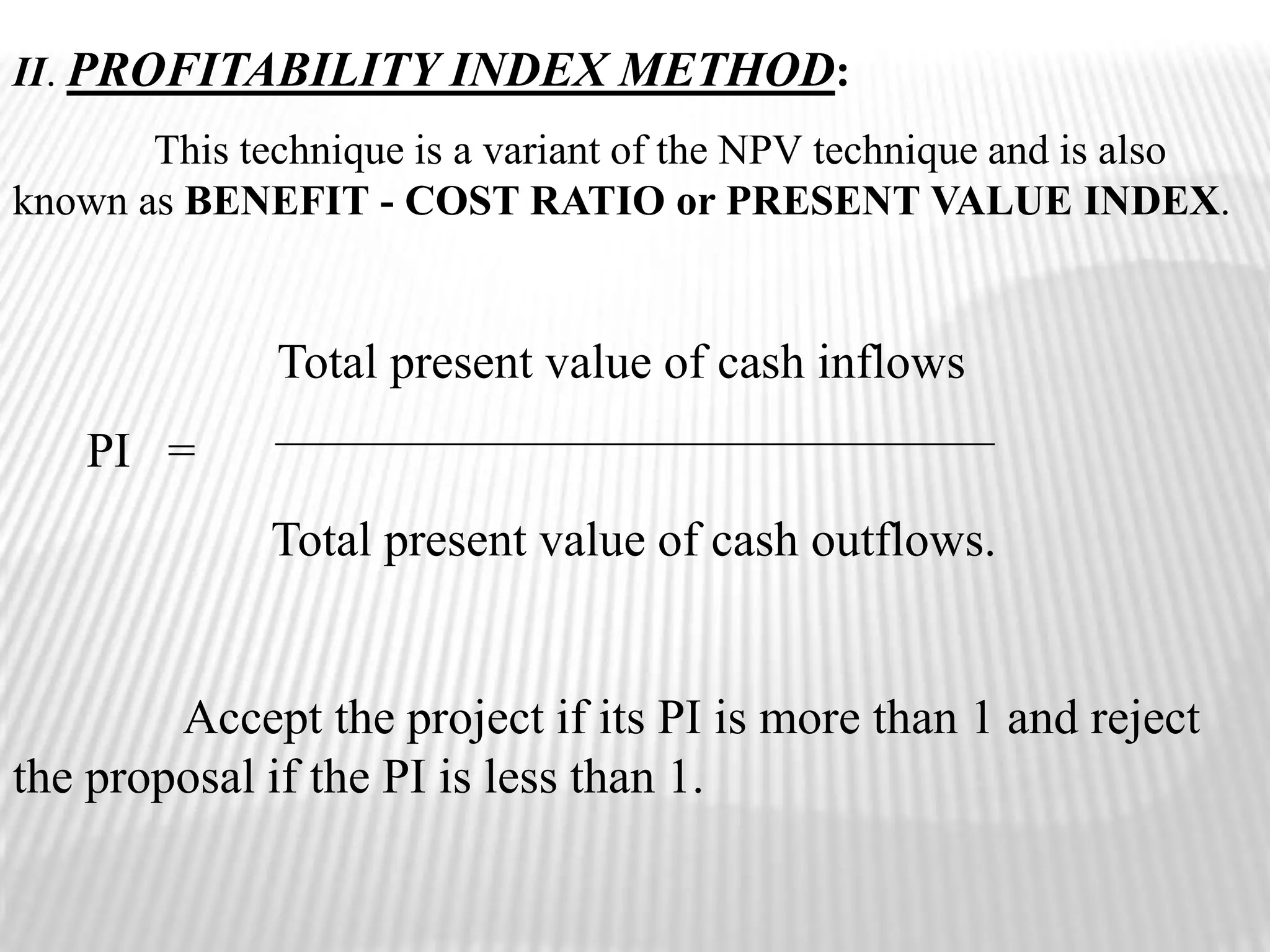

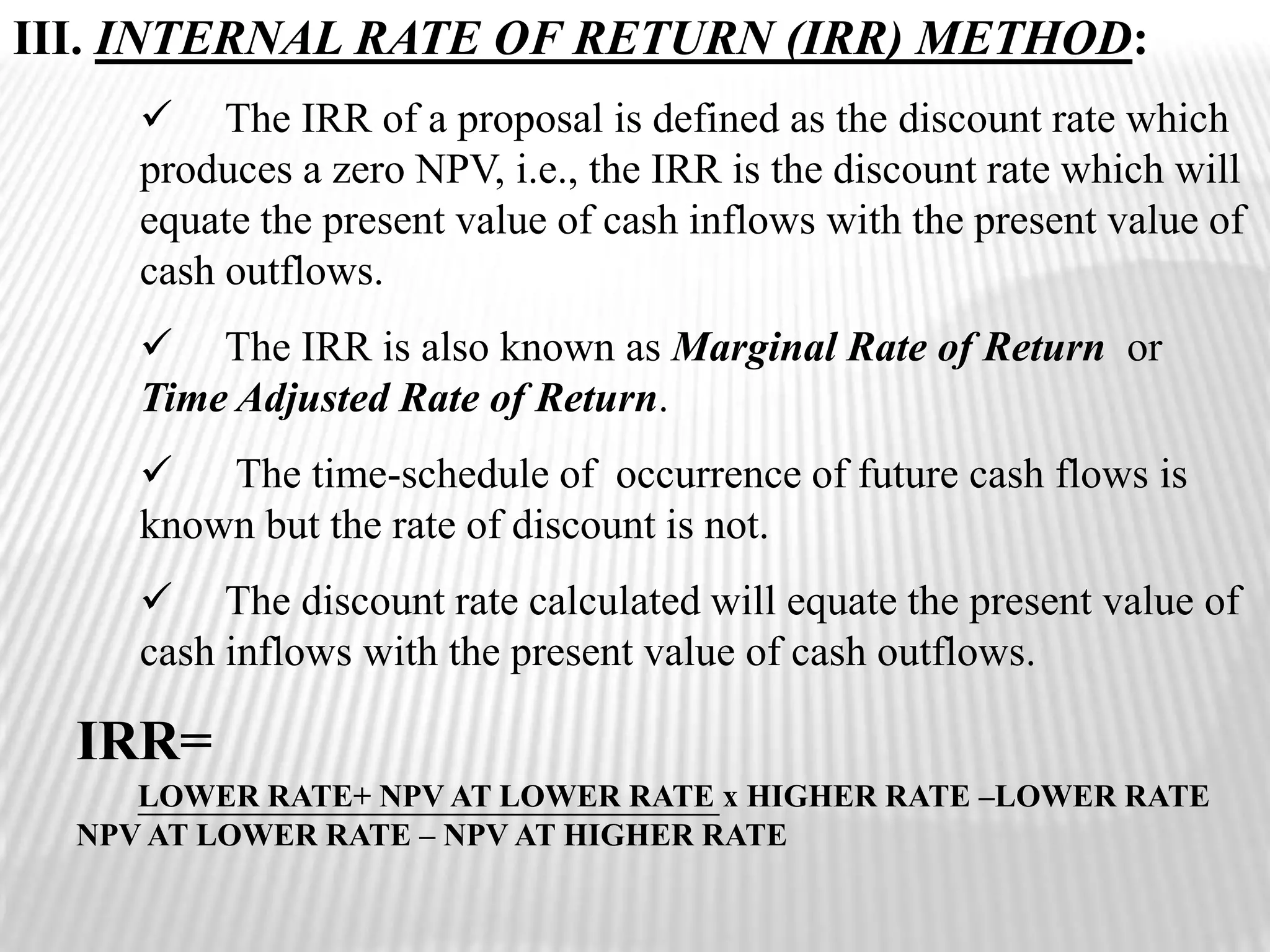

The document provides information about capital budgeting. It defines capital budgeting and discusses the capital budgeting process, which includes identifying investment opportunities, assembling proposals, decision making, budget preparation, implementation, and performance review. It also covers classification of capital projects, features of capital budgeting, estimating cash flows, decision criteria like payback period, accounting rate of return, net present value, profitability index, and internal rate of return.