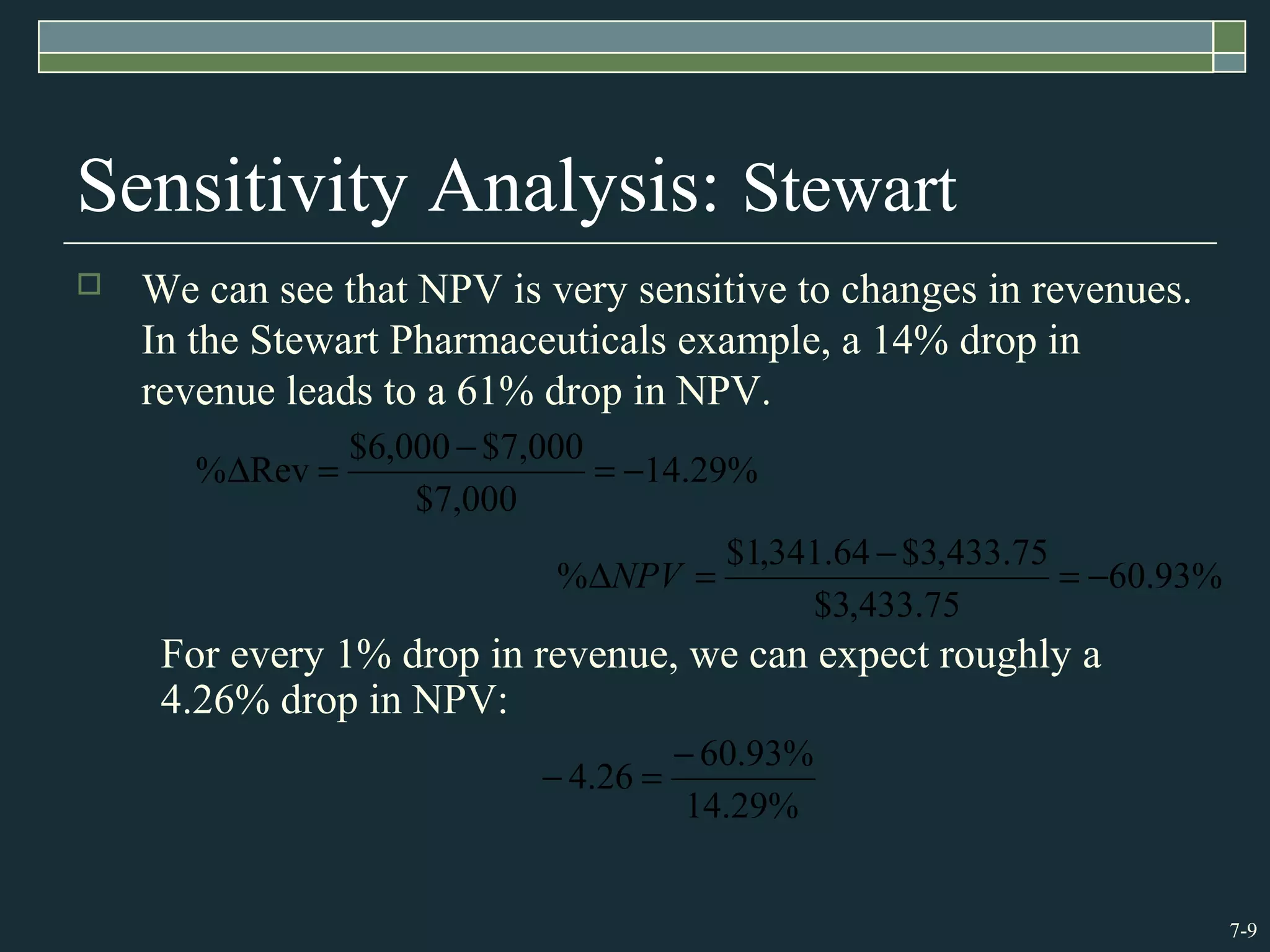

1) Sensitivity analysis, scenario analysis, break-even analysis, and simulation are risk analysis techniques used to evaluate how uncertain variables might impact project outcomes. They allow examining forecasts and estimates in more depth than a single NPV calculation.

