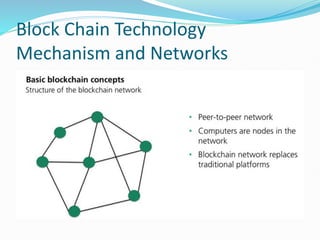

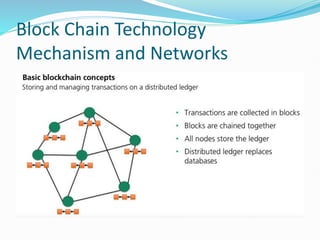

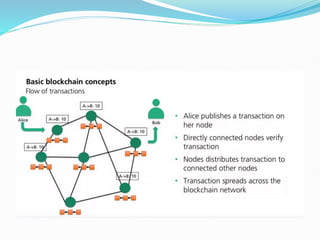

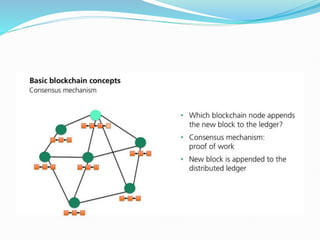

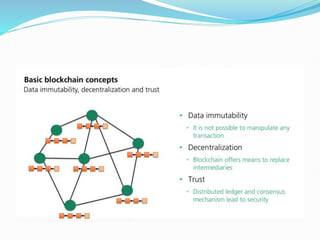

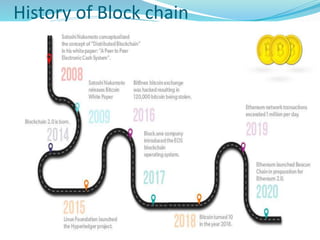

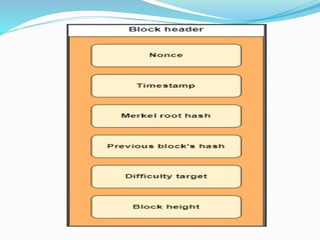

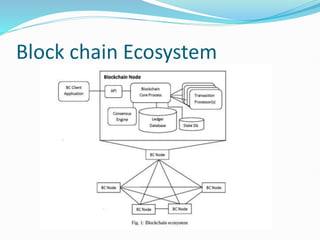

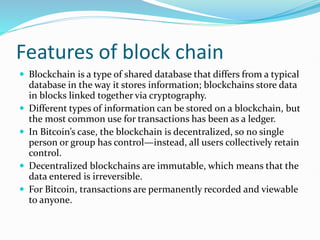

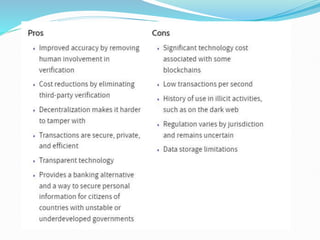

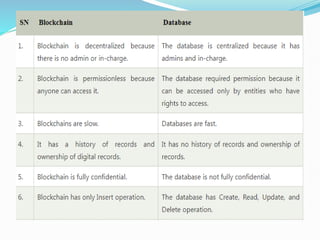

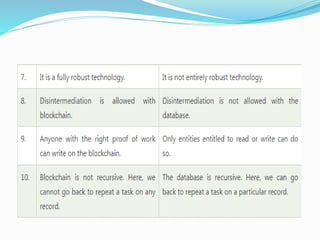

The document provides a comprehensive overview of blockchain technology, including its definition, history, objectives, and challenges. It discusses the transformation blockchain brings to various sectors like finance, healthcare, and insurance by offering a decentralized, secure, and efficient method of transaction management. Additionally, it highlights the key features of blockchain and its potential drawbacks, such as regulatory issues and the need for scalability.