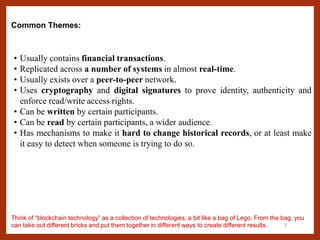

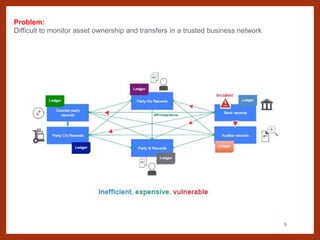

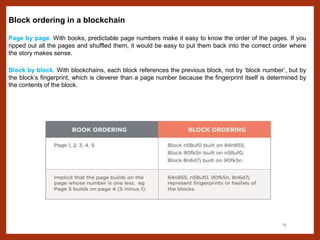

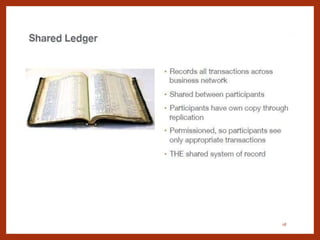

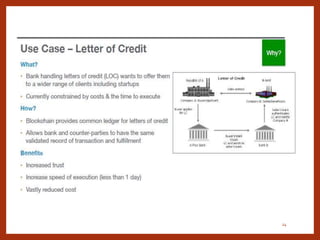

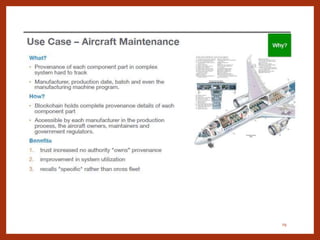

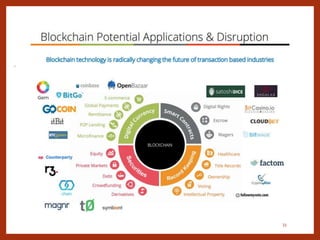

This document discusses blockchain technology and its potential applications. It defines blockchain as a shared, distributed ledger that allows participants in a business network to view transaction records. Blockchain addresses the problem of difficulty monitoring asset ownership and transfers in a trusted network by providing a permissioned, replicated shared ledger. The key properties that enable this are decentralization, strong authentication, and tamper resistance. The document also discusses public versus private blockchains and the challenges and opportunities blockchain poses for financial institutions in validating transactions without third parties.