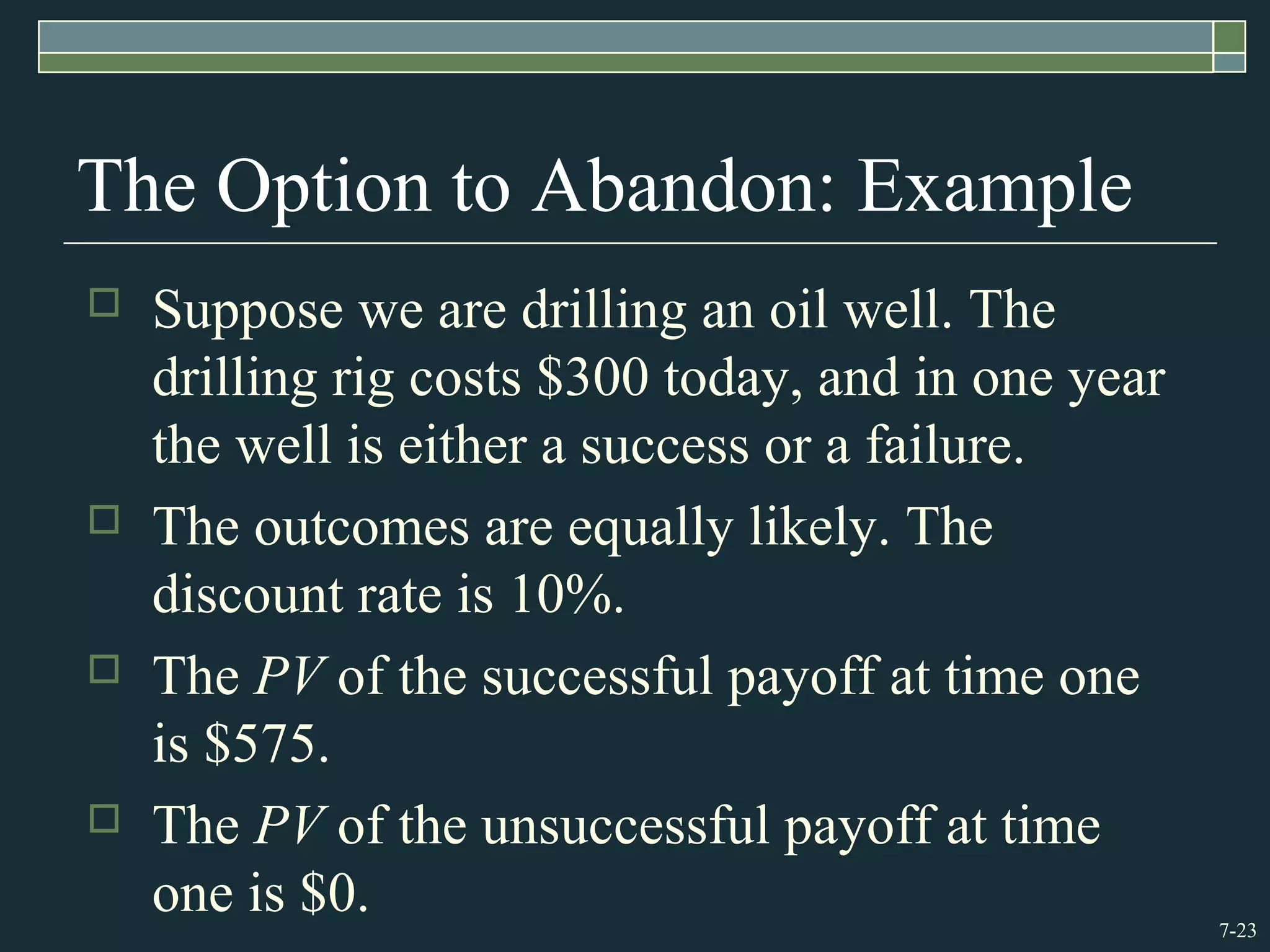

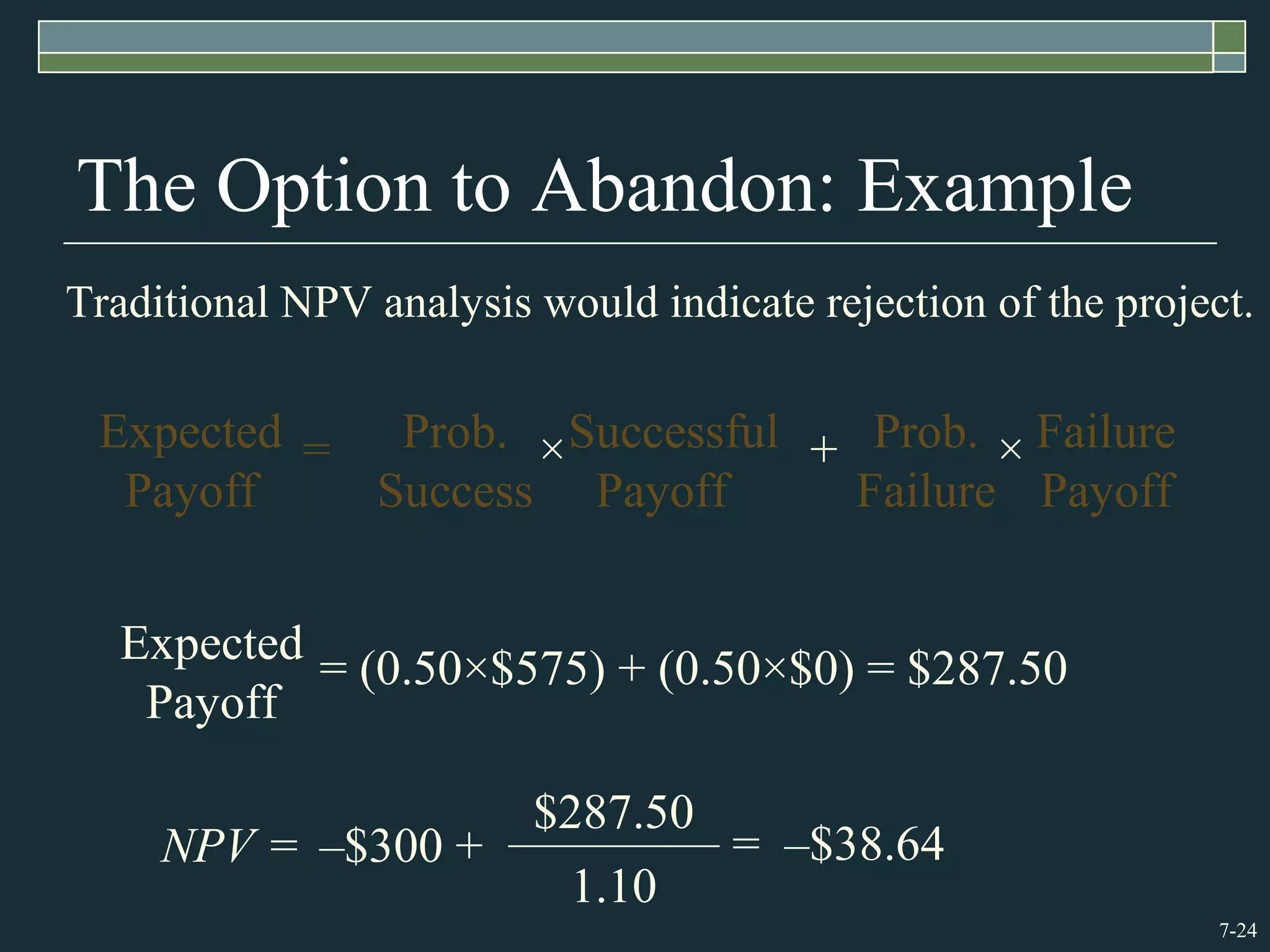

