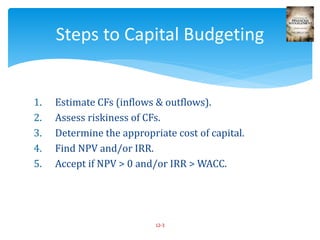

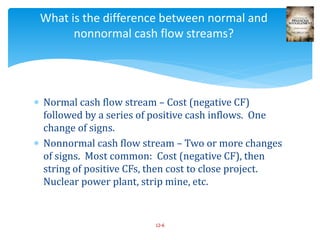

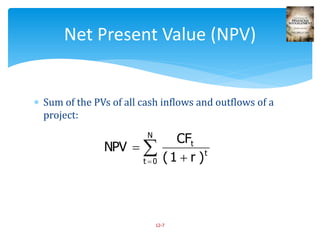

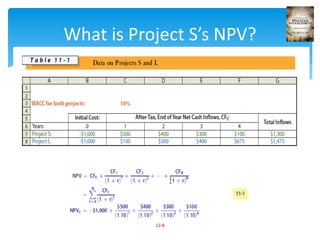

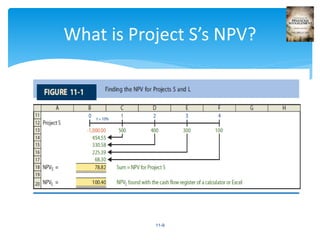

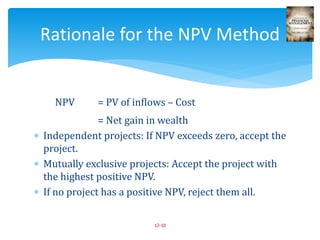

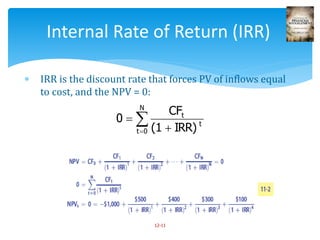

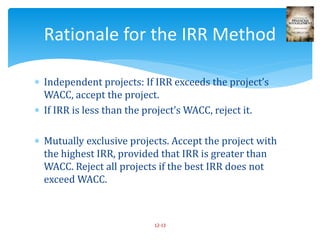

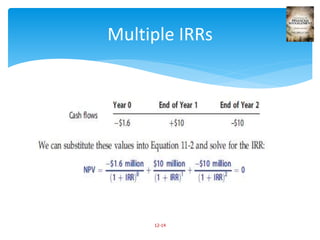

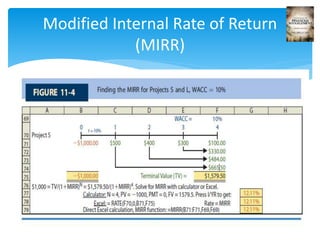

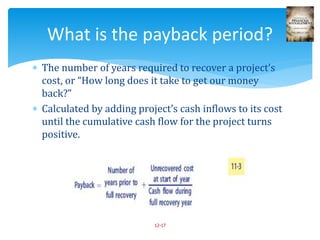

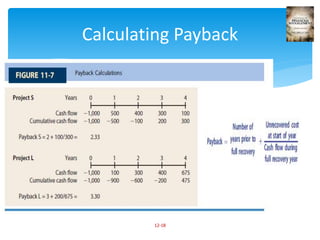

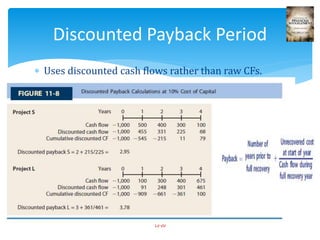

This document discusses capital budgeting and provides an overview of key concepts and methods used to evaluate long-term investment projects. It defines capital budgeting, outlines the steps, and distinguishes between independent and mutually exclusive projects. It then describes five decision criteria - net present value (NPV), internal rate of return (IRR), modified internal rate of return (MIRR), payback period, and discounted payback period. For each method, it provides the calculation and discusses strengths and weaknesses. The document concludes that NPV is the best single criterion but notes that the various methods provide different perspectives on project profitability and liquidity.