Embed presentation

Download to read offline

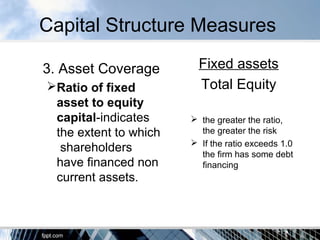

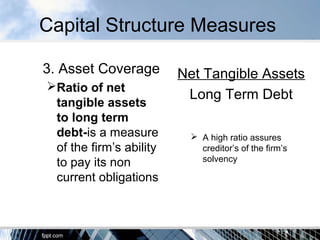

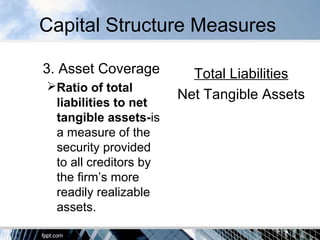

The document discusses capital structure measures that can be used to analyze a firm's financial health and solvency. It identifies three key measures: 1) Capital structure, which includes a firm's sources of financing through equity and debt. 2) Earning power, which is the firm's ability to generate cash flows. 3) Asset coverage, which provides assurance to creditors that the firm can pay its long-term obligations by analyzing ratios of assets to debt and equity. Various asset coverage ratios are explained, including fixed asset to equity ratio and net tangible asset ratios.