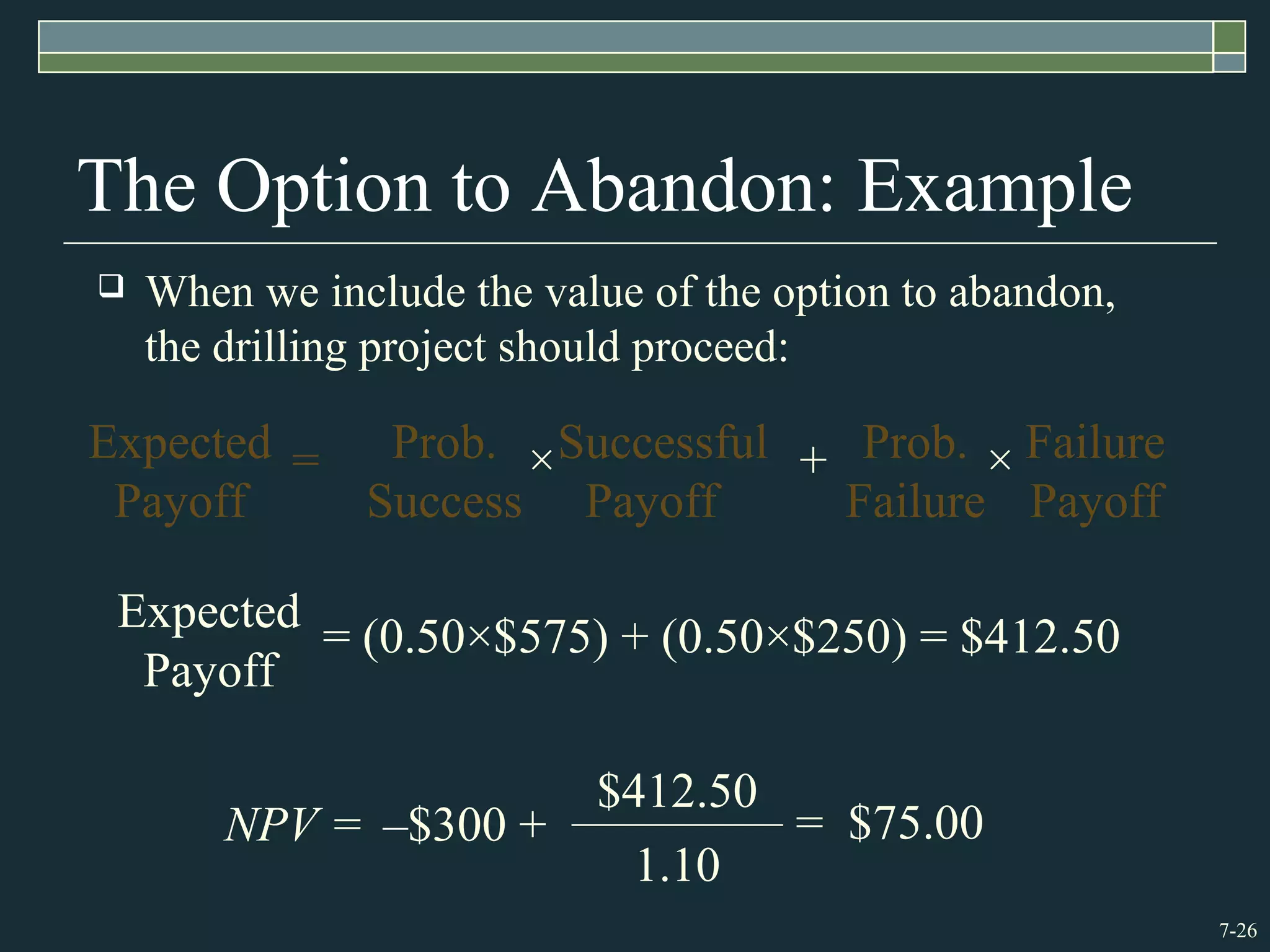

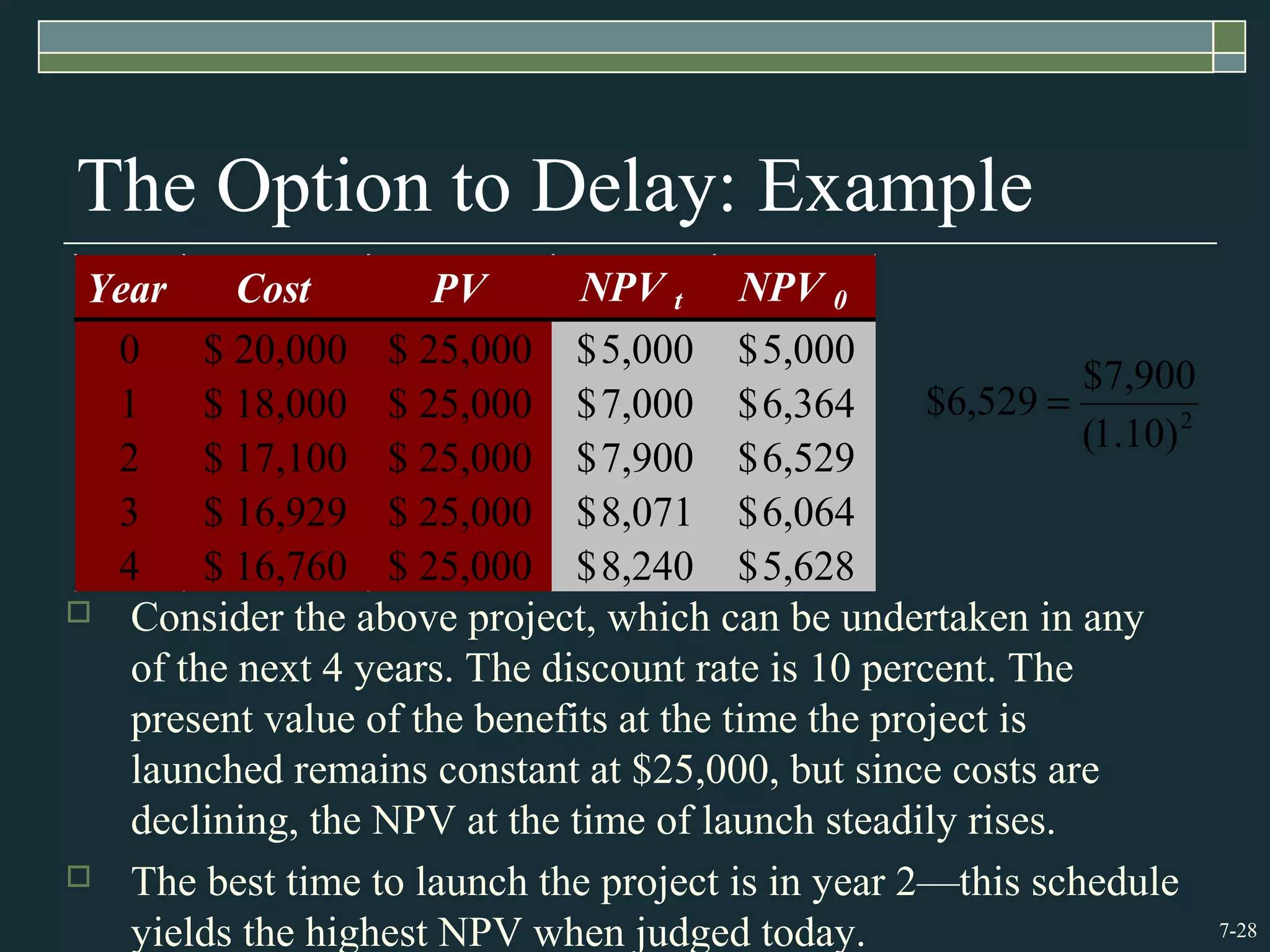

2) Real options, such as the option to expand, abandon, or delay a project, can provide additional value beyond traditional NPV. They should be considered in capital budgeting.

