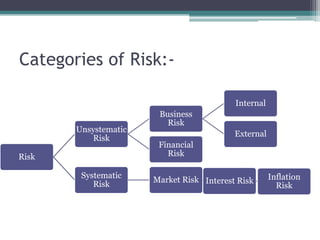

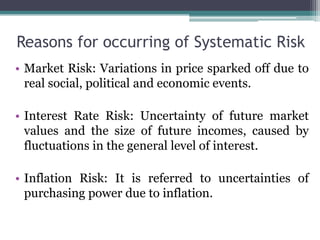

This document discusses risk analysis in capital budgeting. It defines risk and uncertainty, noting that risk can be quantified while uncertainty cannot. It explains that risk arises in investment evaluation because the future is unpredictable. There are two main categories of risk: systematic and unsystematic. Systematic risk relates to overall market trends that affect all securities, while unsystematic risk is specific to individual firms or industries and can be reduced through diversification. The document also outlines reasons for different types of risks and describes investors' possible attitudes toward risk.