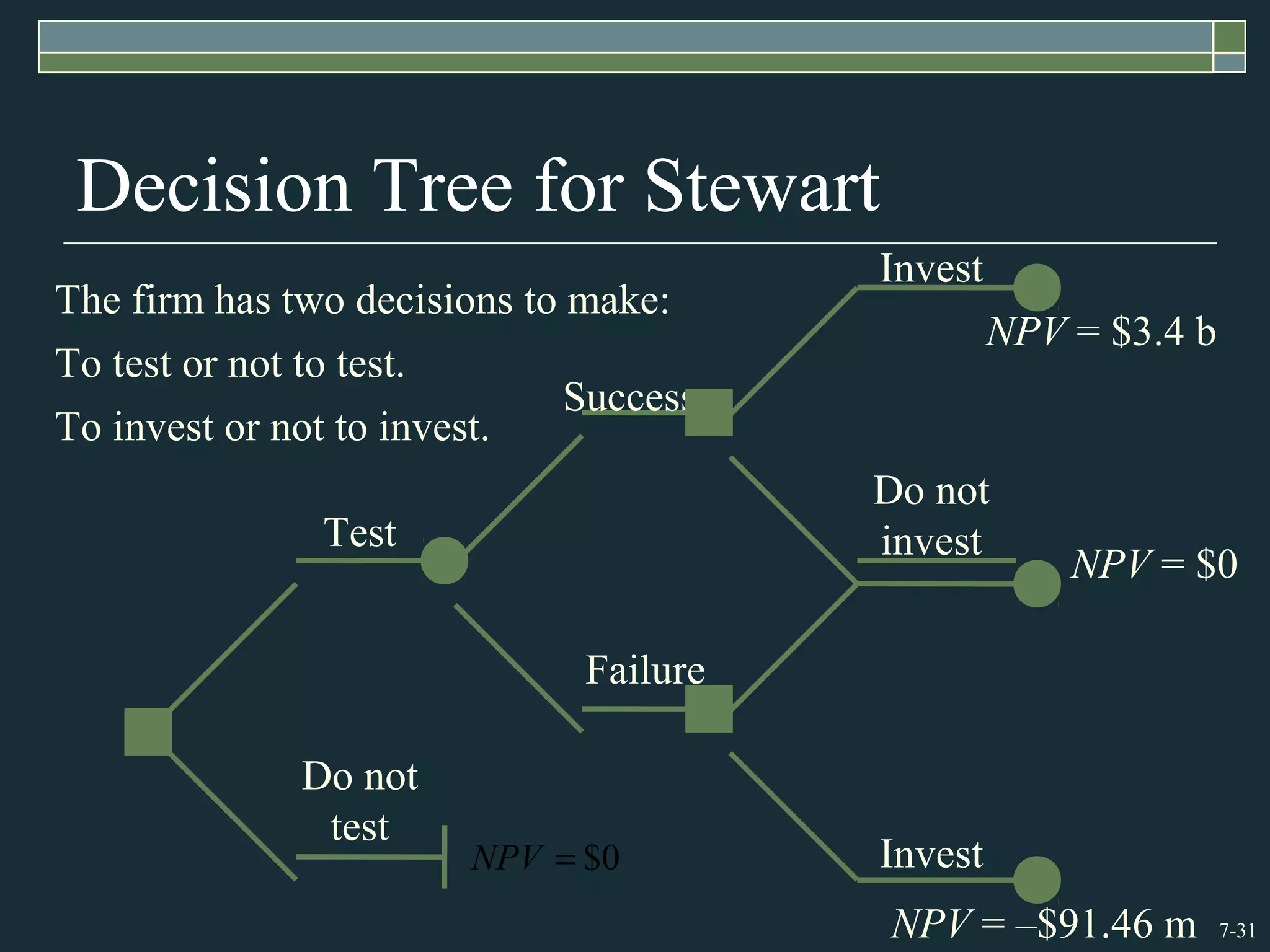

3) Decision trees provide a graphical way to represent alternative decisions and outcomes over time, helping to identify the best course of action for a project under uncertainty.